International Journal of Business Research and Management

OPEN ACCESS | Volume 4 - Issue 3 - 2026

ISSN No: 3065-6753 | Journal DOI: 10.61148/3065-6753/IJBRM

Huimin Li

Jinan, China.

*Corresponding author: Huimin Li, Zhongtai Securities Co.,Ltd, Jinan, China.

Received: January 20, 2026 | Accepted: January 28, 2026 | Published: January 31, 2026

Citation: Huimin Li., (2026). “Core Platform for Data Governance and Wealth Management of Securities Companies”. International Journal of Business Research and Management 4(2); DOI: 10.61148/3065-6753/IJBRM/068.

Copyright: © 2026. Huimin Li, This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

How securities companies can carry out digital transformation has long been a core research issue valued by both academia and industry in recent years. Starting with basic issues such as financial data governance and the construction of relevant system platforms, this paper gradually clarifies and discusses the misunderstandings, development positioning and key design points existing in the process of financial technology promotion in securities companies. On this basis, taking the wealth management business of securities companies as an example, this paper systematically puts forward the methods and processes of embedding artificial intelligence technology into related businesses from the aspects of the needs of companies and customers, product design, implementation architecture, etc., so as to realize the empowerment of financial technology for the digital transformation of companies. Finally, from the perspective of top-level design and data-driven approach, this paper defines the connotation of the securities intelligent expert system; and clearly puts forward policy suggestions and system construction guidelines for promoting the digital transformation of securities companies from key nodes such as model design, technology application and risk control management. In addition, this paper also looks forward to the subsequent development of the securities intelligent expert system.

Securities Company; Digital Transformation; Financial Technology; Artificial Intelligence, Securities Intelligent Expert System

1. Introduction

The financial industry has fully embraced the era of big data. Driven by the continuous innovative application of financial technology, traditional financial development models are obviously no longer adaptable to the new market landscape. Against this backdrop, the financial sector, especially securities companies, is in urgent need of digital transformation to seize opportunities and address challenges brought by technologies such as artificial intelligence, big data, cloud computing, and robotic process automation.

The ultimate goal of digital transformation and data governance for securities companies is essentially to build an intelligent expert system; only such a system is capable of serving as the technological means and platform to underpin the development of various businesses across financial sectors including banking, securities, and insurance.

How to understand, construct and apply intelligent expert systems, explore and refine reasonable and compliant innovations in financial services, and balance the benefits, efficiency and security among securities companies, clients and industry regulators has become a core research issue confronting both market institutions and academic circles.

Building an intelligent expert system to drive the digital transformation of securities companies is essentially the integration of financial technology with the innovative development of these firms. The term FinTech is a portmanteau of the English words Financial and Technology. The People's Bank of China points out that: FinTech refers to technology-driven financial innovation, which aims to leverage modern scientific and technological achievements to transform or innovate financial products, business models, and operational processes, thereby promoting the high-quality and efficient development of the financial sector [1].

At present, academic research on FinTech mainly focuses on the following four aspects. First, from an industry-wide perspective without differentiating between specific enterprises, studies generally discuss the current status and development trends of FinTech, and put forward research prospects related to FinTech [2]. Relevant studies indicate that the market entry of FinTech has promoted the technological innovation and development of enterprises, facilitated the transformation of internal production structures, improved production efficiency, and boosted regional economic growth [3].

Second, research delves into the segmented fields of FinTech, exploring the development status of relevant technologies as well as the risks, challenges, and opportunities they bring. For instance, studies assess the current development of big data technology and the associated risks to the financial industry, such as data monitoring, data protection, privacy infringement, and legal supervision [4][5]; additionally, from the perspective of credit big data, research focuses on the loan management and risk governance of small and micro enterprises [6].

Third, research examines the impacts and applications of FinTech in specific industries. Examples include studies on the degree of impact of FinTech on banks of different scales and their liability-side structures [7], as well as its influence on the risk control of securities companies [8]. Going a step further, research centers on specific corporate businesses, such as the strategic goals and development models of platforms for wealth management [9] and robo-advisory services [10], and puts forward corresponding policy recommendations.

Finally, other existing studies, from the perspective of regulators, explore the dilemmas, approaches, and development of FinTech supervision. For example, some studies propose adhering to the principle of technological neutrality to prevent technological risks from evolving into liquidity risks [11], while others advocate for a distributed, intelligent, pilot-based, and equal dynamic regulatory mechanism [12].

For technology-driven financial innovation, we must not only adhere to the principle of prudence and top-level design at the macro level, but also pay closer attention to specific and feasible technology application solutions at the micro level.

Based on existing literature, this paper takes wealth management as a case study and focuses on the securities big data intelligent expert system—the core platform for the digital transformation of securities companies—for in-depth research.

In the past, constrained by the limitations of technological development such as computer computing power, the importance and practicality of the securities big data intelligent expert system have long been overlooked. Therefore, as technological advances and market changes force securities companies to carry out reforms, the construction and application of this system will serve as an effective enabler to adapt to China's development needs and address country-specific challenges.

2. Overview of Financial Big Data Governance and System Platform Construction

2.1. Existing Problems and Essence of Financial Big Data Governance

Regarding the governance and application of financial big data, the current efforts made by securities companies as well as institutions such as banks, insurance firms, funds, asset management companies, and trust companies are mainly reflected in three aspects: first, using it to identify services for their own clients; second, developing tools on basic platforms to assist clients with wealth management; third, collecting information for internal corporate management. Few of these institutions actually conduct in-depth data analysis.

In fact, data governance consists of the following three dimensions:

First, fully collect all types of information and data, train the system in accordance with the standards, methods, and requirements of big data aggregation, and then enable the system to perform expert-level analysis, diagnosis, and judgment. In other words, it is about transforming the experience, methodologies, technologies, and processes of experts in various business fields into an intelligent expert system, thereby ensuring that every business and key position of the company can receive expert-level technical support. Through this platform and its data, the system can not only serve the company’s operations and clients’ investments, but also provide clients with a platform and technologies to develop their own asset management and investment services. It offers clients valuable options of investment targets and risk control solutions. For example, if a client intends to invest in Company A, they can first utilize various data and information on the platform to study the company’s current value drivers, risk points, operational cycle patterns, and comparisons with peers in the industry. Just like a professional wealth manager, the system presents all these insights systematically, and then formulates one or more proposal schemes based on the client’s intentions and needs for their selection. This constitutes the core of client services.

Second, information integration. Information includes primary data and two categories of information sources. Primary data mainly refers to direct transaction data in the capital market, which can be either purchased or used under licensing agreements. In addition, the investment preferences, concerns, and other trends and tendencies of investor groups also fall into the category of primary data, which can be obtained through monitoring modules on the data platform (including interactive Q&A monitoring and web crawler monitoring). As for information sources, the first category covers policies and regulations, industry rules, public national statistical data, as well as all public data of target companies and listed companies. The second category comprises transaction data of financial and capital markets related to securities investment and trading, which is essential for cross-market research and correlation analysis. Only when these three types of information are available can data analysis and integration be effectively conducted.

Part of the functions of data analysis and integration is to directly provide information services for businesses such as wealth management, investment, and mergers & acquisitions (M&A). The other part is to publish various indices, especially portfolio investment indices—for instance, launching a certain AB Securities Investment Index. The release of portfolio investment indices can be applied to management analysis and investment analysis. It can also support the interpretation, integration, and value mining of big data involved in the expert system, as well as the formulation and operation management of portfolio investment schemes. These indices can serve securities companies’ businesses including M&A, investment, proprietary trading, wealth management, and market value maintenance, and also meet the market value management needs of listed companies (under current regulatory conditions, services for listed companies are limited to value index analysis).

2.2. Key Design Points and Application Error Correction of the Data Governance Platform

Data governance cannot be separated from system platform construction, and the design of platform architecture is crucial. First, it is necessary to clarify the main purposes of the company’s big data. Second, it is necessary to identify the required data sources. Third, it is necessary to define the core technologies that support big data.

At present, many securities companies decouple their efforts from business requirements, equate informatization work with digital transformation, and confuse IT governance with data governance. They invest substantial human, material, and financial resources in routine tasks such as data integration and management, yet often overlook the core principle that data must ultimately serve business needs.

To conduct data governance, we must first determine the types of data required and the core technologies to be adopted for analyzing such data. For example, regarding the trading data we access on a daily basis: What is the correlation between the trading data of the Shanghai Stock Exchange and that of the New York Stock Exchange? How should such data be parsed and integrated? What is the relationship between securities trading data and the Baltic Dry Index? How can they be fused together? This requires value mining to extract valuable information from these datasets.

With the outcomes of data mining and analysis in place, a big data system platform for value portfolio management and services is still required for external expression and output. How should this system platform be built, structured, designed, operated, and upgraded? This involves formulating financial standards, rules, regulations, as well as a series of models and algorithms. How should these models be integrated? What kind of logical reasoning, inference, and solution design should be followed? How should these outcomes be tested and refined into mature solutions for users? All of these processes need to be accomplished through this system platform.

At present, neither securities companies nor institutions in sectors such as banking, insurance, fund management, and asset management have mature models to reference for their data management. Moreover, they generally suffer from four common and pressing problems that need to be addressed:

1). Unclear data sources: There is a lack of clarity on what data is required to support the construction of a big data platform and by what means such data should be obtained.

2). Ambiguous technical frameworks: No clear decisions have been made on the technologies, algorithms, and models to be adopted for processing and analyzing the data.

3). Undefined service targets: It remains unspecified which service recipients (or business lines) the data will be supplied to.

4). Inadequate talent allocation: There is a failure to identify the types of talents that need to be recruited or cultivated for these tasks.

Without guidance from experts in fields such as mathematics, systems science, and management science, relevant parties often fail to conduct in-depth deliberation on these issues. They naively assume that data management can be handed over to IT personnel once data is collected. This is a prevalent challenge encountered in all big data initiatives, and also constitutes the primary reason why many big data projects fail to deliver desired outcomes.

In addition, there exist numerous misconceptions in the application of data governance technologies, which can be summarized as follows:

1). Oversimplification of big data applications: At present, most big data applications are merely simple statistical applications and correlations, also referred to as statistical correlation applications. As mentioned earlier, genuine big data applications should be capable of functioning as expert systems that undertake data analysis and mining. However, many securities companies merely assemble large teams of IT personnel, lacking dedicated teams with expertise in mathematics, systems science, and management science to build expert systems. Impatient for quick results and unwilling to commit to long-term efforts, these companies often resort to creating superficial "vanity projects" just to meet formal requirements.

2). Ambiguity in the presentation of big data analytics outcomes: In other words, how should the results derived from big data analysis be presented? The aforementioned AB Securities Investment Index serves as an example of such a presentation tool, also known as value estimation. The methodology for constructing this index is of critical importance. A well-designed index will enable clients to promptly adopt it for portfolio investment and investment product development. The ultimate goal of securities companies in building big data platforms is to provide clients with platforms and tools to independently develop their own investment products, rather than simply selling pre-packaged products as they do currently.

3). Neglect of data source design in project planning: Many securities companies are formulating data governance schemes and implementation plans, yet they often overlook a crucial prerequisite in the planning phase—defining a comprehensive and clear data source catalog. Without a well-defined data source design, all subsequent work and substantial investments will end up in vain.

4). Incompleteness of client service schemes: Basic elements that must be included in client service schemes are: data analysis solutions, financial data integration solutions and standards, operation plans, target service recipients (including market value management entities, listed companies, banks, insurance firms, asset management companies, fund houses, and government agencies), as well as the profit model of the big data platform.

Only when all the aforementioned misconceptions are properly addressed can securities companies fully gain the trust of their clients.

3. AI-Embedded Business Construction — Taking Wealth Management as an Example

3.1. How to Correctly Understand Securities Companies' Demand for Artificial Intelligence

Since 2019, many securities companies have published research reports on the application of artificial intelligence in related businesses. Overall, these reports are still in the stage of algorithm comprehension and experimentation, remaining at the level of mining algorithms, learning algorithms, regression algorithms, prediction algorithms, and so on.

In fact, the genuine application of artificial intelligence in securities companies is not merely an algorithm issue. Instead, it is an integrated intelligent decision-making and analysis system consisting of knowledge management supported by data, algorithm application governed by knowledge rules, and an intelligent expert system underpinned by algorithms. The business application of artificial intelligence is a process where the "database + algorithm + knowledge management" framework, operating within regulatory constraints, undergoes continuous validation and iteration, evolving from machine learning to deep learning.

At present, artificial intelligence technology is developing rapidly. For financial big data, building such an intelligent expert system or its subsystems is not overly challenging, and the algorithms applied in this field are also fairly mature. The key and difficult point lies in how to organically integrate these components into a coherent expert analysis process.

A well-known example of an intelligent expert system is robo-advisory, which serves as a component and technical support for wealth management businesses. In Europe, the United States and other countries, it is fully presented and maturely applied via systematic solutions. To build this robo-advisory expert subsystem, the workflow should follow four sequential steps: first, develop the algorithms; second, formulate the underlying principles; third, construct a prototype upon the confirmation of principles. Once the prototype is established, preliminary logical verification can be initiated, followed by the formulation of a formal implementation plan. After the plan is finalized, pilot testing in real market conditions is imperative.

Stock trading is essentially a form of quantum trading: regardless of the strategy adopted, any minor input change can trigger overall market fluctuations, with the magnitude of impact proportional to the capital volume invested. The larger the capital scale of strategic trading, the greater the ripple effect on the market. Hence, pilot testing is an indispensable phase. Initially, a small capital pool (e.g., at the 100,000-yuan level) can be allocated for pilot testing, data measurement, and prototype validation. Only after the completion of pilot testing and verification can a beta version be launched, which requires a larger capital injection ranging from millions to tens of millions of yuan. The beta testing phase primarily focuses on two tasks: algorithm optimization and further pilot validation. The final step is the official release of the production version.

In practice, operating the system is straightforward—it mainly involves publishing stock pool indices. Since the system does not engage in high-frequency trading, its operation complies fully with regulatory requirements. These indices conduct comprehensive analysis and evaluation of multiple influencing factors, including the off-exchange macroeconomic environment, industries, industrial chains, the operational performance and brand reputation of target companies. Processes such as stock pool construction, screening, portfolio rebalancing, and post-investment evaluation are all completed with system assistance. Through integrated analysis, the system provides a holistic view of the basic operational status and cyclical patterns of constituent stocks, accurately reflecting the inherent market rules. This automated analysis process operates 24/7 with high information throughput and efficiency, generating highly valuable insights.

The hardware investment for building such an expert subsystem platform is relatively modest, with the primary cost concentrated in development expenses. If the platform’s applicability is further expanded, its underlying standards refined, and relevant indicators, indices, and metrics integrated, the system can be upgraded to support intelligent monitoring, risk detection, and risk management functions, thereby enabling compliance and risk control applications.

Notably, the development logic for expert subsystems in other business lines, and even for the company’s overall big data platform, follows the same methodology. For institutions concerned about the long development cycle and slow return on investment of large-scale system platforms, a more viable approach is to select a high-priority business line, build its dedicated expert subsystem as a starting point, and then promote the digital transformation incrementally from point to whole. This approach helps avoid the common pitfalls of blind pursuit of large-scale, all-encompassing systems—such as mindless hardware procurement, poor business alignment, and disjointed construction of data middle platforms—that often plague hasty digital transformation initiatives.

3.2. Integration Points of Artificial Intelligence Technology and Securities Companies' Businesses

Big data exists in three forms:

1.Statistics-based data After undergoing collection and governance (cleaning, extraction, transformation, and alignment), raw data is converted into specific datasets, which are then visually presented via cockpits, dashboards, and other tools in the form of line charts, pie charts, bar charts, and GIS maps. Due to its closed nature, this type of data can only serve a limited reference role in specific fields, vertical industries, or single-dimensional analysis.

2.Correlation-based data By modeling expert knowledge, correlations between structured and unstructured data are established, and knowledge graphs are used to identify connections between knowledge points, key nodes, and shortest paths. Although this type of data enables cross-domain and cross-disciplinary knowledge association, it faces inherent limitations. Different experts hold divergent understandings (knowledge) of the same event, and each expert can only conduct knowledge classification within their own area of expertise. Furthermore, experts' prior knowledge is derived from the induction of classic cases that have already occurred, making it unable to predict ongoing or upcoming unknown events. For these reasons, it is difficult to develop a unified expert model. Even if a model is created, it will fail to yield expected results once the data source is changed, and it cannot predict "black swan" events and similar occurrences. This explains why knowledge graphs in many fields currently struggle to be translated into practical applications.

3.Causality-based data This form of data enables the logical iteration from concrete data inference to abstract knowledge, and empowers computers with artificial intelligence technology to achieve automated and intelligent reasoning about knowledge causality. In essence, it endows computers with human-like thinking logic. Instead of merely encoding and decoding binary digits (0s and 1s), computers can fundamentally resolve the problems of information semanticization and interpretation. If this function is realized, it will enable early warning and prediction of the evolution of things. This represents the genuine artificial intelligence that can self-evolve and accelerate iteration in open scenarios.

The basic logic of most a priori knowledge (including expert knowledge such as axioms and theorems) acquired by humans follows a progression from qualitative to quantitative analysis: experts first conduct abstract qualitative judgments based on their empirical insights, and then individuals perform quantitative calculations tailored to their specific circumstances.

However, this logic can only apply to the laws governing things that have already occurred or happen regularly. It is incapable of addressing events that are unfolding or about to occur, as even experts are still in the process of exploring and summarizing the underlying rules.

Therefore, if we aim to use big data and artificial intelligence to predict the unknown—or to enable computers to automatically analyze causal relationships—what we essentially need to do is map out the cognitive pathway through which experts move from concrete perceptions to abstract understanding, and then translate this pathway into computable input and output processes.

The services provided by securities companies should not be limited to product sales. Instead, they should offer clients customized investment and wealth management solutions, provide technical support and self-service operation platforms, and effectively address clients’ needs. Therefore, the application of artificial intelligence (AI) in securities companies is not confined to the generic concept of AI; it must satisfy four core requirements: specialized domain applicability, integration of expert knowledge, simulation of expert thinking processes, and achievement of expert-level decision-making capabilities. In essence, it constitutes an AI-augmented intelligent expert system.

Expert systems are actually a subset of artificial intelligence. They are problem-solving oriented, equipped with self-learning capabilities and a knowledge base. They learn from databases, convert insights into structured knowledge that is then stored in the knowledge base, and continuously evolve through this iterative cycle. In contrast, generic AI is not designed as a direct problem-solving tool but rather as a means to enhance operational efficiency.

The integration point between AI and securities business lies in establishing a complete logical taxonomy network, spanning from a central control module to specialized expert sub-modules. Once this logical framework is established, the businesses, workflows, and operational links of securities companies can be mapped onto the taxonomy network—which forms the industry knowledge graph.

Developing an expert system requires dedicated tools, with neural networks serving as the primary building blocks that can be scaled up or simplified according to specific business needs. Many securities companies have assembled teams to research algorithms such as Bayesian inference, Markov chains, decision trees, and logistic regression, resulting in a proliferation of algorithms across various categories. However, focusing solely on algorithm development is meaningless. Algorithms applied to financial big data are relatively straightforward; the key lies in identifying the precise integration points between AI technologies and securities business scenarios. The right approach is to conduct targeted, incremental project development and refinement.

3.3. Implementation Architecture of AI-Embedded Wealth Management Business

To upgrade wealth management businesses through technical means such as big data platforms and artificial intelligence, the first priority is to address the issue of source data. It is crucial to clarify the source data requirements and identify what kind of source data can support a wealth management big data platform.

Second, in conducting wealth management, it is essential not only to perform in-depth analysis of direct and potential clients, but more importantly, to implement effective client segmentation.

Third, a dedicated pool for the investment and operation of wealth management targets should be established, covering the selection, value evaluation, dynamic tracking, and value analysis of investment targets. Wealth management cannot be effectively carried out without a clear understanding of investment cycles and return cycles. This is also the most common and critical weakness in domestic wealth management practices.

Fourth, the methodology systems and model frameworks related to wealth management must be clearly defined. In the process of solution research, it is imperative to clarify the source data, client analysis and segmentation, value analysis, as well as the model systems and supporting methodological frameworks. These are indispensable components of wealth management business that cannot be bypassed.

The fundamental guarantee for conducting wealth management lies in building a system platform, which is then expanded incrementally. It is necessary to construct a corporate value network map and a corporate financial knowledge graph based on the target company’s businesses and the logical relationships between the operations of various business lines.

With these two tools in place, a clear picture will emerge of the financial relationships within the target company, the financial risks involved, the available financial opportunities, and the financial structures that need to be established for corporate governance. Securities companies can thus easily identify entry points for providing services.

For example, if a client asks: How should I invest 5 billion yuan? This question directly relates to the financial knowledge graph. How should the 5 billion yuan be allocated? What model structure can be used to ensure a 5% annual return on this capital? And how can a 5% annual growth rate be sustained over a 20–30 year horizon?

The same logic applies to client services. Without a clear grasp of the target company’s value asset map or an understanding of its value network, it remains uncertain whether the company is worthy of servicing, let alone how to provide effective services.

Although many securities companies have signed strategic cooperation agreements with certain governments, institutions, and enterprises, whether their business departments can quickly follow up to provide corresponding products and services and gain the counterpart’s recognition and cooperation depends, to a certain extent, on whether the securities companies have strong service capabilities and technical support.

Based on the big data platform, the relevant business departments should develop a sound financial risk knowledge graph and value network management and control system for their service targets. They can then conduct diagnostics for the service targets in sequence by virtue of graph tools, engines, platform databases, and the dynamic data of the service targets. Providing targeted solutions to the identified problems based on these diagnostic results constitutes genuine client services that can earn clients’ trust.

In essence, engaging in wealth management means building a value network. Once the value network is established, in-depth analysis should be conducted on the investable nodes within the network, with the analysis going deeper and advancing step by step. Take brokerage business as an example: How many channels are there? What is the level of client stickiness? What is the client hierarchy? Which clients represent value points? What is the cycle of value contribution between clients and the company (i.e., the value network)? How do clients contribute to the securities company? How can clients be incentivized to provide greater contributions? By integrating the two aforementioned graphs, securities companies can clearly identify whether a particular client falls into their target client group.

Similarly, from the perspective of internal management of securities companies, the segmentation of departments prevents the performance management of various businesses from forming a networked support system, which will give rise to value conflicts. If the related businesses are integrated into the network in accordance with the above-mentioned approach, an analysis can be conducted to determine which businesses are profitable, the scale of their profits, and the probability of profitability—thereby clarifying the associated risks. Additionally, by calculating the costs invested by the company, the input-output ratio can also be derived.

Wealth management is essentially a front-store, back-factory concept. The front end consists of the company’s portal terminals and branch offices, while the back end is supported by a system platform that provides products, services, and technical backing.

Building an expert subsystem platform for wealth management requires only one model and one platform. The initial investment is relatively modest, the algorithms involved are not complex, and there are no compliance requirements to address.

First and foremost, an engine should be constructed, including a knowledge graph engine, a data space engine, and a modeling iteration engine. Once the engine is in place, it can be used not only for client services and enterprise services, but also to provide external data platform services for clients.

4. The Essence of Building a Big Data Platform — Constructing an Intelligent Expert System

4.1. Definition of an Expert System

An expert system is a reliable computer-based interactive decision-making system, which is a combination of a series of models and algorithms based on "inference engine + knowledge". It solves the most complex problems in specific domains based on rules and reasoning, and is regarded as the highest level of human intelligence and expertise.

An expert system comprises five components: user interface, inference engine, knowledge base, facts and rules, and knowledge acquisition. From the perspective of a general productized architecture, an expert system is roughly divided into three layers: first, a decision data model oriented to service domains and outputs; second, a rule engine and rule management; third, the data integration capabilities and data models (offline data, online data, real-time data) required for rule calculation.

Expert systems are particularly suitable for decoupling the coding capabilities and business requirements of highly complex systems, and play a role based on complex business rules for complex and specific business scenarios. With the rapid advancement of computer technology, computing power, and algorithms, coupled with the advantages of expert systems—such as top-tier professional proficiency, high efficiency, strong reliability, good flexibility, effective management mechanisms, and the ability to handle challenging decision-making problems—expert systems have been widely applied in fields such as investment and financing, wealth management, risk management, and knowledge graphs in European and American countries.

4.2. Construction Outline of the Securities Big Data Intelligent Expert System

Whether for traditional business models or AI-augmented digital business systems, the participation of specialized expert teams is indispensable. This is precisely the value and role of an expert decision support system. For securities companies, conducting data governance, advancing digital transformation, and building big data platforms are, in essence, equivalent to constructing a securities big data intelligent expert system—a core hub platform that underpins all the company’s business operations.

Tailoring solutions to the diverse needs of different business domains and implementing various applications on this platform constitute the unified integration of expert subsystems for individual business lines. Examples include the robo-advisory expert service subsystem, the proprietary investment quantitative trading expert subsystem, the institutional client channel resource and quantitative strategy service subsystem, the investment banking client value mining and service subsystem, as well as the integrated risk internal control and compliance supervision subsystem.

Take the robo-advisory expert service subsystem as a further illustration. Its core objective is to help investors capture profit opportunities. Therefore, the focus of system platform development should be placed on the design and evaluation of portfolio solutions. The system should deliver group-specific, subgroup-specific, and item-specific service strategies characterized by expert-level insights, personalization, self-learning capabilities, and intelligent features to batches of clients. This goes far beyond the scope of simple, generic advisory Q&A interactions. It represents a mechanism of incentive-response: the incentive being investors’ demand for profitable investments, and the response encompassing profit-making schemes, investment portfolios, trading strategies, and operational procedures.

Furthermore, the system should provide clients with a suite of resource libraries: a free tool library, a standard library with tiered access permissions for all users, a paid knowledge library, and a strategy library based on profit-sharing arrangements.

Artificial intelligence (AI) and big data technologies have enormous potential for application in the businesses of securities companies, as these technologies can be integrated into numerous business lines and operational processes. However, there are also prevalent issues such as the pursuit of quick gains, impetuousness in implementation, haphazard accumulation of hardware and software resources, and lack of interoperability among various business systems. These problems prevent the establishment of a unified and integrated system, which in turn leads to AI applications failing to deliver expected outcomes or even becoming ineffective.

If leveraged effectively, AI, big data technologies, and intelligent expert systems can provide clients with personalized one-on-one, self-configurable ecosystems. For each individual client, it is equivalent to having exclusive access to a customized platform tailored specifically to their needs. From customized data sources and tool libraries to tailored rule bases, methodology libraries, model libraries, knowledge libraries, and strategy libraries, and finally to customized visual interactive interfaces—clients can easily achieve consistency between their envisioned goals and the corresponding approaches and methods. With the support of AI and big data technologies, clients can thus gain a sense of security (derived from visualization and reliable returns) and satisfaction (stemming from self-capability enhancement and asset appreciation).

Key Considerations for Building a Securities Intelligent Expert System:

1). Artificial intelligence has advanced to a stage where it can support applications such as information fusion, rule discovery, trend analysis, anomaly monitoring, optimization and operations research, knowledge accumulation, and decision support in terms of algorithms, learning mechanisms, and system logic. This provides strong technical support for the construction of a securities big data intelligent expert system.

2). The application of artificial intelligence in securities companies’ businesses can reconstruct traditional operations, spawn new businesses, identify value pockets, enhance client stickiness, and improve the standards of compliance monitoring and risk management.

3). In the course of digital and intelligent transformation, securities companies must address clients’ demand for personalized, one-on-one expert-level services, and the validity of such services is measured by an extremely straightforward criterion—whether clients can obtain investment or wealth management returns. The resource advantages of securities companies include channels, qualifications, professional expertise, data, business experience, and teams. To a certain extent, these advantages can be transformed through the construction of a securities big data intelligent expert system, including: conversion of experience into knowledge; extraction of empirical models and their logical patterns; development of expert knowledge learning frameworks and expert analysis rule systems; and design of value analysis, evaluation, and appreciation strategies for investment targets. When these elements are integrated into an expert system capable of delivering one-on-one personalized services to clients, a positive closed loop can be formed between the client value of big data applications and the indirect market revenue model they bring to securities companies.

4). Many securities companies choose investment advisory business as the entry point. The investment advisory big data intelligent service expert subsystem serves as a core hub platform. The adoption of big data and artificial intelligence technologies can easily give rise to derivative businesses and new business models; with sound compliance design, imagination can be leveraged to develop a host of new businesses and models. However, to achieve this goal, support from big data sources is essential, along with the dynamic on-demand configuration of data source systems, their integration, management, and application data pools; the design of portfolio rules; and the development of asset value evaluation models for investment targets, investment risk control models, and operational risk management expert models.

5). The various business expert subsystems of a securities big data intelligent expert system must be planned in a unified manner with room reserved for future expansion. If the system is initially designed for specific, limited businesses in an isolated fashion, it will restrict future development space right from the design and planning phase. The construction should be led by a centralized technology management organization, with unified business planning, integrated system design, centralized data integration and fusion, decentralized implementation by respective business units, and shared resources in application (data sharing, model sharing, rule sharing, and knowledge sharing).

6).Careful planning and design are required for the following aspects: the technical architecture of the securities company’s data center; the design of source data catalogs and their metadata structures; the design requirements of business applications for data configuration capabilities; and clients’ visualization requirements for the data center’s data processing, fusion, mining, knowledge refinement, and practical tool development.

At present, many securities companies have proposed introducing artificial intelligence technology to enhance and derive their business capabilities and products. However, most of these companies have only conducted experimental calculations and result comparisons on some simple algorithms.

As we all know, stock market investment is a stochastic game analysis that continues dynamic gaming with reference to market reactions after capital injection. Faced with thousands of listed and traded stocks, a dynamic value mining network will be formed. Naturally, it is impossible to evaluate algorithms, their application criteria, and portfolio logic by means of off-market ex-post review (ex-post evaluation). This is determined by the quantum characteristics of the stock market or other transaction-based markets. Instead, quantum algorithms based on stochastic games should be adopted for portfolio and trading strategy design, and dynamic gaming operation strategy design and evaluation should be carried out relying on big data resources.

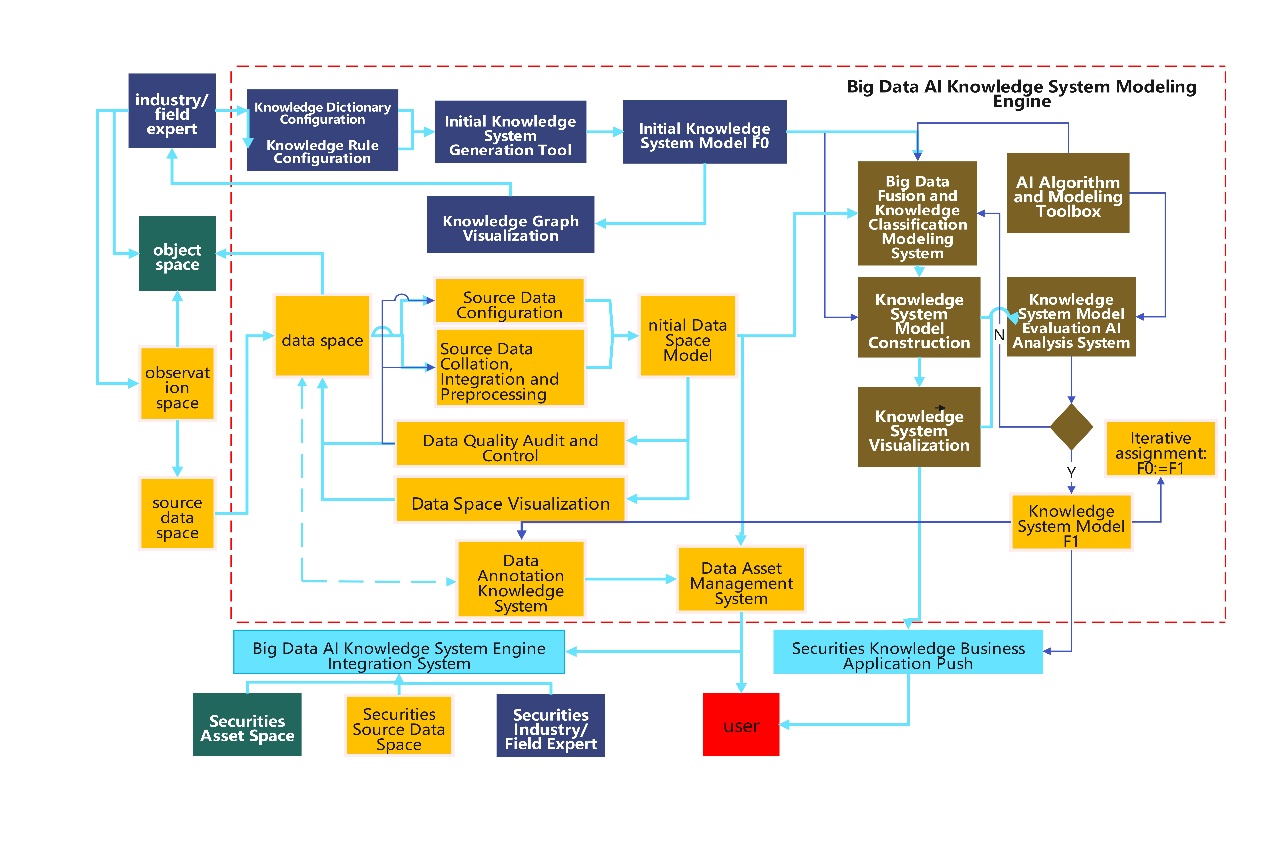

Therefore, when planning the construction of big data resource platforms and building expert subsystems, it is necessary to consider application scenarios as well as the needs and constraints of users such as business personnel, clients, regulators, risk control teams, and compliance departments. It is essential to targetedly develop application tool libraries, criterion libraries, business rule libraries, business knowledge libraries, expert model libraries, and laws and regulations libraries that possess independent intellectual property rights of the company and meet business and client demands. In addition, it is necessary to build source data integration management systems supporting the aforementioned libraries and expert subsystems for various business domains. This approach is far more important than blindly accumulating hardware equipment and purchasing off-the-shelf software products (see Figure 1 for the modeling engine of the big data intelligent expert system).

Figure 1: Modeling Engine of the Big Data Intelligent Expert System

5. Conclusion

Financial big data, artificial intelligence, cloud computing, and automation technologies have spawned numerous implementation scenarios for financial technology in the securities industry. Nevertheless, the application of related technologies and platform construction still suffer from problems such as low quality, inefficiency, and redundant development.

This paper focuses on the construction of the securities big data intelligent expert system—a comprehensive and effective financial technology platform. Starting from practical cases of wealth management in securities companies, it systematically elaborates on the significance, key points, and application ideas of the system construction.

The complexity and long-term nature of the dual integration of technology and finance require securities companies to formulate digital transformation solutions that balance flexibility and efficiency. Undoubtedly, the construction ideas of the securities big data intelligent expert system provide valuable references for the development of related businesses.

In the future, with technological advancements, derivative businesses and products of the securities intelligent expert system will emerge as the times require and be launched continuously. Upon the design of compliance standards, there will be ample room for imagination in the innovative design of business services and their derivative products.

Compliance serves as the prerequisite for service and product innovation, covering both superior-level and industry-specific regulations. On this premise, the securities big data intelligent expert system platform is required to evaluate the value of innovations, assess innovation risks, and conduct pilot testing of innovative products and business processes.

The space for ecological symbiosis of big data and algorithm applications enabled by this system will determine the breadth of possibilities for its innovation and design capabilities.

Biography

Huimin Li, male, is the Managing Director and Senior Economist of Zhongtai Securities Co., Ltd. senior economist. He holds a master's degree in engineering, a doctorate in management, and a postdoctoral degree in mechanics from Tianjin University. His major is Management Science and Engineering. He has published more than 30 papers in domestic and foreign journals, participated in more than 3 scientific research projects at or above the provincial and ministerial level and won awards. He has successively served as the director of the research institute, the general manager of the derivatives department, and the general manager of the retail business department in the securities company, focusing on the application research of management decision-making and nonlinear dynamic systems in the financial securities industry.

Huimin Li, male, is the Managing Director and Senior Economist of Zhongtai Securities Co., Ltd. senior economist. He holds a master's degree in engineering, a doctorate in management, and a postdoctoral degree in mechanics from Tianjin University. His major is Management Science and Engineering. He has published more than 30 papers in domestic and foreign journals, participated in more than 3 scientific research projects at or above the provincial and ministerial level and won awards. He has successively served as the director of the research institute, the general manager of the derivatives department, and the general manager of the retail business department in the securities company, focusing on the application research of management decision-making and nonlinear dynamic systems in the financial securities industry.