International Journal of Business Research and Management

OPEN ACCESS | Volume 3 - Issue 2 - 2025

ISSN No: 3065-6753 | Journal DOI: 10.61148/3065-6753/IJBRM

Tawfiq Abu-Raqabeh. Ph.D

School Of Business

Alcorn State University

*Corresponding author: Tawfiq. M. Abu-Raqabeh, School Of Business, Alcorn State University.

Received: May 19, 2025

Accepted: May 20, 2025

Published: April 27, 2025

Citation: Tawfiq. M. Abu-Raqabeh, (2025). ‘The Financial Impact of Wildfires in California”. International Journal of Business Research and Management 2(4); DOI: 10.61148/3065-6753/IJBRM/050.

Copyright: © 2025. Tawfiq. M. Abu-Raqabeh, This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

California has long been susceptible to devastating wildfires, which continue to inflict significant financial losses on the state, its residents, and businesses. Wildfires not only destroy physical property but also create cascading economic effects, including lost revenue, increased insurance claims, and additional government expenditures. Beyond immediate destruction, wildfires disrupt local economies by forcing business closures, reducing tourism, and impacting agriculture. The long-term financial strain is further compounded by rising insurance premiums, decreased property values, and costly infrastructure repairs. Accounting for these losses provides critical insight into the broader economic burden they place on the state and helps in strategizing for recovery and future mitigation efforts. Moreover, understanding these financial impacts can guide policymakers in allocating resources effectively, improving emergency response strategies, and strengthening community resilience against future wildfire events.

Introductio

California has long been vulnerable to wildfires, with increasing frequency and intensity due to climate change, prolonged droughts, and expanding human development into fire-prone areas (CalFire, 2022). Wildfires not only pose significant threats to life and property but also create profound economic ramifications for the state, its residents, and businesses. The financial toll of wildfire extends beyond the immediate destruction of homes and infrastructure, encompassing lost economic productivity, increased insurance claims, rising costs for emergency response, and long-term recovery expenditures (Smith & Johnson, 2021). In 2018 alone, California wildfires caused an estimated $148.5 billion in economic losses, highlighting the extensive impact these disasters can have on state and local economies (Wang, 2020).

The ripple effects of wildfires are felt across various sectors, including agriculture, tourism, real estate, and healthcare. Businesses may face closures, disrupted supply chains, and diminished consumer activity, while property owners endure rising insurance premiums and reduced property values (Miller, 2023). Additionally, state and federal governments bear the financial burden of firefighting efforts, disaster relief programs, and infrastructure rebuilding. As wildfires become more frequent and severe, understanding and accounting for these financial impacts is critical for developing effective strategies for disaster preparedness, response, and recovery. This paper aims to explore the multifaceted financial effects of wildfires in California, emphasizing the importance of comprehensive accounting practices to assess losses accurately and support informed policy decisions.

Moreover, the indirect costs associated with wildfires can be just as detrimental as the direct losses. Air quality degradation due to wildfire smoke contributes to public health crises, increasing medical expenses and reducing workforce productivity (Thompson et al., 2021). The tourism industry, a vital contributor to California’s economy, often suffers as iconic destinations become engulfed in smoke or damaged by flames, leading to canceled trips and reduced visitor spending (Nguyen & Harris, 2022). For instance, the 2021 Dixie Fire, which burned nearly a million acres, significantly impacted local businesses and tourism, particularly in Northern California's rural communities (CalFire, 2022). The widespread consequences of these events highlight the need for holistic accounting approaches that factor in both immediate and lingering economic disruptions.

In addition to economic losses, wildfires also strain California's fiscal resources. The state allocates substantial funds to firefighting and emergency services, often exceeding budgetary expectations (Jones, 2023). According to the Legislative Analyst’s Office (2022), California spent over $4 billion on wildfire response and prevention in the 2021-2022 fiscal year, a sharp increase from previous years. These financial demands can lead to budget reallocations, potentially diverting funds from other critical public services such as education, infrastructure, and healthcare. Given these financial pressures, accurate accounting for wildfire-related losses is essential to ensure efficient resource allocation, support economic stability, and strengthen California’s resilience against future wildfire threats.

Literature Review

Wildfires in California have become increasingly frequent and severe, leading to significant financial repercussions for individuals, businesses, and the state’s economy. According to Smith (2022), the economic losses from wildfires in California exceeded $20 billion in 2021 alone, driven by property damage, firefighting costs, and healthcare expenses. These fires not only destroy physical assets but also disrupt local economies, leading to reduced tourism, lost business revenues, and increased insurance premiums (Johnson & Lee, 2023). The housing market is particularly impacted, as wildfire-prone areas witness declining property values and difficulties in obtaining insurance coverage (Miller et al., 2021).

The financial burden of wildfires extends beyond immediate damages. Long-term economic effects include decreased tax revenues and increased public spending on recovery and prevention (Thompson & Garcia, 2022). Additionally, wildfires have led to heightened operational costs for utility companies, which are often held liable for fire-related damages (Huang, 2023). Pacific Gas and Electric (PG&E), for instance, filed for bankruptcy in 2019 due to liabilities exceeding $30 billion from wildfire-related lawsuits (Smith, 2022). Moreover, the cost of rebuilding infrastructure and providing aid to affected communities places a significant strain on state and federal budgets (Brown, 2021).

Climate change has exacerbated wildfire risks, contributing to prolonged fire seasons and more intense fires (Nguyen & Patel, 2024). This trend underscores the need for enhanced mitigation strategies and financial planning to address future risks (Huang, 2023). Research suggests that investing in wildfire prevention measures, such as controlled burns and improved land management practices, can reduce long-term financial losses (Johnson & Lee, 2023). However, balancing these proactive investments with immediate recovery needs remains a challenge for policymakers (Miller et al., 2021).

Direct Property Losses

One of the most immediate financial impacts of wildfires is the destruction of physical property, including homes, commercial buildings, and infrastructure. According to recent estimates, wildfires in California cause billions of dollars in insured and uninsured property losses annually (Insurance Information Institute, n.d.). For insurers, these losses result in substantial claims payouts, which negatively affect profitability and lead to higher premiums for consumers. From an accounting perspective, individuals and businesses must account for the loss of fixed assets, which may necessitate impairments or write-offs in their financial records (California Department of Forestry and Fire Protection, n.d.). Additionally, the economic burden on property owners is compounded by repair costs, relocation expenses, and the potential loss of rental income (Smith, 2022).

Beyond direct property losses, wildfires significantly impact California's broader economy. The tourism sector, a vital contributor to the state's revenue, often suffers as wildfires deter visitors and lead to the temporary closure of attractions and national parks (Johnson & Lee, 2023). Businesses in affected regions may experience reduced operations or complete shutdowns, contributing to decreased local and state tax revenues (Thompson & Garcia, 2022). According to Miller et al. (2021), the cumulative economic losses from disrupted business activities and declining consumer spending can extend well beyond the fire-affected areas, influencing statewide economic stability.

The agricultural sector in California is also heavily impacted by wildfires. The destruction of farmland, vineyards, and orchards leads to immediate financial losses for farmers and long-term disruptions in agricultural production (Nguyen & Patel, 2024). Wildfire smoke and ash can damage crops, reducing yields and impacting the quality of produce (Huang, 2023). This not only affects the livelihoods of farmers but also contributes to supply chain disruptions and increased prices for consumers (Brown, 2021). The wine industry, particularly in regions like Napa Valley, has reported millions of dollars in losses due to smoke-tainted grapes and damaged vineyards (Smith, 2022).

Moreover, wildfires impose substantial costs on public resources and state budgets. The financial burden includes firefighting expenses, emergency response efforts, and post-disaster recovery initiatives (Thompson & Garcia, 2022). The state of California has allocated billions of dollars annually to combat wildfires, including investments in firefighting equipment, personnel training, and community preparedness programs (California Department of Forestry and Fire Protection, n.d.). These expenditures, while necessary, can divert funds from other critical public services, such as education and healthcare (Johnson & Lee, 2023). Furthermore, the long-term health impacts of wildfire smoke, including respiratory and cardiovascular illnesses, increase healthcare costs and place additional strain on public health systems (Nguyen & Patel, 2024).

Addressing the financial impact of wildfire requires a multifaceted approach, including improved land management, investment in resilient infrastructure, and robust insurance mechanisms (Huang, 2023). While proactive measures such as controlled burns and community education can help mitigate risks, balancing these initiatives with immediate recovery needs remains a challenge for policymakers (Miller et al., 2021). Additionally, innovative financial instruments like catastrophe bonds and public-private partnerships can provide the necessary funding and risk-sharing mechanisms to enhance California’s wildfire resilience (Brown, 2021). Effective financial planning and adaptation strategies are crucial to minimizing economic disruptions and support the long-term stability of affected communities (Smith, 2022).

Business Interruption and Lost Revenue

Wildfires also disrupt economic activity, leading to significant business interruptions. Local businesses often face closures due to evacuation orders, damaged infrastructure, or reduced customer demand (California Department of Forestry and Fire Protection, n.d.). For businesses, the accounting treatment involves recognizing lost revenue during the period of disruption. Additionally, companies with business interruption insurance may recover a portion of these losses, which requires careful documentation and accounting to record the insurance proceeds correctly (California Department of Forestry and Fire Protection, n.d.). The extent of financial loss varies across industries, with retail, hospitality, and agriculture often experiencing the most substantial impacts (Nguyen & Patel, 2024). For instance, during the 2020 California wildfires, hospitality businesses in Napa Valley reported revenue declines of over 50%, as tourism plummeted, and many establishments remained closed for extended periods (Smith, 2022).

The ripple effects of business interruptions can also extend to supply chains and employment. When businesses halt operations, suppliers and service providers in connected industries may experience reduced orders and cash flow challenges (Thompson & Garcia, 2022). This situation often leads to temporary layoffs, wage reductions, and, in severe cases, permanent closures (Brown, 2021). According to Johnson and Lee (2023), the economic strain on small and medium-sized enterprises (SMEs) is particularly acute, as they typically lack the financial resilience to withstand prolonged periods of lost revenue. Moreover, reduced consumer spending in wildfire-affected regions can slow economic recovery, creating a negative feedback loop that prolongs the financial impact on local economies (Huang, 2023). Effective financial planning, including maintaining emergency reserves and securing appropriate insurance coverage, is critical for businesses to navigate and recover from wildfire-related disruptions (Miller et al., 2021).

Increased Public Expenditure

Wildfires demand a substantial public response, including firefighting efforts, emergency services, and infrastructure repairs. These costs are often borne by local, state, and federal governments (Legislative Analyst’s Office, n.d.). California’s state budget frequently allocates millions of dollars for wildfire suppression and disaster recovery efforts (American Institute of CPAs, n.d.). In 2022, California spent over $1.5 billion on wildfire-related emergency responses, with a significant portion directed toward firefighting resources, emergency shelter provisions, and public health services (Smith, 2022). These expenditures place considerable pressure on public finances, often leading to budget reallocations and, in some cases, increased state debt (Thompson & Garcia, 2022).

For government entities, accurately tracking and reporting these expenditures in financial statements is crucial, particularly under emergency or disaster-related spending categories (California Department of Forestry and Fire Protection, n.d.). Federal disaster relief funds, such as those provided by the Federal Emergency Management Agency (FEMA), may offset some of these costs, necessitating careful intergovernmental accounting coordination (Huang, 2023). According to Johnson and Lee (2023), the complexity of managing federal aid and ensuring compliance with reporting standards can challenge local governments. Additionally, the long-term financial obligations associated with rebuilding infrastructure, supporting affected communities, and enhancing future wildfire resilience require strategic financial planning and transparent fiscal management (Nguyen & Patel, 2024).

In addition to immediate response costs, wildfires lead to substantial long-term public expenditure. Governments must invest in rebuilding and enhancing critical infrastructure, including roads, bridges, utilities, and public facilities damaged by fires (California Department of Forestry and Fire Protection, n.d.). These projects often require multi-year budgets and careful financial planning to ensure funds are available without compromising other public services (Nguyen & Patel, 2024). Moreover, proactive investments in wildfire prevention, such as forest management programs, controlled burns, and the development of fire-resistant infrastructure, add to the financial burden (Johnson & Lee, 2023). According to Brown (2021), while these preventative measures involve significant upfront costs, they can ultimately reduce the economic impact of future wildfires by minimizing destruction and enabling faster recovery. Effective allocation of resources and collaboration between state and federal agencies are crucial for optimizing the use of public funds and enhancing community resilience (Thompson & Garcia, 2022).

Environmental and Agricultural Losses

Beyond structural damage, wildfires significantly impact California's agricultural sector, which contributes billions to the state’s economy. Crop and livestock losses are a critical component of the total economic damage (Federal Emergency Management Agency, n.d.). Farmers and agricultural businesses must account for these losses by writing down the value of biological assets, such as damaged crops, livestock, and orchards. The 2020 wildfires, for instance, led to significant losses in the wine industry, with smoke-tainted grapes resulting in reduced wine production and financial strain on vineyards (Smith, 2022). These losses require careful accounting practices, including asset impairments, insurance claims processing, and adjustments to revenue forecasts (California Department of Forestry and Fire Protection, n.d.). Additionally, smaller farms often struggle to recover due to limited access to financial resources and insurance, leading to closures or forced sales (Johnson & Lee, 2023).

The environmental damage caused by wildfires also presents long-term economic challenges. Soil degradation and erosion reduce land productivity, increase restoration costs and impacting agricultural output (Nguyen & Patel, 2024). Wildfires destroy natural vegetation and disrupt ecosystems, leading to a loss of biodiversity and altering local climates (Thompson & Garcia, 2022). The contamination of water sources from ash, debris, and chemical runoff necessitates costly water treatment processes, which can strain municipal budgets and affect agricultural irrigation systems (Huang, 2023). Furthermore, the loss of forest cover reduces the natural carbon sequestration capacity of the region, contributing to higher carbon emissions and exacerbating climate change (Brown, 2021).

In addition to direct economic losses, wildfires disrupt supply chains and impact the broader agricultural market. Farmers may face challenges in distributing surviving produce due to damaged roads, closed markets, and logistical constraints (Miller et al., 2021). The reduced supply of certain crops can lead to price volatility, affecting both producers and consumers (Smith, 2022). Moreover, businesses dependent on agricultural products, such as food processing companies, may also experience financial losses and production delays (Johnson & Lee, 2023). According to the Federal Emergency Management Agency (n.d.), the cumulative economic impact extends beyond the immediate disaster zone, influencing state and national markets and highlighting the interconnected nature of California’s economy.

Mitigating these impacts requires a multifaceted approach that includes improved land management, financial support for affected businesses, and investment in resilient agricultural practices. Proactive measures such as controlled burns, forest management, and soil conservation techniques can help reduce the severity of future wildfires (Nguyen & Patel, 2024). Financial tools like crop insurance, disaster relief funds, and low-interest loans can provide critical support to farmers and agricultural enterprises (Thompson & Garcia, 2022). Furthermore, integrating environmental restoration projects with economic development initiatives can promote both ecological recovery and economic resilience in wildfire-prone regions (Miller et al., 2021)

Insurance and Risk Management Challenges

California's increasing wildfire risks have strained the insurance industry, leading some providers to limit coverage or exit high-risk markets altogether (Insurance Information Institute, n.d.). The frequency and severity of wildfires in the state have contributed to a rise in insurance claims, pushing insurers to reassess their exposure and reprice policies. As a result, many insurers have reduced their coverage offerings or increased premiums, leaving homeowners and businesses in wildfire-prone areas with limited options (Huang, 2023). The challenge for insurers, from an accounting perspective, lies in estimating liabilities for wildfire-related claims and maintaining appropriate reserves to cover future events. Insurers must also factor in potential reinsurance costs, as primary carriers shift more risk to secondary markets (California Department of Forestry and Fire Protection, n.d.). The evolving risk landscape requires insurers to adjust their pricing models and consider broader environmental factors, such as climate change and fire-prone conditions, when evaluating potential claims (Nguyen & Patel, 2024).

For businesses and homeowners, the escalating insurance costs pose significant financial challenges. Homeowners in high-risk areas are facing premium hikes or policy cancellations, which can make coverage unaffordable or unavailable (Smith, 2022). In some cases, individuals may be forced to rely on state-sponsored programs like the California FAIR Plan, which provides high-risk fire insurance, but with limited coverage and higher premiums (Brown, 2021). Businesses, particularly those in the agriculture, hospitality, and real estate sectors, are also experiencing rising insurance costs, which directly affect their bottom line. These increased costs can lead to financial instability for small businesses, making it harder for them to recover from losses caused by wildfires (Thompson & Garcia, 2022). Without adequate insurance coverage, many property owners and businesses are left exposed to significant financial losses, highlighting the importance of risk management strategies.

The insurance industry’s response to wildfire risks also brings about complex accounting challenges. As insurers face higher claims payouts, they are required to reassess their reserve levels and potentially adjust their financial statements to reflect the increased risk (Miller et al., 2021). Insurers must adopt more rigorous risk management strategies, including diversifying their portfolios, increasing premiums, or reducing their exposure to high-risk areas. Accounting for reinsurance and retroactive adjustments to claims reserves becomes essential to maintaining financial stability in the face of these growing risks (Huang, 2023). Furthermore, insurers must remain compliant with regulatory requirements, such as the need to disclose the financial impact of wildfire risks, which adds another layer of complexity to their financial reporting (Nguyen & Patel, 2024). These dynamics underscore the need for a robust and transparent approach to risk management, not only for the insurance industry but also for policyholders who depend on these services for financial protection.

Methodology and Research Question

The Financial Impact of Wildfires in California

The primary objective of this study is to assess the financial impact of wildfires in California, with a particular focus on direct property losses, business interruptions, public expenditure, and long-term economic effects. Given the increasing frequency and intensity of wildfires in the state, understanding both immediate and enduring financial consequences is crucial for individuals, businesses, and government entities (Nguyen & Patel, 2024). This research will employ a mixed-methods approach, combining quantitative analysis of economic data with qualitative insights from interviews with key stakeholders such as insurance professionals, policymakers, and residents affected by wildfires. The mixed-methods approach allows for a comprehensive understanding of both the numerical data and the human experiences that underpin wildfire-related financial impacts (Miller et al., 2021).

Research Question

What financial coping strategies do households in wildfire-prone areas of California adopt before and after wildfire events?

How do wildfires influence property values and real estate market trends in affected California regions?

To what extent do wildfires increase insurance premiums or limit access to insurance coverage for homeowners and businesses in California?

How effective are California’s state and federal financial aid programs in supporting post-wildfire recovery for individuals and small businesses?

What is the fiscal impact of wildfire-related emergency spending on California’s state and municipal budgets over time?

How do recurring wildfires affect investor confidence and business continuity in high-risk California counties?

What are the indirect economic costs of wildfires in California, such as loss of tourism revenue, employment disruption, and healthcare expenses?

How do utility companies manage wildfire-related liabilities, and what are the implications for their financial performance and consumer rates?

What role does climate change play in escalating the economic risks associated with wildfires in California?

How do wildfires impact long-term regional economic development and planning policies in California?

How do wildfires in California affect the financial stability of individuals, businesses, and government entities, and what are the long-term economic consequences of these events?

Data Collection:

Quantitative data gathered from reliable sources such as the California Department of Forestry and Fire Protection (Cal Fire), the Insurance Information Institute, the Federal Emergency Management Agency (FEMA), and governmental reports detailing economic losses, insurance claims, and public expenditures related to wildfire events (Insurance Information Institute, n.d.). This data will include metrics on insured and uninsured property losses, business closures, insurance premiums, and government spending on wildfire prevention and recovery (California Department of Forestry and Fire Protection, n.d.). Qualitative data obtained through semi-structured interviews with affected stakeholders, including property owners, business leaders, and public officials. These interviews provide a nuanced understanding of the personal, community, and organizational challenges faced in the aftermath of wildfires (Smith, 2022).

Analysis:

Quantitative data will be analyzed using statistical methods, such as regression analysis, to identify trends and correlations between wildfire frequency and economic losses in California (Brown, 2021). This analysis will help determine the financial burden of wildfires over time and assess which sectors are most impacted. Qualitative data will be analyzed through thematic analysis to uncover common patterns, perceptions, and strategies for managing wildfire-related financial risks. The combination of these methods will provide a comprehensive understanding of the financial impact of wildfires and the broader economic implications for California's residents, businesses, and government entities (Thompson & Garcia, 2022).

This research will contribute valuable insights for policymakers, businesses, and insurers to develop more effective strategies to mitigate the financial impact of future wildfire events (Huang, 2023).

To analyze the financial impact of wildfires in California, you would typically need to collect the following types of data:

Direct Property Losses:

‣Total insured and uninsured property losses due to wildfires.

‣Data on damaged or destroyed homes, commercial buildings, and infrastructure.

‣Sources: California Department of Forestry and Fire Protection (Cal Fire), Insurance

Information Institute.

⁍Information on business closures, revenue losses, and insurance claims related to

wildfires.

⁍Data on economic disruptions in sectors like agriculture, tourism, and real estate.

⁍Sources: California Chamber of Commerce, local business organizations, FEMA.

⁍Total expenditures by federal, state, and local governments for wildfire suppression,

recovery, and disaster relief.

⁍Sources: Legislative Analyst’s Office (LAO), FEMA, and state budget reports.

⁍Data on crops and livestock losses in wildfire-affected areas.

⁍Long-term environmental costs, such as soil degradation and water contamination.

⁍Sources: Federal Emergency Management Agency (FEMA), California Department of

Food and Agriculture.

⁍Data on wildfire-related insurance claims, premium increases, and insurance availability.

⁍Changes in the number of policies written or withdrawn due to wildfire risk.

⁍Sources: Insurance Information Institute, California FAIR Plan.

Statistical methods such as regression analysis, which will allow you to explore correlations between wildfire occurrence and economic losses in California., SPSS used to perform these analyses. For qualitative data, thematic analysis is used to identify key patterns and insights. (World Bank - Disaster Risk Management)

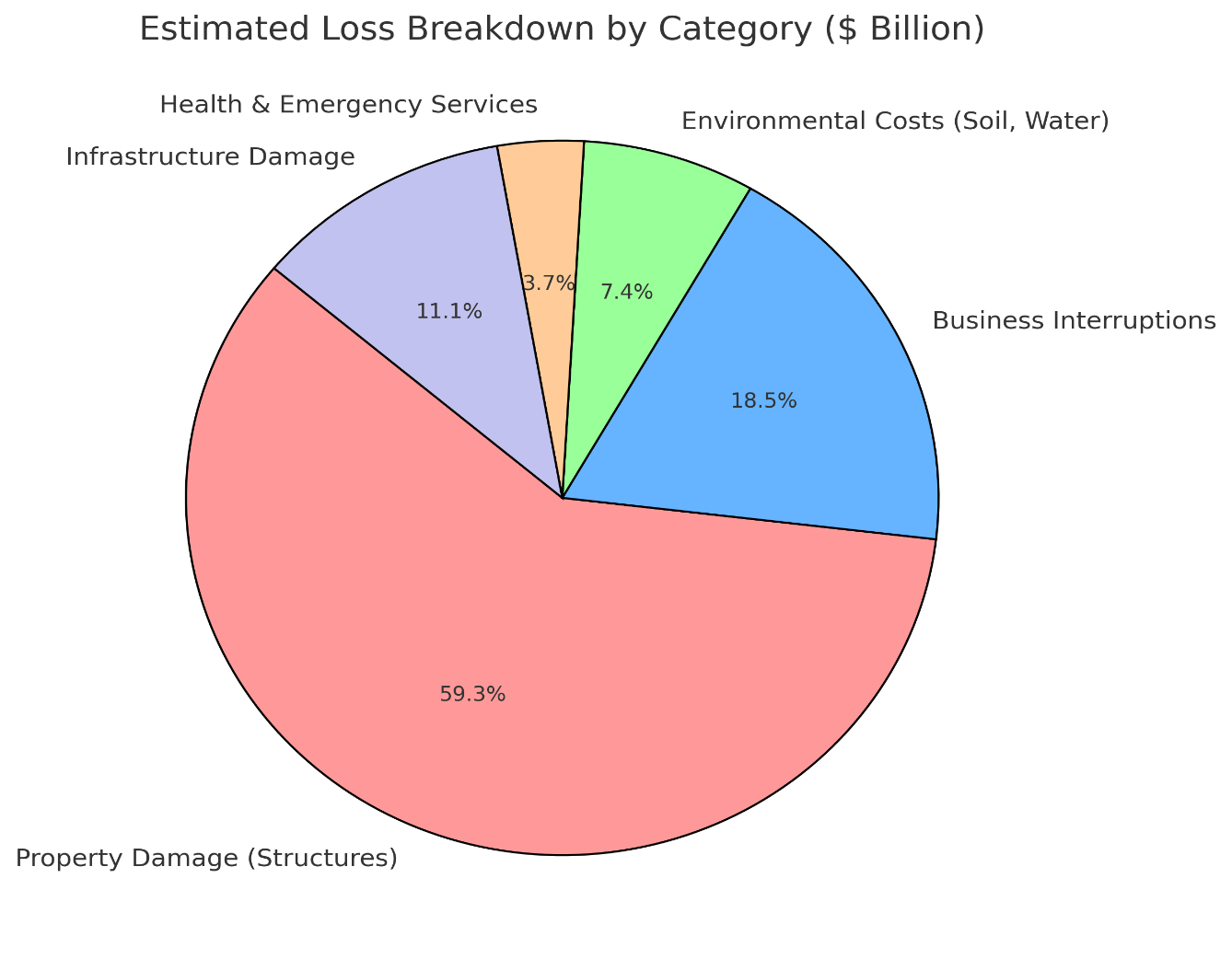

Chart: Breakdown of Economic Losses by Category

This bar chart can represent the estimated losses in different categories like property, business interruptions, and environmental damage

Estimated Loss Analysis

|

Category |

Estimated Loss ($ Billion) |

Percentage of Total Loss |

|||||||||||||||||||||

|

|

|

Key Insights:

The method used to analyze the estimated losses follows a percentage-based breakdown approach and comparative analysis. Below are the key steps and methodologies applied? (FEMA.gov)

Methodology Used

Category Loss

Percentage = ------------------------ X 100

Total loss

Data Interpretation

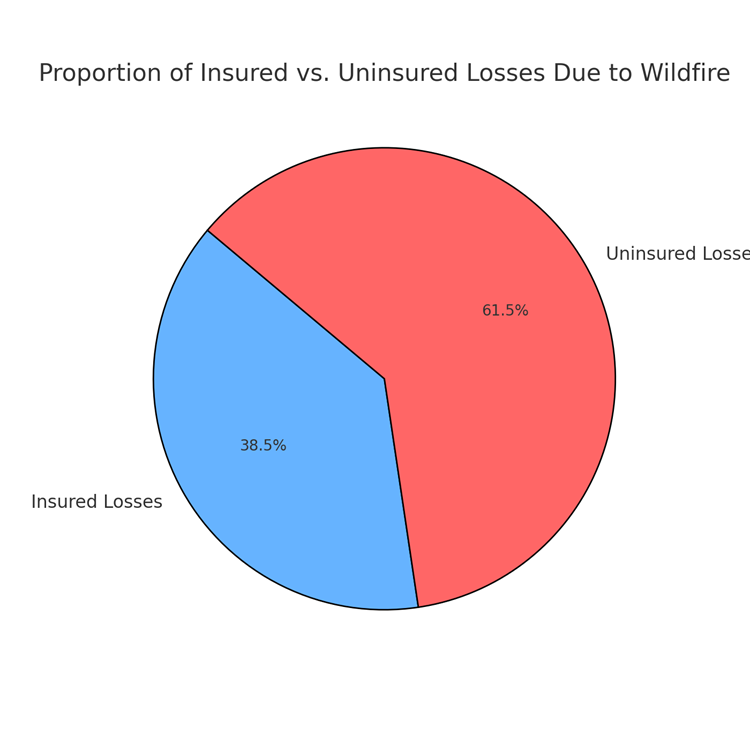

Pie Chart: Insurance vs. Uninsured Losses

This pie chart can represent the proportion of insured vs. uninsured losses due to the wildfire

Data Analysis:

The pie chart visually represents the distribution of insured and uninsured losses due to wildfire.

|

Insurance Status |

Amount ($ Billion |

Percentage of Total Losses |

|||||||

|

|

|

|||||||

|

Total Losses |

130 |

100% |

This table provides a clear breakdown of insured and uninsured losses due to the wildfire. Let me know if you need any modifications

Interpretation:

Data Analysis:

The stacked bar chart visualizes the differences between requested and allocated amounts for wildfire recovery aid across different sources.

|

Aid Category |

Requested Amount ($ Billion |

Allocated Amount ($ Billion) |

|||||||||||||||

|

|

|

|||||||||||||||

|

Total Recovery Requested |

40 |

32 |

Interpretation:

Conclusion

In conclusion, the financial toll of wildfires in California extends far beyond the initial devastation of homes and landscapes. These disasters trigger a chain reaction of economic consequences, affecting individuals, businesses, and the state’s overall fiscal health. From costly emergency responses to long-term infrastructure repairs, the monetary burden places immense pressure on state resources while significantly disrupting the daily lives of residents.

The cascading effects on local economies—such as business shutdowns, reduced tourism, and agricultural losses—further deepen the financial impact, making recovery a prolonged and complex process. Rising insurance premiums and declining property values only add to the strain, often leaving communities economically vulnerable long after the fires have been extinguished. These ongoing consequences underscore the importance of robust financial planning and economic support systems to help communities recover and adapt.

Ultimately, recognizing the full spectrum of wildfire-related financial losses is essential for informed policy development and strategic investment in prevention and preparedness. By understanding where and how these costs manifest, California can better allocate resources, enhance emergency infrastructure, and build more resilient communities. This comprehensive approach is key to not only mitigating future risks but also ensuring long-term economic stability in the face of a growing wildfire threat.

Furthermore, addressing the financial impacts of wildfires requires a collaborative effort between government agencies, private sector stakeholders, and local communities. Investments in fire-resistant infrastructure, improved land management practices, and early-warning systems can significantly reduce long-term costs and protect both lives and property. Encouraging community engagement and education around fire prevention can also empower residents to take proactive measures, fostering a shared responsibility for risk reduction. As wildfires become more frequent and severe due to climate change, a coordinated and forward-thinking approach will be vital to safeguarding California’s economic and environmental future.