International Journal of Business Research and Management

OPEN ACCESS | Volume 3 - Issue 2 - 2025

ISSN No: 3065-6753 | Journal DOI: 10.61148/3065-6753/IJBRM

Igwe, Chijioke Paul*, Anastecia Odinaka Igwe, Md Abdul Kader

Ulster University Business School London.

*Corresponding author: Igwe, Chijioke Paul, Ulster University Business School London.

Received: January 16, 2025 Accepted: March 24, 2025 Published: April 07, 2025

Citation: Igwe, Chijioke Paul, Anastecia O Igwe, Md Abdul Kader, (2025) “An Appraisal of International Entrepreneurship in Nigeria: A Case Study of SMEs”. International Journal of Business Research and Management 2(4); DOI: 10.61148/IJBRM/036

Copyright: © 2025. Igwe, Chijioke Paul. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

International entrepreneurship is the study of entrepreneurship and entrepreneurial activities by actors across international borders. The sole goal of this study is to gain an understanding of the challenges and opportunities attributable to SMEs. However, it appears that research on international entrepreneurship in Nigeria is limited. In addition, some dimensions of factors peculiar to the Nigerian economy but not generalized in literature were identified. Four groups of factors were considered such as: internal factors, external factors (economic factors, political factors) and psychical distance factors; and their individual effect on internationalization. To achieve these objectives, the researcher administered questionnaires to a randomly selected sample of two hundred and fifty-one (251) respondents through an online platform (Google form) and analysed the data using descriptive and inferential statistics, within the quantitative methodology. Specifically, frequency table, correlation analysis and the multiple regression models were used to analyse the objectives. The study found that managerial capacity, networking, foreign language, and industrialization, were identified to increase the internationalization process in Nigeria. On the other hand, inflation, interest rate, tax, and cultural differences, were found to negatively impact on the process of internationalization of SMEs in Nigeria. The recommendations were based on the findings and among other things, the study recommends that managers should be encouraged further through training, which will broaden their horizon, improve their wealth of experience and better their networking capacity. These are observed key ingredients that have proven to improve the internationalization process of SMEs. Furthermore, the Nigerian monetary authority is advised to control inflation and prevent commercial banks from charging exorbitant interest rates on loans made to individuals interested in business

Introduction:

Entrepreneurs, the world over, are saddled with the responsibility of identifying a problem and seeing it as an opportunity to better the environment and also to attain its reward, profit. However, it becomes somewhat of a greater task by looking beyond one’s national borders. This brings us to the central concept of this study “international entrepreneurship”. According to Masango, and Lassalle, (2020) and Gholizadeh, and Mohammadkazemi, (2022) an international entrepreneur discovers, enacts, evaluates, or exploits opportunities to create future goods or services and who cross national borders to do so.

In this context, with Nigeria as a case study, international entrepreneurs could be seen as multinational companies, foreigners doing business in Nigeria as well as small businesses owned by nationals to internationalize. Nigeria is a developing country having vast mineral and human resources with a sum of them largely untapped. Therefore, foreigners find it worthwhile and profitable to invest in Nigeria to take advantage of the mineral resources and cheap labour. International business according to ACT, (2022) involves the exportation, sharing of ownership by foreigners, and the presence of foreign subsidiaries together with the appointment of foreigners in the organisational structure of a firm.

According to the literature, the drive for a small or new firm to survive and grow internationally is propelled through exportation (Ayakwah, Osabutey, and Damoah, 2019). For businesses to thrive and go global in Nigeria both internal and external factors need consideration. The internal factors are those factors within the firm/organisation that affect the organisation either positively or negatively, while the external factors are those factors beyond the power of organisation (outside the organization) an outcome that is capable of affecting an organisation either positively or negatively. These two factors have the potential of affecting the profitability of the firm and their ability to internationalize.

The internal factors as discussed can be the manager’s capacity (knowledge), opportunity recognition, and networking capacity with potential foreign partners amongst others. The macroeconomic environment enumerates the external factors which an organisation/firm will be confronted with that might either have positive or adverse implications. The macroeconomic environment can be decentralized into political factors, economic, technological, social, environmental, and legal factors (Dźwigoł, 2021; Appiah, Anderson and Ayisi-Addo, 2022). Of key interest to this study are the economic, political, and technological factors. Examples of economic factors include business cycle, inflation, unemployment, interest rate, and GDP level. Political factors include taxation policy, foreign trade regulation, and government stability (Goslin, and Kluka, 2020). These factors could be seen as factors to consider when evaluating the cost of doing business in any location. For instance, the COVID-19 pandemic distorted businesses in Nigeria, having affected some macroeconomic indicators. The aftermath of the pandemic which led to a global lockdown in economic activities affected Nigeria particularly in terms of low economic activities, an increase in inflation, currency devaluation, low foreign direct investment, and a lot more. According to Azeez (2021) multiple tax structure appears to be the reason for the collapse of small and medium enterprises (SMEs) which could hinder their abilities to internationalize.

As opined by Shenkar, Luo, and Chi, (2021) small firms tends to internationalize when they can produce their products cheaply in foreign countries or export their products efficiently in international markets hitch-free. Conventionally, because small businesses do not have the required resources for foreign direct investment, the first step to internationalize is usually through exportation (Abubakar, et al., 2019). The overall exports in Nigeria have been fluctuating, however, there is no specific information as to the export volume from small and medium businesses. However, Omokaro-Romanus et al. (2019) noted that in the wake of the 21st century in Nigeria, her attained level of economic growth to some extent has been tied to the internationalization of indigenous firms. Child, Karmowska, and Shenkar, (2022) opined that the internationalization of small businesses is a strategy for wealth creation.

There is a surge in the creation or establishment of small businesses in Nigeria, however, only a handful gets recognized in the global space. This could be attributed to the high degree of unstableness in some factors, psychical distances, and more.

The macroeconomic environment in Nigeria with a focus on the unsteadiness in the economic and political arena has mitigated further developments in technology and thus these tend to suggest a negative effect on the possibility of small businesses thriving locally or even internationalizing. The unrest in some regions of the country – for instance, the scare of Boko Haram in the northern region, the Biafra agitation in the eastern region, and the Niger Delta crisis in the southern region of the country have further destabilized the economic activities and worse still, the political strength of the country. Also, within these unrests are the incessant kidnapping and banditry of nationals and foreigners, including herdsmen attack on farmers who supplies raw materials to most businesses. These have affected the business environment in Nigeria. More so, there exist, a case of high multiple tax rate on small-scale businesses (Azeez, 2021). This tends to affect the capital base of the business. The aforementioned have made the political atmosphere rather weak, which trickles down towards making entrepreneurs (both nationals and foreigners) scared of investing and for possible expansion. In addition to these miseries, the foreign exchange market has been very uncertain, thus, making business people so sceptical about planning and engaging in international business.

However, despite all these major challenges, small and medium businesses increase in their numbers. This study is therefore focused on conducting a general assessment of the challenges and motivating factors that have dispelled or propelled the internationalization of small and medium businesses in Nigeria.

This study aims at understanding the challenges and opportunities faced by entrepreneurs (specifically SMEs) in Nigeria, and how they can overcome the enumerated challenges and advance with identified opportunities. Therefore, the broad aim of this study is to evaluate an appraisal of international entrepreneurship in Nigeria with much emphasis on SMEs. Therefore, to achieve the aim of this study, the following are the specific objectives:

From the above aims and objectives, the following research questions beg for answers:

1.5 Methodology and data analysis:

A quantitative research approach was employed through data obtained from the survey research design. The questionnaire for the survey was well-structured and was well administered to the target respondents in an organized manner through an online platform (Google Form). The study utilized descriptive (frequency and percentages analysis) and inferential statistical techniques to drive home the answers to the study’s research questions. All these were achieved through the Statistical Package for Social Sciences (SPSS) version 25.

Statistically speaking, data are analysed using descriptive statistics and inferential statistics. Descriptive statistics can also be called summary statistics which is to inform us about the nature and characteristics of the obtained variables. Descriptive statistics includes the means, standard deviation, minimum values and maximum values. This method if properly analysed, further reinforces the inferential statistics. By inferential analysis, we mean analysis such as regression analysis, correlation analysis and more. Regression analysis is used specifically for quantitative analysis to determine impact analysis or causal analysis. Impact analysis is done to determine the impact or effect of an independent variable on a variable that begs for answers known as the dependent variable. However, correlation analysis is done primarily to determine the relationship between two variables (Lind et al. 2017). It is important to note that correlation is not same as causation.

Specifically, this study will do a combination of descriptive to describe the variables and inferential analysis to answer the various research questions.

1.6 Literature Review:

International entrepreneurship evolved from the advent of technological advancement and global cultural diffusion paved way for new ventures to access untapped opportunities in the international market (Baier-Fuentes et al., 2019). Unlike the conventional concept of entrepreneurship, which is more locally based, international entrepreneurship is much more complex as it deals with issues not only based or defined under a specific border or location but that which cuts across international borders. It is specifically noted that the complexity in the discus of international entrepreneurship is such that when an individual is considering a particular country in which he chooses to invest, such individual must be mindful of the country’s level of economic development, her balance of payment, the country’s political environment, her advancement in technology and other general economic indicators. Following this, studies on international entrepreneurship, as emphasized in the study of Leite and Moraes (2014 cited by Castro et al. 2020, p. 39), are primarily focused on the United States, implying that it is critical to broaden the scope of international entrepreneurship research to include other countries. Also, to Leite and Moraes (2014 cited by Castro et al 2020), the constituent of these disciplines can determine the international process of an organisation/firm.

To this end, developing countries as it were appear to be in dire need of studies of this nature. This is because it is pretty difficult for developing countries to survive in autarky (without international trade or business). The rationale for this is that developing countries tend to enjoy better comparative advantages when they combine trendy innovations and international best practices into their businesses. In the same vein, (Abubakar, et al., 2019) noted that small businesses are very likely to grow when they embrace and internalize the resources and technicalities offered by foreign firms from developed countries. This, therefore, creates the necessity to analyse the concept of international entrepreneurship.

Therefore, focusing on the firm as an actor in international entrepreneurship, defined international entrepreneurship as “the study of the nature and consequences of a firm risk-taking behaviour as it ventures into international entrepreneurship”. To facilitate international entrepreneurship, Guo, Z. and Jiang, W., (2020) noted that small as well as large businesses utilize the channel of imports and exports. These channels are crucial means, which propel the growth and access to new knowledge and technologies abroad. According to the Organisation for Economic Corporations and Development (OECD, 1997), the government of a nation gives its support to entrepreneurship across borders specifically through exports with the sole aim of increasing national wealth and enhance international competitiveness of the domestic nation. These channels are the same instruments that make or facilitate international trade within the field/discipline of economics.

1.6.1 SMEs Review:

Conventional economic wisdom posits that the influx of a good number of small business owners is a propeller to economic growth. According to the International Labour Organisation (ILO, 1999), small scale enterprises are those with a workforce of 11-50 employees. However, an emphasis on the capital base shows that a small enterprise (medium enterprises) should have an asset base within the range of 5 million to 50 million (50 million to less than 500 million) excluding land and buildings with a staff strength of 10 to 49 workers (50 to 199 workers) (Small and Medium Enterprises Development Agency of Nigeria, SMEDAN, 2012). A fair playground for small and medium businesses to thrive is one of the keys to economic development. More so, when they can internationalize through exports and other channels, there will be more foreign exchange earnings and greater attainment of the overall goal.

1.6.2The Integrative Model of Small Firm Internationalization:

This model is associated with the model developed by Zahoor, et al., (2020) with the sole intention to provide a comprehensive ideology of small-firm internationalization. This model describes the differences that propel the internationalization, motivation, and behavioural process of small firms by three (3) separate compartments which are the traditional, born global, and born again global.

Traditional firms (domestic firms that are yet to internationalize) follow an incremental approach toward internationalization. First and foremost, they establish a robust domestic market for their products and often enter the international market with increasing “psychic” distance. The knowledge factor of this group of firms is not that sophisticated and the product or services they offer are not so advanced. Born global firms are the extreme opposite of traditional firms in that they are highly knowledge-based firms. This means that a high level of scientific knowledge in the development of a product is very fundamental. An increase in technology leads to a higher level of knowledge. For instance, firms in this group such as software firms or internet service providers either develop proprietary knowledge or acquire knowledge and if they fail to do so, they will most likely cease to exist. It is important to mention categorically that knowledge based firms usually internationalize quite rapidly. The speed in internationalization is a function of a firm’s innovation of a particular technology or adoption of an already existing technology. Born again global are manufacturing firms that are between the two poles of traditional and born global. Born again global are traditional firm that is been taken over by another firm with more involvement in the international firm. Also, this is a traditional firm that has modified its modus operandi to internationalize via the internet. This could be through market innovation or the adoption of new technologies (Steinhäuser, et al., 2021; Freixanet, Rialp, and Churakova, 2020).

1.6.3 Factors Affecting the Performance of SMEs towards Internationalizing:

This section presents literature on the various factors affecting the internationalization of SMEs. We shall group them based on internal factors, external factors and psychical distance factors.

1.6.4 Internal factors affecting the internationalization of SMEs:

Internal factors are micro factors that are peculiar to an organisation. Marquis, and Qiao, (2020) noted some salient factors that affect internationalization as the entrepreneurs’ ideologies, attitudes, experience and strategic behaviour. Mashapa, and Maziriri, (2020) identified using the factor analysis method, four factors influencing internationalization of SMEs in Township. They are owner manager’s international orientation, globalization of SME’s industry, foreign market potential and SMEs established international networks. Using a Delphi method of analysis through the perspectives of some panel of experts, Torkkeli, et al., (2019) identified networking as the most potent factor for SME to go international. In addition, other factors worthy of recognition are: firm, industrial, external and motivational factors play key roles in internationalization of small and medium firms. These authors suggested that foreign and domestic conditions affect internationalization either positively or negatively. Likewise, Kunday and Senguler (2015) identified innovation and the right business skills as the factors that increase export orientation of SMEs.

Adebayo et al. (2019) identified some factors affecting SMEs internationalization process in Nigeria. The study found out that within the South-western region of the country, SME managers/owners’ educational attainment, previous exporting experience and business registration status amongst others as factors affecting the internationalization process in Nigeria.

1.6.5 External factors affecting the internationalization of SMEs:

External factors comprise of both economic factors and political factors. These are macroeconomic factors that are external to the firm. Sendra-Pons et al. (2022) identified five factors that affect entrepreneurship on a global level. These are institutional framework such as government effectiveness, a robust rule of law, access to credit, political stability and regulatory quality. The study further showed implications that economic factors such as low per capita income and high corruption index shows a reflection on the poor performance of entrepreneurship.

Hassan et al. (2020) identified that government policy of multiple taxations led to the surge in the cost of production, therefore, having an adverse effect on SMEs. Insecurity was identified as a factor but showed no tangibility in affecting SMEs significantly.

1.6.6 Psychical distance factors affecting the internationalization of SMEs:

The Uppsala theory and the integrative model brought about the consideration of psychical distance factors. These are factors that are capable of affecting the smooth flow of information within firms. A careful examination of this is also a careful examination of the dynamism involved in ensuring that information is passed smoothly and without interruption. The following are the findings of various authors.

A South Korean study by Kim (2017) identified the factors affecting the internationalization of small medium-sized enterprises. The study revealed that human capital, which reflects the accumulation of valuable skills, knowledge and experience, is positively related to the degree of internationalization of SMEs. Also, technological capabilities, foreign language skill, international experience and orientation of the entrepreneur are also crucial factors affecting the degree of internationalization of SMEs.

The relevance of psychic distance towards internationalization was conducted by Xavier et al. (2019) within a survey of 35 companies. Psychical factors before now have been germane when internationalization of companies is mentioned. However, this study finds evidence that cultural factors, which is a dimension of psychical distance has not been potent towards the internationalization decisions. However, economic factors identified in the study gained more relevance.

Lobo et al. (2020) noted that according to the literature, SMEs can penetrate the international market based on several factors such as cultural differences, company tradition, venture capital, product and competitors. However, Lobo found that the decision of SMEs to internationalize is a function of institutional change as it regards the external pressures in the home country. A positive institutional change will superlatively affect the speed of internationalizing more radically.

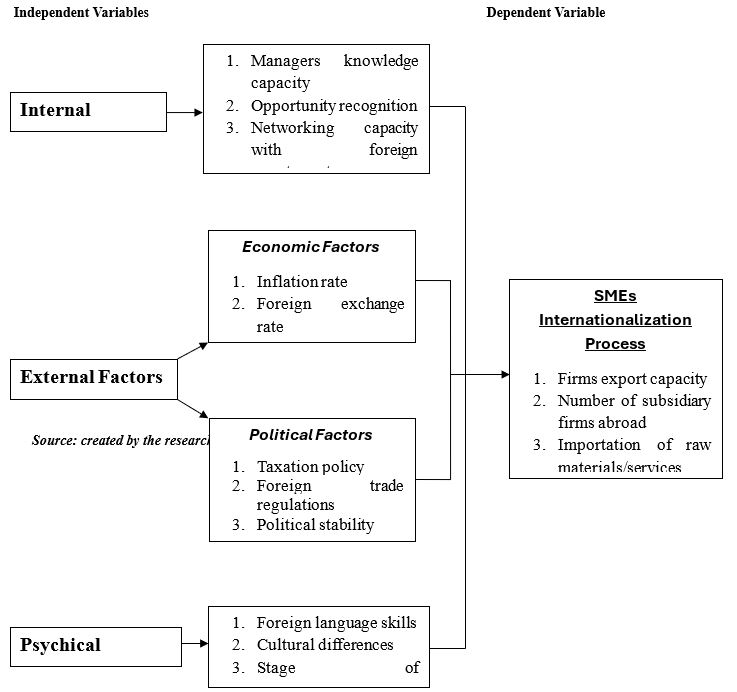

1.6.7 Conceptual Framework:

This captures the specific objectives in this study as it shows the dependence of SMEs capacity to internationalize (dependent variables) on the identified factors according to the literature gaps. According to the literature, generally internal, external and psychical factors are largely unexplored within a single study. Specifically in Nigeria, there is dearth amount of literature covering internal (firm factors) that has covered economic, political and psychical factors all in one.

The chart below shows the path through which the hypotheses in this study will be tested.

Source: created by the researchers

1.1.7 Findings, Analysis and Discussion:

1.7.1 Response Rate:

This study conducted a survey analysis by administering questionnaires to small and medium scale holders in Nigeria. Two hundred and fifty three (253) respondents filled the questionnaires while two from the total number did not give consent for the survey process. This led to the total neglect of their responses. The study utilized the responses of two hundred and fifty one (251) respondents which responded ‘YES’ to the consent question. It is important to note here that there is no missing information. This results to an impressive valid response rate of 99.2%, which is quite sufficient for analytical purpose. The table below buttresses the claims.

|

Observations made from the output of the survey |

Outcome |

|

Number of respondents |

253 |

|

Number of respondent who gave consent “YES” to the survey |

251 |

|

Number of respondents who didn’t give consent but went ahead to fill the questionnaire |

2 |

|

Number of valid respondents |

251 |

|

Rate of valid respondents (%) |

99.2% |

Table 1.7.1: Rate of response from respondents

Source: researchers survey output from Google forms, 2022.

In this section, we presented an analysis of demographical features that classifies the respondents in groups which in one way or the other makes the findings more meaningful.

|

1. What is your gender? |

|||||

|

|

Frequency |

Percent |

Valid Percent |

Cumulative Percent |

|

|

Valid |

Male |

138 |

55.0 |

55.0 |

55.0 |

|

Female |

113 |

45.0 |

45.0 |

100.0 |

|

|

Total |

251 |

100.0 |

100.0 |

|

|

Table 1.7.2: Gender

One of the millennium development goals is to promote gender equality which seeks to improve female participation in local and global affairs with the aim of reducing poverty and to trigger sustainable development. This study, through a random survey shows a close margin between the male and female genders. Table1.7.2 shows a total number of 251 individuals who responded to this survey, out of which 138 males and 113 females from both genders participated in the survey. This gives about 55% of male gender and 45% of female gender respectively. This shows an impressive performance of the female gender towards national development. This is quite a competitive scenario.

|

2. What is your age? |

|||||

|

|

Frequency |

Percent |

Valid Percent |

Cumulative Percent |

|

|

Valid |

18 – 24 |

19 |

7.6 |

7.6 |

7.6 |

|

25 – 39 |

131 |

52.2 |

52.2 |

59.8 |

|

|

40 – 54 |

74 |

29.5 |

29.5 |

89.2 |

|

|

44 – 69 |

21 |

8.4 |

8.4 |

97.6 |

|

|

70 and above |

6 |

2.4 |

2.4 |

100.0 |

|

|

Total |

251 |

100.0 |

100.0 |

|

|

Table 1.7.3: Age

Also, the table 1.7.3 shows how the respondents were grouped and identified by their age range. From the table, the frequency analysis reveals that 7.6% of the respondents are within the age range of 18 to 24 years; 52.2% of the respondents are within the age range of 25 to 39 years; 29.5% of the respondents falls within the range of 40 to 54 years; 8.4% of the respondents are within the age range of 40 to 54 years; finally 2.4% of the respondents falls within the range of 70 years and above. This shows that over half of the respondents in this study are in their youthful age are in their youthful age.

|

3. What is your current level of academic qualification? |

|||||

|

|

Frequency |

Percent |

Valid Percent |

Cumulative Percent |

|

|

Valid |

First School Leaving Certificate |

12 |

4.8 |

4.8 |

4.8 |

|

Senior Secondary Certificate Examination |

26 |

10.4 |

10.4 |

15.1 |

|

|

Bachelor Degree |

124 |

49.4 |

49.4 |

64.5 |

|

|

Masters Degree |

73 |

29.1 |

29.1 |

93.6 |

|

|

Doctorate Degree |

16 |

6.4 |

6.4 |

100.0 |

|

|

Total |

251 |

100.0 |

100.0 |

|

|

Table1.7.4: Educational Attainment

Educational attainment with respect to this study is to report the academic qualifications of those in SMEs. The result as shown in table 1.7.4 indicates that from a total valid sample of two hundred and fifty-one (251). From the sample, 12 (4.8%) are first school leaving certificate holders; 26 (10.4%) have attained their SSCE; 124 (49.4%) are bachelor degree holders; 73 (29.1%) are masters degree holders; while 16 (6.4%) are doctorate degree holders. This result suggests that more graduates are into the business phase than those without a degree.

|

4. How long have you been in business? |

|||||

|

|

Frequency |

Percent |

Valid Percent |

Cumulative Percent |

|

|

Valid |

Less than 5 years |

71 |

28.3 |

28.3 |

28.3 |

|

5 to 15 years |

114 |

45.4 |

45.4 |

73.7 |

|

|

16 to 25 years |

41 |

16.3 |

16.3 |

90.0 |

|

|

26 to 35 years |

15 |

6.0 |

6.0 |

96.0 |

|

|

36 years and above |

10 |

4.0 |

4.0 |

100.0 |

|

|

Total |

251 |

100.0 |

100.0 |

|

|

Table 1.7.5: Experience in Business (measured by the length of time)

Aside age, which tends to measure how advanced an individual might be, the question posed in table 4.5 deals on the experience of business owners. The table shows that given a total number of 251 respondents, 71 (28.3%) of them have been in business less than five years; 114 (45.4%) have been in business within the space of 5 to 15 years; 41 (16.3%) have been in business within 16 to 25 years; 14 (6%) of the sample have been in business within the range of 26 to 35 years; while 10 (4%) have been in business over 36 years. From this result, it is quite suggestive that there are not much individuals with so much experience in business. However, conventional wisdom would agree that not all business establishments will survive for over two decades. This is evident as the number gradually collapses from 5 to 15 years.

|

5. What is your current staff strength? |

|||||

|

|

Frequency |

Percent |

Valid Percent |

Cumulative Percent |

|

|

Valid |

10 to 50 workers |

225 |

89.6 |

89.6 |

89.6 |

|

50 and above |

26 |

10.4 |

10.4 |

100.0 |

|

|

Total |

251 |

100.0 |

100.0 |

|

|

Table 1.7.6: Staff Strength

This is simply to show us the total number of respondents under the small business and those under medium business which is the focus of this study in terms of scope according to SMEDAN (2012). Form the study’s 251 randomly sampled respondents, 225 (89.6%) are small business owners, while 26 (10.4%) are medium business owners. This implies that a good number of the population is small business owners. Therefore, economic developments through SMEs are fuelled by small business owners.

|

6. Where does your business fall in? |

|||||

|

|

Frequency |

Percent |

Valid Percent |

Cumulative Percent |

|

|

Valid |

Northern Nigeria |

66 |

26.3 |

26.3 |

26.3 |

|

Southern Nigeria |

185 |

73.7 |

73.7 |

100.0 |

|

|

Total |

251 |

100.0 |

100.0 |

|

|

Table 1.7.7: Business Location

The location of an entrepreneur business tells us from the two extreme poles, the region that fully engaged in small and medium businesses in Nigeria. the result reveals that 66 of the total sample, which makes up 26.3% are from the northern part of the country, while the largest number, a total o 185 from the entire sample are from the southern part of Nigeria. This is undoubtedly true as the business hubs of Nigeria such as Lagos, Onitsha and Aba market are mainly from the southern part of the country.

|

|

|

Lowest level |

Low level |

Average level |

High level |

Highest level |

|

1.1 How viable will you rate your firms' export capacity? |

Frequency |

55 |

68 |

100 |

23 |

5 |

|

Percent |

21.9% |

27.1% |

39.8% |

9.2% |

2.0% |

|

|

1.2 What level of subsidiary firm do you have abroad? |

Frequency |

78 |

86 |

69 |

15 |

3 |

|

Percent |

31.1% |

34.3% |

27.5% |

6.0% |

1.2% |

|

|

1.3 To what extent do you import raw materials/services from abroad? |

Frequency |

61 |

68 |

66 |

38 |

18 |

|

Percent |

24.3% |

27.1% |

26.3% |

15.1% |

7.2% |

|

|

2.1 How would you rate your firms' managerial capacity? |

Frequency |

12 |

26 |

123 |

78 |

12 |

|

Percent |

4.8% |

10.4% |

49.0% |

31.1% |

4.8% |

|

|

2.2 To what extend does your firm recognize opportunities? |

Frequency |

5 |

25 |

85 |

107 |

29 |

|

Percent |

2.0% |

10.0% |

33.9% |

42.6% |

11.6% |

|

|

2.3 What level is the foreign networking capacity of your business? |

Frequency |

32 |

59 |

103 |

46 |

11 |

|

Percent |

12.7% |

23.5% |

41.0% |

18.3% |

4.4% |

|

|

3.1 How has the current inflation rate affected your business positively? |

Frequency |

33 |

54 |

59 |

64 |

41 |

|

Percent |

13.1% |

21.5% |

23.5% |

25.5% |

16.3% |

|

|

3.2 At what level has the massive depreciation of naira relative to dollar improved your business? |

Frequency |

69 |

68 |

66 |

30 |

18 |

|

Percent |

27.5% |

27.1% |

26.3% |

12.0% |

7.2% |

|

|

3.3 How has the interest rate on loans by commercial banks improved your business? |

Frequency |

64 |

77 |

74 |

27 |

9 |

|

Percent |

25.5% |

30.7% |

29.5% |

10.8% |

3.6% |

|

|

5.1 To what extent are you conversant with foreign languages? |

Frequency |

54 |

71 |

90 |

30 |

6 |

|

Percent |

21.5% |

28.3% |

35.9% |

12.0% |

2.4% |

|

|

|

|

Strongly disagree |

Disagree |

Neutral |

Agree |

Strongly agree |

|

4.1 The current tax rate does not negatively affect the performance of my business. |

Frequency |

70 |

90 |

51 |

31 |

9 |

|

Percent |

27.9% |

35.9% |

20.3% |

12.4% |

3.6% |

|

|

4.2 There are no international rules that act as a barrier in my line of business. |

Frequency |

30 |

73 |

74 |

62 |

12 |

|

Percent |

12.0% |

29.1% |

29.5% |

24.7% |

4.8% |

|

|

4.3 Is the political environment stable enough for your business to thrive? |

Frequency |

44 |

105 |

48 |

40 |

14 |

|

Percent |

17.5% |

41.8% |

19.1% |

15.9% |

5.6% |

|

|

5.2 Cultural differences with other countries have no negative effect to my choice of business. |

Frequency |

21 |

52 |

69 |

82 |

27 |

|

Percent |

8.4% |

20.7% |

27.5% |

32.7% |

10.8% |

|

|

5.3 The current stage of industrialization in my country has greatly improved on my business. |

Frequency |

36 |

88 |

61 |

58 |

8 |

|

Percent |

14.3% |

35.1% |

24.3% |

23.1% |

3.2% |

Table 1.8.1: Independent and Dependent Variables

The table 1.8.1 above shows the frequencies and percentage responses from all variables.

Correlation Analysis

This section shows the relationship between the dependent variables and all independent variables. Correlation analysis is not sufficient for a causal analysis but to show the strength of relationship amongst to variables at a time. According to Saunders et al. (2009) the coefficient of correlation falls within the range of +1 to -1. A positive correlation depicts that there is a direct relationship. This means that the two variables move close to same direction. Whereas, a negative correlation suggests an inverse relationship between two variables this means that as the two variables dives apart. In addition to this, the value it carries shows the strength of relationship. It has a strong relationship as it approaches the value one in absolute terms and has a weak relationship as it gravitates towards zero. It is important not to throw caution to the wind when we imply that correlation means causation. This is emphatically debunked by Van et al., (2020) and so many other scholars who opined that correlation is not causation. Therefore, correlation suggests merely a pattern of relationship and not sufficient for an impact analysis as does regression. The analysis below shows the correlation result of the dependent variable (internationalization process) and independent variables ranging from internal factors, external factors (economic and political factors), and psychical factors.

|

|

Internationalization process |

|

|

Internationalization process |

Pearson Correlation |

1 |

|

Sig. (2-tailed) |

|

|

|

N |

251 |

|

|

Managerial capacity |

Pearson Correlation |

0.321** |

|

Sig. (2-tailed) |

<0.001 |

|

|

N |

251 |

|

|

Opportunity recognition |

Pearson Correlation |

0.224** |

|

Sig. (2-tailed) |

<0.001 |

|

|

N |

251 |

|

|

Networking |

Pearson Correlation |

0.537** |

|

Sig. (2-tailed) |

<0.001 |

|

|

N |

251 |

|

|

Table 9.0: Correlation between Internationalization Process and the Internal Factors **. Correlation is significant at the 0.01 level (2-tailed). |

The correlation result between internationalization process and internal factors of the firms are discussed as follows. Managerial capacity shows a significant positive relationship with internationalization process. This means that both variables gravitate towards the same direction. However, the Pearson correlation coefficient shows 0.32, though a significant correlation, but it is a weak one in terms of strength. Opportunity recognition of firm is seen to have a weak positive and significant correlation with internationalization process. However, networking is seen to have a positive, strong and significant relationship with internationalization process.

|

|

Internationalization process |

|

|

Internationalization process |

Pearson Correlation |

1 |

|

Sig. (2-tailed) |

|

|

|

N |

251 |

|

|

Inflation |

Pearson Correlation |

-0.145* |

|

Sig. (2-tailed) |

0.022 |

|

|

N |

251 |

|

|

Depreciation of exchange rate |

Pearson Correlation |

-0.173** |

|

Sig. (2-tailed) |

0.006 |

|

|

N |

251 |

|

|

Interest rate |

Pearson Correlation |

-0.331** |

|

Sig. (2-tailed) |

<0.001 |

|

|

N |

251 |

|

|

Table 1.9.1: Correlation between Internationalization Process and the Economic Factors *. Correlation is significant at the 0.05 level (2-tailed). |

|

**. Correlation is significant at the 0.01 level (2-tailed). |

Table 1.9.1 shows the correlation between the dependent variable (internationalization process) and economic factors. Inflation shows a negatively significant but weak (0.145) strength of relationship with internationalization process at the 5% level. It suggests that as one goes up, the other goes down but with a weak magnitude. Depreciation of exchange rate shows a weak but a significant negative relationship with internationalization process at the 1% level of significance. This implies that their relationship is inverse in nature. Interest rate shows evidence for a negative significant relationship with internationalization process. Although the strength of relationship is bigger than the other two discussed, but it is still a weak strength of relationship.

|

|

Internationalization process |

|

|

Internationalization process |

Pearson Correlation |

1 |

|

Sig. (2-tailed) |

|

|

|

N |

251 |

|

|

Tax |

Pearson Correlation |

-0.118 |

|

Sig. (2-tailed) |

0.063 |

|

|

N |

251 |

|

|

External trade laws |

Pearson Correlation |

-0.047 |

|

Sig. (2-tailed) |

0.461 |

|

|

N |

251 |

|

|

Political stability |

Pearson Correlation |

-0.005 |

|

Sig. (2-tailed) |

0.942 |

|

|

N |

251 |

|

|

Table 1.9.2: Correlation between Internationalization Process and the Political Factors **. Correlation is significant at the 0.01 level (2-tailed). |

Table 1.9.2 shows the correlation analysis between internationalization process and political factors. Unfortunately, the Pearson correlation are all negative but no showed no evidence of significance between variables. Therefore, given the sample under investigation, there is no correlation between internationalization process and observed political factors.

|

|

Internationalization process |

||

|

Internationalization process |

Pearson Correlation |

1 |

|

|

Sig. (2-tailed) |

|

||

|

N |

251 |

||

|

Foreign language |

Pearson Correlation |

0.317** |

|

|

Sig. (2-tailed) |

<0.001 |

||

|

N |

251 |

||

|

Cultural differences |

Pearson Correlation |

-0.114 |

|

|

Sig. (2-tailed) |

0.072 |

||

|

N |

251 |

||

|

Industrialization |

Pearson Correlation |

0.137* |

|

|

Sig. (2-tailed) |

0.030 |

||

|

N |

251 |

||

|

Table 1.9.3: Correlation between Internationalization Process and the Psychical distance Factors **. Correlation is significant at the 0.01 level (2-tailed). |

|

||

|

*. Correlation is significant at the 0.05 level (2-tailed). |

|

||

Table1.9.3 shows the correlation result between the dependent variable for the study and the psychical factors. Foreign language and internationalization process shows a positive and significant relationship together at one percent significant level, but with a not too strong relationship (0.317). Cultural differences and internationalization process is not significant. Industrialization and internationalization process is positive and significant in s percent level of significance.

Regression analysis is mostly conducted to test how significant an independent variable is in predicting the behaviour of the dependent variable. In this study, a multiple regression analysis is conducted, the essence of which is to group them accordingly and prevent any case of multicollinearity amongst variables.

There are some key items we focus on in a regression output. They are: coefficients, which show the effect or impact of a variable; student’s t-statistics which can be used to measure the significance of a model and probability value (p-value), which is the true level of significance. We also have some model diagnostic tests such as the Durbin-Watson statistics, which shows if there is a case of autocorrelation in the model. A Durbin-Watson value between 1.5 and 2.4 shows that there is no autocorrelation in the model, otherwise, there is. Also, we look at the R2, which is the coefficient of determination that shows how the variation in the dependent variable is explained by the independent variables or predictors. Finally, the F-statistic through the ANOVA table shows if the model is well specified given an analysis of variance. In clear terms, the F-test shows the probability that there is an association on the findings of a random regression model (Malhotra, 2019).

|

Dependent Variable: Internationalization process |

||||||

|

Model |

Regression coefficients |

t-statistic |

p-value |

Remark |

||

|

B |

Std. Error |

|||||

|

1 |

(Constant) |

1.047 |

0.187 |

5.608 |

<0.001 |

Significant |

|

Managerial capacity |

0.119 |

0.062 |

1.913 |

0.057 |

Significant |

|

|

Opportunity recognition |

-0.032 |

0.059 |

-0.548 |

0.584 |

Insignificant |

|

|

Networking |

0.375 |

0.045 |

8.289 |

<0.001 |

Significant |

|

|

||||||

Table 1.10.0: Regressing Internationalization Process on Internal Factors

Table 1.10.0 shows the impact of internal factors on internationalization process. Three variables were considered in this model. They are: managerial capacity, opportunity recognition and networking. Managerial capacity of the firm is significant at 10% level in increasing internationalization process of the firms. This shows that a unit increase in managerial capacity, will increase the internationalization process by 0.12 units if other variables are equal to zero. Opportunity recognition is negative but not statistically significant. This shows that opportunity recognition of a firm shows no evidence of having impact on internationalization process in Nigeria. However, networking is positive and highly statistically significant at 1% level of significance. Therefore, if all other variables is equal to zero, a unit increase in the networking capacity of a firm will increase its chance of internationalizing by 0.38 units. This means that networking as an internal factor has positive impact on internationalization process. The constant, though having no concrete importance in discussing impact analysis shows a positive effect on internationalization process. This means that if all variables are not being considered, internationalization process will likely increase.

The diagnostic table shows a healthy Durbin-Watson statistics of 1.72. This shows that there is no autocorrelation in the model. The R2 coefficient of determination indicates that the model explains approximately 30% of the variance in the internationalization process. Finally, the F-statistics and probability value shows that the model is well specified.

|

Dependent Variable: Internationalization process |

||||||

|

Model |

Regression coefficients |

t-statistic |

p-value |

Remark |

||

|

B |

Std. Error |

|||||

|

2

|

(Constant) |

3.373 |

0.191 |

17.612 |

<0.001 |

Significant |

|

Inflation |

-0.064 |

0.039 |

-1.646 |

0.101 |

Significant |

|

|

Depreciation of exchange rate |

0.003 |

0.045 |

0.060 |

0.952 |

Insignificant |

|

|

Interest rate |

-0.230 |

0.048 |

-4.786 |

<0.001 |

Significant |

|

|

||||||

Table 1.10.1: Regressing Internationalization Process on Economic Factors

This multiple regression model result in table 1.10.1 shows the impact analysis of the economic factors on internationalization process. Inflation is negative and significant at 10% level of significance. This shows that holding the influence of other variables constant a unit increase in inflation will reduces the drive for internationalization by 0.06 units. This means that inflation as an economic factor has a negative impact on internationalization process in Nigeria. Depreciation of exchange rate is positive and not statistically significant even at 10%. Therefore, depreciation of exchange rate has no impact on internationalization process in Nigeria for the sample under investigation. Finally, interest rate from banks is negative and statistically significant at 1% level of significance. This shows that when all other variables is equal to zero, a unit increase in interest rate by banks will decrease the drive for internationalization by 0.23 units. Therefore, interest rate has a significant impact on internationalization process in Nigeria for the period and sample under investigation. In this second model, the constant coefficient is positive and statistically significant at 1% level. This reaffirms that internationalization will increase given no variables under consideration. However, this has no justification and therefore, almost irrelevant.

The Durbin-Watson test is ok at 1.72 showing no autocorrelation in the model. Secondly the goodness of fit of the model, which is reported by the R2, shows that the predictors are able to predict 12% of the variation in internationalization process. Also, the F-stat and p-value is significant at 1% level. This shows that the model is well specified.

|

Dependent Variable: Internationalization process |

||||||

|

Model |

Regression coefficients |

t-statistic |

p-value |

Remark |

||

|

B |

Std. Error |

|||||

|

3 |

(Constant) |

2.842 |

0.281 |

10.105 |

<0.001 |

Significant |

|

Tax |

-0.088 |

0.047 |

-1.859 |

0.064 |

Significant |

|

|

External trade laws |

-0.022 |

0.048 |

-0.461 |

0.645 |

Insignificant |

|

|

Political stability |

-0.034 |

0.047 |

-0.717 |

0.474 |

Insignificant |

|

|

||||||

Table 1.10.2: Regressing Internationalization Process on Political Factors

Table 1.10.2 above shows a summary on the impact of political factors on internationalization process in Nigeria. The constant value is positive and statistically significant. This means that internationalization process will keep on increasing even if all other variables are zero. Howbeit, there is no justification towards such claim. Tax is negative and statistically significant at 10% level. This suggests that a unit increase in tax will reduce the internationalization process by 0.09 units, given that all other variables are assumed to be zero. Therefore, tax has a significant impact on internationalization process in Nigeria, given the period and sample under investigation. However, external trade laws and political stability are negative and not statistically significant at the 10% level. Therefore, we conclude that neither external trade laws nor political stability has an impact on internationalisation process in Nigeria.

The Durbin-Watson result shows that there is no autocorrelation in the model as the value is 1.71. Secondly the goodness of fit of the model, which is reported by the R2, shows that the predictors are able to predict 2% of the variation in internationalization process. This is quite poor. Also, the F-stat and p-value is not significant at even 10% level. This shows that the model is not well specified.

|

Dependent Variable: Internationalization process |

||||||

|

Model |

Regression coefficients |

t-statistic |

p-value |

Remark |

||

|

B |

Std. Error |

|||||

|

4 |

(Constant) |

1.880 |

0.188 |

9.999 |

<0.001 |

Significant |

|

Foreign language |

0.238 |

0.045 |

5.275 |

<0.001 |

Significant |

|

|

Cultural differences |

-0.115 |

0.042 |

-2.734 |

0.007 |

Significant |

|

|

Industrialization |

0.097 |

0.044 |

2.207 |

0.028 |

Significant |

|

|

||||||

Table 1.10.3: Regressing Internationalization Process on Psychical Distance Factors

Table 1.10.3 shows the impact of psychical factors on internationalization process in Nigeria. Three factors were identified to be psychical factors such as: foreign language, cultural differences and industrialization. Like in other models, this model has a positive significant constant coefficient. This means that industrialization process will improve regardless of other variables. This should be taken with a pinch of salt. Foreign language is positive and statistically significant at 1% level. This means that holding the influence of other variables constant, a unit increase in foreign language will increase internationalization process by 0.10 units. Therefore, foreign language has positive impact on internationalization process in Nigeria. Cultural differences is negative and statistically significant at 1% level. This shows that a unit increase in cultural differences will reduce internationalization process by 0.12 units if other variables are equal to zero. Thus, we conclude that cultural differences has a significant impact on internationalization process in Nigeria. Finally, industrialization is positive and statistically significant at 5% level of significance. Therefore, if all other variables are equal to zero, a unit increase in industrialization will further propel internationalization process in Nigeria. This shows that industrialization has a positive impact on internationalization process in Nigeria.

The diagnostic table shows a healthy Durbin-Watson statistics of 1.72. This shows that there is no autocorrelation in the model. The coefficient of determination, given by the R2, reveals that 13% of the variation in internationalization process is explained by the regressors. Finally, the F-statistics and probability value shows that the model is well specified given a significant probability value at 1%.

This study conducted a survey to explore an appraisal of international entrepreneurship in Nigeria for a sample size of two hundred and fifty one (251) respondents. The concept of international entrepreneurship was developed on the theories of internationalization. Therefore, for this study, international entrepreneurship was conceptualized under internationalization. Four salient questions were asked in the first chapter of this work. However, the answer to the fourth question has been provided in the chapter that follows. Therefore, the findings for the first three questions will be discussed below:

RQ1. How have the identified internal factors affected the growth of SMEs in Nigeria towards internationalization?

The study identified three internal factors according to the literature. They are: managerial capacity of managers, opportunity recognition and networking. Of these three factors identified, managerial capacity and networking showed evidence for a positive impact on the expansion or growth of SMEs in Nigeria, through the channel of internationalization. Opportunity recognition showed no evidence for impact. Cooke, Heidenreich, Braczyk, (2024) and Stallkamp, and Schotter, (2021) jointly agreed that networking is potent for any firm with the desire to go global. These significant factors also showed evidence for a positive correlation with internationalization process which is a surrogate for international entrepreneurship according to this study.

RQ2. What are the crucial external factors affecting the internationalization of SMEs in Nigeria?

In this study, external factors are macroeconomic factors which were broken down into two different forms. The first is economic factors and second is political factors. For the economic factors, threes variables were selected and used in the model such as inflation, exchange rate depreciation and interest rate. Also, for the political factors, three variables where considered. They are: tax, external trade laws and political stability.

Findings from the economic factors show evidence for an increase in inflation and interest rate to have negative impact on the internationalization process of SMEs in Nigeria. Depreciation exchange rate did not show any evidence for an impact.

Evidence from analysing the impact of political factors on internationalization in SMEs in Nigeria shows that tax has impact on reducing the speed of internationalization in Nigeria. External trade laws and political stability has no impact on internationalization. Hassan et al. (2020) and Azeez (2021) agrees that multiple tax on SMEs discourage their drive for more profitability and desire to expand internationally.

RQ3. To what extent have psychical distance limited internationalization of SMEs in Nigeria?

In this study three psychical factors were identified. They are proficiency in foreign language, cultural differences and industrialization stage of the country. The study showed that these three psychical factors have proved to impact on internationalization process in Nigeria. Specifically, foreign language and industrialization positively impact on the speed of internationalization, while cultural differences was found to show evidence for a negative impact on internationalization process - noting that psychical distance is the dynamic aspect of focus in terms of the internationalization of SMEs.

1.12 Conclusions:

The purpose of this study was to evaluate international apprenticeship in Nigeria, with a particular emphasis on SMEs. The study sought to comprehend the challenges and opportunities confronting entrepreneurs (particularly small and medium-sized enterprises) in Nigeria, as well as how they can overcome the aforementioned obstacles and progress through effective recommendations. To accomplish this, the study used quantitative methodology and administered questionnaires to a randomly selected sample of 251 respondents. The descriptive and inferential statistical techniques were used in this study. Because we used categorical variables, we needed to perform a frequency analysis to determine the number of times a specific item was voted for, as well as the percentages. Following that, inferential statistical techniques such as correlation analysis and multiple regression analysis were used. The former is used to establish the relationship between two variables, while the latter is used to answer the research questions. Four research questions were brought forth in the course of carrying out this study, three of which were impact analyses of macroeconomic and microeconomic factors on the speed or process of internationalization, and the fourth is based on recommendations, which are discussed in the section that follows.

Because we are considering an appraisal, we classified factors into various groups in order to determine or assess how they have affected the internationalization of SMEs and thus international entrepreneurship. This study's literature was based on the internationalization theory. The paragraphs that follow are drawn from the study’s research questions, analysed and concluded based on the findings.

To begin, the study investigated how the identified internal factors influenced the growth of SMEs in Nigeria toward internationalization. According to the findings of the study, managerial capacity and networking have been effective in accelerating the process of internationalization of SMEs in Nigeria.

Second, the study inquired about the major external factors influencing the internationalization of SMEs in Nigeria. The study discovered evidence that inflation, interest rates, and taxes have a negative impact on internationalization. This suggests that Nigerian entrepreneurs are uneasy about the rate of inflation, commercial bank interest rates, and taxation. Hassan et al. (2020) agree with our findings by emphasizing that government policy of multiple taxation had a negative impact on the internationalization of SMEs. Azeez (2021) believes that evidence of multiple tax structures is another reason for unattractive SMEs. It is important to note that an unfavourable tax structure has a tendency to lead to inflation as a result of increased production costs (cost-push inflation).

1.13 Recommendations:

We identified approximately eight (8) factors that influence international entrepreneurship in Nigeria. The majority of those who participated in this study were small businesses, with 89.6% being small businesses and 10.4% being medium-sized businesses. Four of the eight determinants of SMEs' internationalization (managerial capacity, networking, foreign language, and industrialization) encourages international entrepreneurship, while the remaining four (inflation, interest rate, tax, and cultural differences) discourages international entrepreneurship in Nigeria. As a result, the following policy recommendation would be to encourage small businesses to thrive, despite the fact that the frequency analysis revealed that only a few businesses (4%) of the sample had been in operation for more than 36 years.

Based on our findings and the assertion of Lobo et al. (2020), a positive institutional change transforms the quest for massive internationalization in the same direction, the study makes the following recommendations: