International Journal of Business Research and Management

OPEN ACCESS | Volume 4 - Issue 1 - 2026

ISSN No: 3065-6753 | Journal DOI: 10.61148/3065-6753/IJBRM

Hassan Tawakol Ahmed Fadol1*, Hiyam Abdulrahim2, Mohammed Gebrail Hag Mohammed3, Fathi Ahmed Ali Adam4

1Associate Professor of Econometrics and Applied Statistics, Sudan University of Science and Technology, wdalaweeea1981@gmail.com, ORCID: https://orcid.org/0000-0003-4456-9082.

2Assistant Professor, Department of Economics, College of Business Administration, Princess Nourah Bint Abdulrahman University, P.O. Box 84428, Riyadh 11671, Saudi Arabia - haalrahim@pnu.edu.sa - ORCID: 0000-0003-3992-6241.

3Assistant Professor of Econometrics and Social Statistics, Department of Politics and Public Administration, University of Konstanz, Germany, mohammed.gebrail@uni-konstanz.de, ORCID: 0009-0009-2909-9466.

4Assistant professor, Al-Jouf University, College of Business, Economics, Associate Professor in Economics Faculty of Economics and Administrative Sciences -University of Zalingei Declarations, ORCID: 0009-0000-4015.

*Corresponding author: Hassan Tawakol Ahmed Fadol, Associate Professor of Econometrics and Applied Statistics, Sudan University of Science and Technology, wdalaweeea1981@gmail.com, ORCID: https://orcid.org/0000-0003-4456-9082.

Received: December 15, 2025 | Accepted: January 05, 2026 | Published: January 11, 2026

Citation: Ahmed Fadol HT, Abdulrahim H, Hag Mohammed MG, Ali Adam FA., (2026). “Does Government Debt and Degree of Openness and Oil Price on The Inflation Rates in Gcc Countries: Evidence from Pardl and Pnardl Approach”. International Journal of Business Research and Management 4(1); DOI: 10.61148/3065-6753/IJBRM/064.

Copyright: © 2026. Hassan Tawakol Ahmed Fadol, This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Purpose

This study investigates the linear and nonlinear effects of government debt, trade openness, and oil prices on inflation rates in Gulf Cooperation Council (GCC) countries from 1980 to 2024. It explores whether these relationships are symmetric or asymmetric and examines how external shocks influence inflationary dynamics.

Design/methodology/approach

The analysis applies Panel Autoregressive Distributed Lag (PARDL) and Panel Nonlinear ARDL (PNARDL) models to capture both long- and short-run dynamics. Stationarity and co-integration tests confirm robust specification, while bootstrap causality tests identify the direction and crisis-sensitivity of relationships among variables.

Findings

The results show that government debt, trade openness, and oil prices exert significant and asymmetric effects on inflation. Positive shocks to trade openness amplify inflationary pressures more strongly than negative shocks. Error correction terms support long-run convergence, and causality tests reveal bidirectional and crisis-sensitive linkages, especially during the 2007–2008 financial crisis and the COVID-19 pandemic.

Research limitations/implications

The study is limited to GCC countries, which may constrain the generalizability of results. Future studies could extend the framework to other resource-dependent economies or incorporate institutional quality indicators.

Practical implications

The findings highlight the need for fiscal and monetary policies that account for asymmetric effects and external vulnerabilities, particularly under global economic shocks.

Social implications: Policies should address inflationary pressures by mitigating structural inequalities and protecting households from uneven distributional impacts of debt, openness, and oil price shocks.

Originality/value: This study contributes novel evidence on the asymmetric and crisis-sensitive dynamics of fiscal, trade, and commodity factors on inflation in the GCC, offering insights for more resilient macroeconomic policy design.

Government debt, Degree of openness, Oil price, Inflation rate, Panel ARDL-NARDL, Symmetric-asymmetric panel causality

1. Introduction

A widespread and steady rise in the cost of goods and services is known as inflation. The two most notable terms in that formulation are progressive rather than seasonal or transient and general pricing rather than those for just one or two items. Therefore, a decrease in the real worth (purchasing power) of money is equivalent to inflation. This condition affects the social and political facets of life in addition to the economy. One factor contributing to the income difference is inflation. While rising market prices without a corresponding rise in wages improve corporate profit, inflation erodes real wages, skewing the distribution of income. Variations in oil prices, government debt, and openness have all been linked to changes in inflation. For instance, increases in oil prices, abrupt changes in the amount of government debt and openness, and/or financial crises—including debt and currency crises—were the main causes of the inflation that increased in many advanced economies and emerging market and developing economies (EMDEs) between the early 1970s and the mid-1990s. On the other hand, brief drops in the price of oil in the mid-1980s and early 1990s were linked to decreases in inflation in both advanced nations and EMDEs. Interest in the connections between inflation and oil prices has increased recently.

Since the middle of 2020, inflation has been rising in many countries after plummeting in the early months of the COVID-19 epidemic. A quick recovery in demand following the reopening in many countries, ongoing disruptions in global supply chains, and extremely unpredictable swings in the price of food and oil all seemed to contribute to the highly coordinated surge in inflation. Global variables such as oil prices, government debt, and the level of openness have become more significant drivers of inflation after the Russian invasion of Ukraine in 2022. In light of this, we investigate the effects of oil prices, government debt, and openness on inflation rates in GCC nations from 1980 to 2024. Dynamic symmetric and asymmetric panel causality tests, as well as robust econometric models with thorough estimating and multiple testing (PARDL and PNARDL models), are used to accomplish this.

Prior to, during, and following the pandemic and the global financial crisis, the inflation rates in the GCC countries mirrored those of the rest of the world. A thorough summary of this nation's historical inflation swings from 1980 to 2024 is shown in Figure 1. Following years of steady inflation, the GCC economies went through a spike in prices, which was caused by the surge in oil prices that began in 2003 and peaked in 2007. The substantial payroll expansions made the inflationary pressures worse.

Figure 1. Inflation rate of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates (1980-2024)

Source: Data were processing with E-views13

As seen in Figure 1, the GCC countries' inflation variable fluctuated throughout the research period, rising and falling from the 1980s to the start of the global crisis and continuing to do so even after their economies recovered. It is also evident that it varied between rising and declining throughout the COVID-19 pandemic, which was a departure from the average inflation rate. Additionally, this encourages the researchers to examine the asymmetrical impact of inflation rate fluctuations on macroeconomic variables for three distinct time periods: before the economic crisis, after the crisis, and when the entire sample period is chosen, or before and after COVID-19.

This study aims to investigate the asymmetrical relationships between the inflation rates of six GCC economies—Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates—and the degree of openness, government debt, and oil price. In order to examine the linear and nonlinear effects of government debt, degree of openness, and oil price fluctuations on inflation rates of GCC countries, panel (ARDL, NARDL) models are used to examine the asymmetries among inflation rate fluctuations and these factors. This is because these models have the ability to break down these factors into positive and negative shocks. They also use dynamic symmetric and asymmetric panel causality tests.

This is how the remainder of the paper is organized. A overview of the literature is given in Section 2. The data and factors utilized in this investigation are explained in Section 3. The panel ARDL and panel NARDL econometric methodologies are presented in Section 4. Using dynamic symmetric and asymmetric panel causality tests, Section 5 presents the findings and some discussions between the panel ARDL and panel NARDL models, contrasting the asymmetric effects. Lastly, the primary conclusions are presented in Section 6.

2. Theoretical Framework and Literature Review

There are several economic theories that explain the causes of inflation, including structural, cost-push, demand-pull, new political macroeconomics, and quantity theories of money. Myrdal and Streeten initially coined the term "structural theory of inflation." According to the structural theory of inflation, structural imbalances in economic, political, and social systems are caused by a disproportionate reaction of output to increases in investment spending and money supply. Proponents of this idea argue that savings in developing countries are insufficient to fund investment, hence the government needs deficit financing.

Numerous research on inflation have demonstrated that it is both a monetary and structural phenomenon, as structural problems in developing countries often exacerbate supply-side inflationary pressures. Structural issues include international relations, specifically a worsening term of trade (TOT) that could lead to price fluctuations in the domestic market, and domestic economic shocks, such as crop failure (caused by external factors like weather patterns and natural disasters) and restrictions on food distribution. In order to promote supply-side improvements in such circumstances, supply-side management policies—including sectoral economic policies—are usually implemented. Numerous research has been conducted on the topic, and the results of each study differ based on the data collected, the technique employed, and the participating nations.

2.1. Government debt and inflation rates

The market value of the federal government debt held by the general people in the United States is used to calculate government debt. The value of all credit market instruments across all maturities—Treasury bonds, Treasury notes, Treasury bills, TIPS, etc.—is added up to create market value. This metric is consistent with theoretical representations and does not include holdings in government accounts or the Federal Reserve (Hall and Sargent, 2011). The Federal Reserve Bank of Dallas updates the most recent data every month, while historical data is sourced from Hall and Sargent (2011). A substantial body of theoretical research demonstrates a clear correlation between the level of prices and government debt. The first is fiscal dominance, which states that because of the amount of government debt, a central bank responds to an increase in inflation by tightening monetary policy less than it would otherwise. High levels of government debt may cause central banks to restrict policy rate hikes out of worry for the government's viability, particularly if that debt is in local currency. Economic agents then increase their inflation expectations in anticipation of this response. In the worst-case scenario, businesses and individuals might worry that the central bank will turn to direct debt monetization. According to the research (Luis et al., 2023), debt surprises persistently enhance long-term inflation expectations in emerging market economies but not in advanced economies. When initial debt levels are high, when inflation is initially high, and when sovereign debt is heavily denominated in dollars, the impacts are more pronounced. In contrast, in nations where inflation targeting is in place, the impact of debt surprises is minimal. With weaker monetary policy frameworks and high and dollarized debt levels, developing market economies may find it more difficult to combat inflation. According to a study by Bhattarai et al. (2014), a higher level of public debt causes inflation to respond more strongly to shocks, whereas a poorer responsiveness of taxes to debt causes inflation to respond less strongly. In a system with passive fiscal and monetary policy, inflation is influenced by both fiscal and monetary policy factors.

2.2. Openness and inflation rate

One of the more well-known correlations is that between inflation and openness. One of the contemporary conundrums in international macroeconomics, according to Temple (2002). According to proponents of the spillover hypothesis, protectionism causes inflation since openness is linked to falling prices (Musa, 1974). This negative relationship between openness and inflation is explained by a variety of ideas. The conventional wisdom holds that more open nations have lower inflation because real depreciation, such as that caused by anticipatory monetary expansion, results in negative effects like higher production costs, which are more common in more open nations. As a result, authorities will not expand as much, which lowers inflation (Romer, 1993). According to (Lane 1997), the negative link between openness and inflation is caused by the existence of stiff nominal pricing and imperfect competition in the non-tradable sector. Numerous empirical investigations into the relationship between openness and inflation have produced conflicting findings. While some research (Triffin and Grubel, 1962; Whitman, 1969; Iyoha, 1973; Romer, 1993; Lane, 1997; Sachsida et al., 2003; IMF, 2006) found that openness hurt inflation, others (Batra, 2001; Alfaro, 2005) found that the connection was negligible or even beneficial. On the other hand, according to Bleaney (1999), a strong negative association between inflation and openness only occurred in the 1970s and 1980s and vanished in the 1990s. Conflicting findings can be attributed to a variety of factors, such as the fact that different researchers have employed various trade openness indicators and methods, that the scope of openness studies varies, that the majority of studies have examined scenarios rather than assessing the effects, and so forth.

2.3. Oil price on the inflation rates

Is inflation caused by oil prices, or is it the other way around? In order to mitigate the actual effects of an oil price shock on the economy, theory has employed variations of the Taylor rules to support the idea that the monetary authority should reduce interest rates by expanding the money supply (Natal, 2012). This is a theory concerning the feedback between the money supply and oil prices. There has been discussion on the empirical nature of the feedback from oil prices to the money supply ever since Bernanke et al. (1997), Hamilton and Herrera (2004), and Bernanke et al. (2004). Many macroeconomic variables that affect inflation are included in the measurement of slack in an economy. The macroeconomic component, or "slack," that we take into account in this study is the price of oil. Although their performance is episodic, a number of studies have demonstrated that Phillips curve forecasts—which are generally understood to be forecasts utilizing an activity variable—are superior to other multivariate forecasts (Rudd & Whelan, 2005, Stock & Watson, 2008).

3. Empirical review

Previous research has used a variety of analytical and econometric models to investigate the sources of inflation. (Al-Mutairi et al. 2020) used multiple linear regression to find that inflation is positively associated with interest rate spreads, imports of goods and services, and money supply. The same study found that inflation is negatively and strongly related to tax revenue and current account balance. Furthermore, (Okoye et al. 2021) used an autoregressive distributed lag model to study the determinants of inflation rate behavior in Nigeria and discovered that external debt, exchange rate, fiscal deficits, money supply, and economic growth are the most important determinants of inflation.

(Erdoğan's, 2020) a study on inflation in European countries identified official exchange rates and domestic money supply as the main sources of inflation. Moreover, a study by (Olamide et al. 2022) on currency rate volatility and inflation in underdeveloped nations found that exchange rates are positively and strongly related to inflation. However, (Islam et al. 2017) discovered a negative and substantial relationship between exchange rate and inflation.

4. Datasets, and Method

In order to provide more effective and efficient monetary policymaking, inflation indicators are a collection of statistics and information that are collected and evaluated to reveal the direction of future inflation variations. Along with other macroeconomic aggregates including interest rates, currency rates, price measures, inflation expectations, the coupon rate on government bonds, and aggregate supply and demand, inflation indicators also include the actual inflation rate. Two categories of monetary policy indicators are typically included in the monetary policy framework. First, financial and economic indicators that predict future changes in inflation are known as leading indicators. The second is policy indicators, specifically economic and financial indicators that are useful for analyzing and guiding monetary policy. One category of leading indicators is inflation.

4.1 Datasets Sources

The variables of inflation rate, government debt, degree of openness, oil price, money supply, and government expenditure for the six chosen nations are examined using the available annual data for the years 1980–2024. The variables' description, measurement unit, and data sources are displayed in Table 1.

Table 1. Variables’ Description

|

Variables |

Source |

Unit |

|

INFt |

inflation rate |

|

|

DEBTt |

government debt |

|

|

OPENt |

degree of openness |

|

|

OPt |

oil price |

|

|

MSt |

money supply |

|

|

GSt |

government expenditure |

4.2 Descriptive Statistics for Panel data

Table 2. Descriptive Statistics for Panel data

|

Descriptive Statistics |

INF |

MS |

GE |

OP |

OPEN |

Debt |

|

Mean |

87.030 |

59.349 |

83.975 |

29.636 |

-0.086 |

28.089 |

|

Median |

81.953 |

56.906 |

84.2339 |

28.247 |

7.663 |

21.1 |

|

Maximum |

144.120 |

192.239 |

211.090 |

70.290 |

2.0128 |

126.7 |

|

Minimum |

33.270 |

14.146 |

51.547 |

6.695 |

-0.931 |

1.5 |

|

Std. Dev. |

23.872 |

24.909 |

14.591 |

12.357 |

0.2071 |

25.405 |

|

Skewness |

0.041 |

0.722 |

2.333 |

0.638 |

-2.379 |

1.628 |

|

Kurtosis |

2.382 |

4.848 |

23.219 |

3.286 |

7.686 |

5.805 |

|

Jarque-Bera |

4.324 |

61.276 |

4790.277 |

19.054 |

496.353 |

205.557 |

|

Probability |

0.115 |

4.944 |

0 |

7.282 |

1.653 |

2.311 |

Source: Data were processing with E-views13

5. Preliminary Tests

5.1 Panel unit root test

Determining whether a panel is dynamic or static in panel data analysis requires testing for stationarity in the temporal dimension. More sophisticated methods have been developed to check for stationarity in panel data, in contrast to basic time series analysis, which uses standard unit root tests for stationarity. The augmented Dickey-Fuller (ADF) test, which was first proposed by Fuller W. (1979) for a single cross-section series, was modified for multiple cross-sectional units to obtain the panel unit root regression (Barbieri, 2005). This study used the first-generation panel unit root tests, which assume cross-sectional independence.

The CIPS panel unit root test is a second-generation unit root test in contrast to first-generation unit root testing. First-generation unit root tests, which mainly assumed cross-sectional independence and homogeneity, were employed in a number of studies, such as Levin et al. (2002), Im et al. (2003), and Maddala and Wu (1999). If the variables under study are not cross-sectional independent and homogeneous, the first-generation tests are likely to produce useless results. However, the 2nd-generation panel unit root test (CIPS-test) developed by Choi (2006) and Pesaran (2007) yields more reliable results because to its ability to effectively account for CSD and heterogeneity.

Δyit = άiβit +ρiyit-1 +µit

The general test hypotheses are:

H0: ρi =0, φi (The series has a unit root or is non-stationary)

Hά: ρi =0, φi (The series has a no unit root or is stationary)

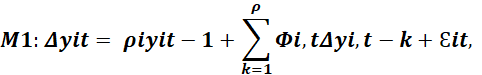

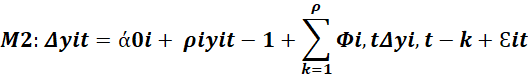

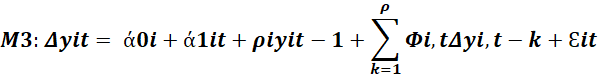

5.1.1 Levin, Lin and Chu (LLC) test

Levin (2002) suggested a unit root test that does independent ADF regressions for distinct cross-sections. The LLC test initially presumes that one of the following regression models, all of which are estimated using pooled ordinary least squares (OLS), produced the dependent variable:

M1: Δyit= ρiyit-1+k=1ρΦi,tΔyi,t-k+Ɛit,

M2: Δyit=ά0i+ ρiyit-1+k=1ρΦi,tΔyi,t-k+Ɛit

M3: Δyit= ά0i+ά1it+ρiyit-1+k=1ρΦi,tΔyi,t-k+Ɛit

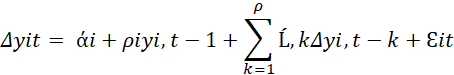

5.1.2. Im, Pesaran and Shin (IPS) test

(Shin Y, 2003) established a t-statistic based on the simple mean of cross-section-specific ADF t-statistics. Autocorrelation and residual heterogeneity problems can be handled by their test. Since only the constant fixed effects comprise the deterministic component, the LLC test takes the unit root regression to be as follows (Zardoub A, 2021):

Δyit= άi+ρiyi,t-1+k=1ρĹ,kΔyi,t-k+Ɛit

5.2. Panel co-integration tests

In panel data analysis, the panel ARDL approach is a co-integration process (Pimhidzai, 2011). The Pedroni co-integration test for panel data is explained in depth in (Pedroni, 2004). This test determines whether long-term dynamics are present. The panel ARDL Error Correction Model calculates estimates of the long-term relationship. To ascertain if the dependent and independent variables have a long-term relationship, the panel co-integration tests—the Pedroni (Pedroni 1999) co-integration test, the Kao (1999) co-integration test, and the Fisher co-integration test—are used. We employ individual intercepts, individual intercepts with trends, individual intercepts without trends, individual intercepts followed by statistics tests, and weighted statistics tests in every situation. We also use the Schwarz Info criteria as the lag duration.

The general test hypotheses are:

H0: φ1=φ2=φ3=φ4=φ5=φ6 (no co-integration)

Hά: φi ≠ φj for at least one i ≠ j (co-integration)

6. Econometric methodology

This section explains the econometric procedure of estimating panel ARDL and the panel NARDL models for the symmetrical, and asymmetrical impact to answer the study question (does government debt and degree of openness and oil price on the inflation rates in GCC countries).

6.1. The Asymmetric impacts of (Panel ARDL Model)

This section reviews the panel Autoregressive Distributed Lag (panel ARDL) general framework, which is based on the three alternative estimators. First of all, it's crucial to note that standard panel models typically have certain disadvantages because of the limitations that are placed on them. For example, the fixed effects model creates similar slopes and variance, or the pooled ordinary least square (OLS) imposes the same intercept and slope for all cross-sections, making it a severely constrained model. Furthermore, when some regressors are endogenous and linked with the error terms, bias can be detected in the fixed effects model, as noted by Campos and Kinoshita (2008). Furthermore, the random effects model does not ensure strict exogeneity even though it does not present many problems in terms of degrees of freedom (Arellano, 2003).

However, dynamic panel models, such the GMM-system estimator presented by Arellano and Bover (1995) or the generalized method of moments (GMM)-difference estimator proposed by Arellano and Bond (1991), alleviate some of these drawbacks. The GMM estimators, however, may produce erroneous results when N is small and T is large for two reasons, according to Roodman (2006): first, because of the unreliable autocorrelation test, and second, because this condition may compromise the validity of the Sargan test of over-identification restriction.

This paper applies the panel ARDL methodology using three distinct estimators: the Mean Group (MG) estimator, the Dynamic Fixed Effects (DFE) estimator, and the Pooled Mean Group (PMG) estimator. This is done in order to overcome these limitations and because the panel ARDL methodology can simultaneously determine coefficients of a short- and long-term nature (Thampanya et al., 2021). Below is the panel form of the generalized empirical ARDL (1, 1, 1, 1, 1) equation:

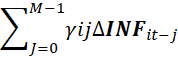

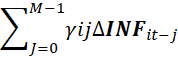

ΔINFit=β0i+β1tINFit-1+β2tDebtit-1+β3tOPENit-1+β4tGEit-1+β5tMSit-1+β6tOPit-1 -1+J=0M-1γij∆INFit-j +J=0N-1γij∆Debtit-j+J=0O-1γij∆OPENit-j+J=0P-1γij∆GEit-j+J=0Q-1γij∆MSit-j+J=0S-1γij∆OPit-j

+J=0N-1γij∆Debtit-j+J=0O-1γij∆OPENit-j+J=0P-1γij∆GEit-j+J=0Q-1γij∆MSit-j+J=0S-1γij∆OPit-j +µi+Ɛit

+µi+Ɛit

Where INF refers inflation rate, Debt government debt, OPEN captures the degree of openness, GE is the government expenditure, MS is money supply, OP is oil prices, and , i = 1, 2,…N and time by t = 1, 2, …T; µi represents the fixed effects and εit denotes the error term.

The fact that panel ARDL does not require the variables to have the same order of integration in order to support a long-term relationship is one of its primary benefits. Stated differently, the panel ARDL estimation can function effectively irrespective of the degree of variable integration (Fang et al., 2015; Kim et al., 2010). More precisely, it indicates that this method works well with integrated variables of order 0 or order 1, or a combination of both. Since Pesaran and Pesaran (1996) assert that it will produce spurious regression since the estimated F-statistic of the limits test is made incorrect, the unit root pre-testing is therefore only required to rule out the possibility of I(2) variables (Chigusiwa et al., 2011). Furthermore, because PMG and MG estimators incorporate lags of both independent and dependent variables, Pesaran et al. (1999) claim that they remain consistent even when endogeneity is present.

First, Pesaran and Smith (1995) created the MG estimator, which is distinguished by estimating a regression for every nation and then utilizing unweighted means to get the coefficients. Every coefficient is permitted to be both short- and long-term time-varying and country-specific (i.e., heterogeneous). Large time-series are one of the prerequisites for putting this strategy into practice. It is especially important that at least 6 countries be taken into account in the study. Second, while the PMG estimator permits cross-country heterogeneity for short-term coefficients, the rate of adjustment, error variances, and intercepts, it assumes homogeneity for long-term slope coefficients across economies. One of the fundamental presumptions is that the explanatory factors can be regarded as exogenous variables as the error correction term (ECT) is normally distributed and uncorrelated with regressors. Last but not least, Pesaran et al. (1999) created the DFE approach, which is comparable to the PMG estimator but makes the long-term assumption that the slope coefficient and error variances are the same across nations. While the intercepts are country-specific, the short-run coefficient and the adjustment speed are both uniform.

Since the investigation spans 44 years, the MG estimator lacks sufficient degrees of freedom; as a result, PMG estimations become more crucial for the analysis. However, the Hausman (1978) test is used to more formally ascertain which approach is appropriate for estimating the model. This test aims to shed insight on whether the estimators differ significantly from one another. Since the PMG estimator is more efficient than others, it is the ideal choice to use it in the event that the null hypothesis is rejected (that is, the difference between PMG and DFE or between PMG and MG is not significant).

6.2. The Asymmetric impacts of (Panel NARDL Model)

The drivers of inflation rates in GCC nations can be affected differently by overvaluation and undervaluation, hence an asymmetric panel approach should be used. Stated differently, the panel Nonlinear ARDL is used in this work to determine if positive and negative shocks can indicate distinct responses to inflation rates and economic performance. The equation (1) is reformulated as a non-linear equation in accordance with Shin et al. (2014):

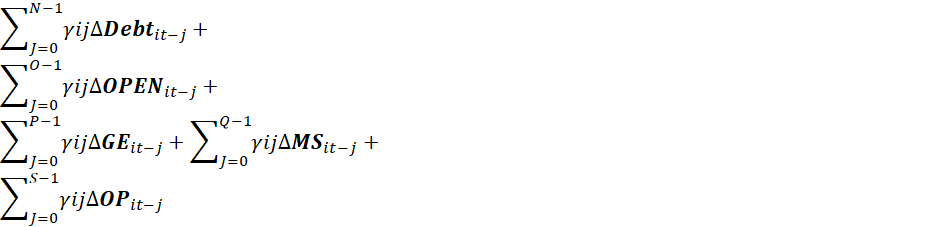

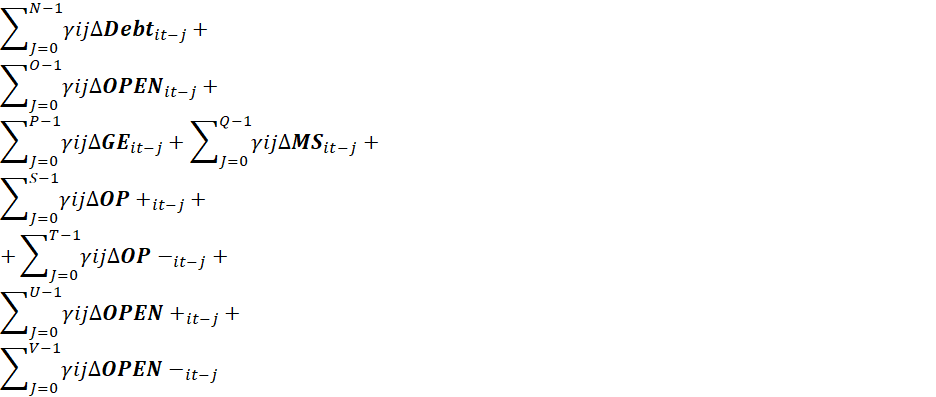

ΔINFit=β0i+β1tINFit-1+β2tDebtit-1+β3tOPENit-1+β4tGEit-1+β5tMSit-1+β6tOP+it-1+β7tOP-it-1+β8tOPEN+it-1+β9tOPEN-it-1+J=0M-1γij∆INFit-j +J=0N-1γij∆Debtit-j+J=0O-1γij∆OPENit-j+J=0P-1γij∆GEit-j+J=0Q-1γij∆MSit-j+J=0S-1γij∆OP+it-j++J=0T-1γij∆OP-it-j+J=0U-1γij∆OPEN+it-j+J=0V-1γij∆OPEN-it-j

+J=0N-1γij∆Debtit-j+J=0O-1γij∆OPENit-j+J=0P-1γij∆GEit-j+J=0Q-1γij∆MSit-j+J=0S-1γij∆OP+it-j++J=0T-1γij∆OP-it-j+J=0U-1γij∆OPEN+it-j+J=0V-1γij∆OPEN-it-j +µi+Ɛit

+µi+Ɛit

The non-linear ARDL model was introduced by Amassoma et al. (2018), who expanded on the traditional ARDL model. When there is asymmetry between the dependent variable and one or more explanatory factors, we can estimate the cointegration using the asymmetric ARDL. The NARDL model enables evaluating if the shifting behavior of the independent variable would have a different impact on the dependent variable, whereas the traditional ARDL model presupposes asymmetry between the dependent variable and the regressors. This study assesses if there are asymmetrical relationships among debt, oil prices, and openness, and inflation in accordance with (Guo, el at. 2022, Hassan, el at. 2016, Aliyev, el at. 2023, Mukhtarov, el at. 2019, Sultan, el at. 2020, Köse, el at. 2021, Lacheheb, el at. 2019).

6.3. Dynamic, Symmetric, and Asymmetric Bootstrap Panel Causality Test

Numerous elements, particularly economic ones, might be impacted by significant events in other nations or by unique circumstances within the nation. The aforementioned significant events include war, natural disasters, significant policy shifts, economic crises, etc. These circumstances are taken into account in the study and have the potential to impact relationships like cointegration between the variables and symmetric and asymmetric causality. For the reasons outlined, it is believed that during times of strong causality ties in the nations included in the analysis, this causality relationship is impacted by significant changes in that nation as well as in the global community. This issue becomes even more evident when we examine specific time periods where these strong causation links are observed.

One can determine that there is a causal relationship between the two variables in order to evaluate whether the values of one variable in the past and present aid in predicting the value of another. Numerous causality tests have been developed since Granger's study (Zellner, 1962), and they are applied to both panel data and individual time series. Because of its appealing features, this study uses Kónya's methodology (Ghita et al., 2018). For example, since we compute unit-specific critical values using bootstrap simulations, there is no need to test for cointegration between the variables if they have a unit root or for stationarity of the variables before testing for causality. Additionally, Kónya's bootstrap panel causality test (Ghita et al., 2018) takes heterogeneity and cross-sectional dependence into account.

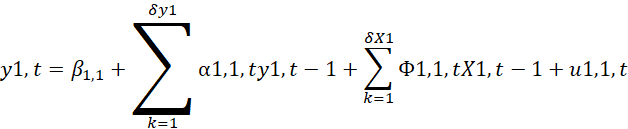

y1,t=β1,1+k=1δy1α1,1,ty1,t-1+k=1δX1Φ1,1,tX1,t-1+u1,1,t

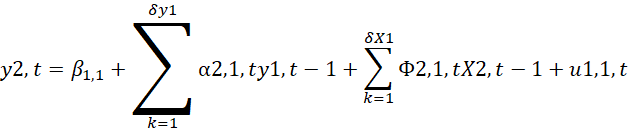

y2,t=β1,1+k=1δy1α2,1,ty1,t-1+k=1δX1Φ2,1,tX2,t-1+u1,1,t

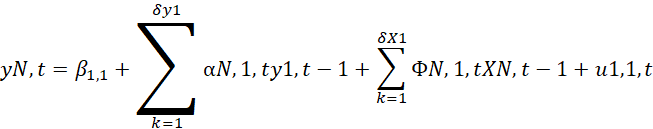

yN,t=β1,1+k=1δy1αN,1,ty1,t-1+k=1δX1ΦN,1,tXN,t-1+u1,1,t

The symmetric causality relationship in a panel dataset can be tested using the bootstrap panel causality test with original series. Granger and Yoon's recommendation to breakdown the original data into positive and negative components and test the causality between decomposed series is necessary to examine the existence of an asymmetric causality nexus (Hatemi, 2012). According to Granger and Yoon [7], conventional cointegration tests show whether or not the considered series reacts to a shock as a group. These tests cannot detect this type of association when two people react to the same type of shock jointly. As a result, they also recommended identifying the series' positive and negative components and utilizing the usual Engle–Granger cointegration test to determine the long-term relationship between them. They dubbed this test the "hidden cointegration" test. (Hatemi, 2012) proposed an asymmetric panel causality test, while (Yilanci and Aydin, 2016) proposed an asymmetric causality test based on the research of (Granger and Yoon, 2002).

7. Empirical results

For the estimation of the Panel NARDL model, it is crucial that the variables be integrated in the same order, such as regressors and regress, which display seasonality trends at level but become stationary after taking first differencing. This is because the Panel non-linear and linear ARDL model can be estimated if none of the variables become stationary at second differencing (Pesaran et al., 2001; Shin et al., 2014). When some variables exhibit non-stationarity trends at level but others are stationary at level, the Panel-based NARDL model can still be estimated. This indicates that while some factors, such as the assortment of I (0) and I (1), are stationary at level, others are not (Shin et al., 2014). Finding the cross-sectional dependence in the data is the first step in estimating the Panel NARDL model. If cross-sectional dependence is present, the first-generation unit root test (such as LLC by Levin et al., 2002), Fisher Type Pane unit root test by Choi (2001), and Hadri Langrage Multiplier (LM) panel unit root test by Hadri (2000), will no longer be reliable. It is now crucial to estimate seasonality trends using the cross-sectional augmented IPS Panel unit root test, which Pesaran developed in 2007 and is also referred to as the second-generation Panel unit root testing approach (Pesaran, 2007).

There were multiple steps in the panel ARDL and panel NARDL models' analytical procedure. To ensure a clean and stable dataset for analysis, the data was prepared by removing outliers using the natural logarithm and verifying for missing values. Both constant and constant + trend time series components of variables were tested for stationarity using panel unit root tests (LLC and IPS). The panel ARDL approach was judged appropriate because the findings indicated a mixture of stationary [I(0)] and stationary after the first difference [I(1)] variables. ARDL Pedroni To find out if there was a long-term relationship between the variables, bounds testing was used. The building model served as the basis for estimating the panel ARDL and panel NARDL models. Inferences about the short- and long-term associations between each independent variable and the dependent variable were made using the chosen model.

7.1 Panel Unit Root Test

The findings of the panel unit root test, which are shown in Table 3, show a combination of stationary and non-stationary variables, with government debt and the money supply being integrated of order 1. They so become stationary when we apply the first difference. On the other hand, the oil price, government spending, and openness all remained constant at the level. Given that the panel data is non-stationary, the Panel ARDL approach can be used to evaluate both immediate and long-term impacts.

Table 3. Panel Unit Root Test, (LLC - test, and IPS - test)

|

Test |

LLC |

IPS |

||

|

Variable's |

Level |

1st Difference |

Level |

1st Difference |

|

INF |

-6.464** I(0) |

|

-7.816*** I(0) |

|

|

MS |

1.122 |

-8.762** I(1) |

0.860 |

-11.171** I(1) |

|

GE |

*3.767** I(0) |

|

-4.594** I(0) |

|

|

OP |

-4.374** I(0) |

|

-5.266** I(0) |

|

|

OPEN |

-3.434** I(0) |

|

-4.669** I(0) |

|

|

Debt |

1.254 |

-8.004** I(1) |

1.443 |

-8.552** I(1) |

Source: Data were processing with E-views13

NT: Significance at 10%, 5%, and 1% is indicated by the symbols *, **, and ***, respectively. The corresponding p-values are shown in brackets

7.2 Panel Co-integration Test

Two-dimension test statistics, or within-dimension and between-dimension test statistics, are reported by the Pedroni panel co-integration test analysis. Panel co-integration's H0 and H1 were contrasted. In Tables 4 and 5, the H0 of no co-integration can be rejected at a level of significance of 10%, 5%, or 1% based on the findings of Pedroni panel co-integration tests.

Table4. Pedroni (Engle-Granger based) test: within-dimension Alternative hypothesis: common AR Coefs

|

Alternative hypothesis: individual AR coefs |

(Panel B: betweendimension) |

||

|

Panel cointegration test |

Individual intercept |

Individual intercept and trend |

No intercept or trend |

|

statistic |

statistic |

statistic |

|

|

Panel V-statistic |

-1.52 |

1.08 |

1.73 |

|

Panel rho-statistic |

1.07 |

2.51 |

0.54 |

|

Panel PP-statistic |

0.59 |

2.03 |

-0.16 |

|

Panel ADF - statistics |

1.60 |

1.59 |

0.80 |

Source: Data were processing with E-views13

Basis: Authors' calculations. The Schwarz Info criteria was used to choose the lag length.

Table5. Pedroni (Engle-Granger based) test: within-dimension (Panel A: within-dimension)

|

Alternative hypothesis: individual AR coefs |

(Panel B: betweendimension) |

||

|

Panel cointegration test |

Individual intercept |

Individual intercept and trend |

No intercept or trend |

|

statistic |

statistic |

statistic |

|

|

Panel V-statistic |

-0.98 |

0.76 |

-1.56 |

|

Panel rho-statistic |

0.75 |

2.17 |

0.39 |

|

Panel PP-statistic |

0.03 |

1.49 |

-0.50 |

|

Panel ADF - statistics |

0.89 |

1.14 |

0.23 |

Source: Data were processing with E-views13

Basis: The writers' calculations. Using the Schwarz Info criteria, the lag length was chosen.

The Group of 6 countries' inflation rate is correlated over the long term with government debt, openness, oil prices, money supply, and government spending, as shown by Table 6's Kao (Engle-Granger-based) test.

Table6. Kao (Engle-Granger-based) test

|

Residual variance |

HAC variance |

ADF (prob.) |

|

7.40 |

14.96 |

0.029** |

Source: Data were processing with E-views13

NT: ** indicates significance at 5%. The related p-values are given in brackets.

According to Table 7. The inflation rate in GCC countries has a long-term association with government debt, degree of openness, oil price, money supply, and government spending. Table 8 shows an alternate test for co-integration analysis based on Trace and Max-Eigen tests: the Fisher panel co-integration test. Table 7 displays the results of all co-integration tests, with the study's projected output implying a long-term link between all conceivable variables. Based on the results of the Fisher panel cointegration tests, the null hypothesis of no cointegration can be rejected at a 10%, 5%, or 1% level of significance.

Table7. Fisher (combined Johansen) test

|

Hypothesized no. of CE(s) |

Fisher stat. (from Trace test) (prob.) |

Fisher stat. (from Max-Eigen test) (prob.) |

|

None |

0.000*** |

0.000*** |

|

At most 1 |

0.000*** |

0.009** |

|

At most 2 |

0.072* |

0.222 |

|

At most 3 |

0.566 |

0.760 |

|

At most 4 |

0.843 |

0.729 |

|

At most 5 |

0.979 |

0.979 |

Source: Data were processing with E-views13

NT: (*, **, and ***) indicate significance at (10%, 5%, and 1%), respectively. In brackets are the associated p-values. Source: Data were processing with E-views13

7.3 Panel ARDL model results

After determining the integration features of the variables under consideration, we proceed to assess the long- and short-term dynamics of the linkages between government debt, openness, oil prices, and inflation rates. Table 8 describes the estimation results using the whole sample. Long-run estimations revealed the following findings: (i) In GCC countries, there is a positive and significant relationship between government debt, openness, oil price, money supply, and inflation rates, as well as a negative significant relationship between government spending and inflation rates. It implies that a 0.47% increase in government debt is caused by a 1% increase in the inflation rate, as well as a 74% increase in openness and a 0.12% increase in openness. Taking into account the positive influence of money supply and the negative impact of government spending on inflation rates in GCC countries. The estimated COINTEQ (-0.04) is negative and statistically significant, indicating a speedier return to equilibrium during an imbalance. The long-run coefficients in the model are statistically significant and have the theoretically predicted signatures.

In ARDL short-run estimation, as expected, the (ETC) or (COINTEQ) has a negative coefficient that is statistically significant. This is the error correction term of the models, indicating that the variables in the models have a long-run relationship. The error correction term calculates the rate of adjustment from the short to the long run. As a result, the ETC advises that changes in unemployment and public debt be adjusted at a rate of 0.4 to maintain long-term convergence to equilibrium. The results show that in GCC nations, inflation rate (DINF) correlates negatively and considerably with government debt. As a result, inflation is adversely associated with government debt in the near run, with a correlation of -0.06. Notably, government debt and openness had a negative short-run link with inflation. In other words, a reduction in government debt is connected with an increase in inflation in GCC countries. In addition, a decline in openness is connected with an increase in inflation in GCC countries. Money supply has a -0.09 correlation, indicating that money supply correlates favorably with inflation in GCC countries. The linear ARDL model shows that oil prices have no effect on the short-run inflation rate.

Table 8. Long-run and short-run estimations of the Panel ARDL model

INF is the dependent variable

|

Variables |

Coefficient |

Standard error |

t-statistics |

Prob |

|

Long-run estimation |

||||

|

Debt |

0.47 |

0.12 |

3.66 |

0.000 |

|

GE |

-0.47 |

0.13 |

-3.46 |

0.000 |

|

MS |

0.22 |

0.07 |

3.03 |

0.002 |

|

OP |

0.12 |

0.21 |

1.58 |

0.057 |

|

OPEN |

74.66 |

17.72 |

4.21 |

0.000 |

|

C |

-117.32 |

13.78 |

8.51 |

0.000 |

|

Short-run estimation |

||||

|

COINTEQ |

-0.04 |

0.06 |

-3.89 |

0.003 |

|

D(INF(-1)) |

0.58 |

0.10 |

5.87 |

0.000 |

|

D(DEBT) |

-0.06 |

0.01 |

-3.62 |

0.000 |

|

D(DEBT(-1)) |

-0.06 |

0.04 |

-1.88 |

0.062 |

|

D(DEBT(-2))) |

0.02 |

0.03 |

0.07 |

0.994 |

|

D(OPEN) |

-18.67 |

1.11 |

-1.68 |

0.062 |

|

D(OPEN(-1)) |

-16.71 |

1.83 |

-1.92 |

0.048 |

|

D(MS) |

0.09 |

0.02 |

3.81 |

0.000 |

Source: Data were processing with E-views13

Table9. Bounds Test

For the effects of government debt, degree of openness, and oil price on inflation rates in GCC countries from 1980 to 2024 for Bahrain, Kuwait, Oman, Qatar, and the United Arab Emirates, we have sufficient evidence to reject the null hypothesis of no cointegration at a 5% and 1% significance level, as indicated by the F-statistics in Table 9. Saudi Arabia is an exception. This only indicates that these models' calculated F-statistics are higher than the upper bound critical value. The PARDL boundaries test results for the United Arab Emirates, Bahrain, Kuwait, Oman, and Qatar. Provide proof that the null hypothesis has been rejected, with the exception of Saudi Arabia. Refer to Appendix 1 and Table 9.

Table 9. Bounds test

|

Cross-Section |

Obs. |

F-Stat. |

|

BAH |

42 |

3.852 |

|

KWT |

40 |

2.094 |

|

QAT |

42 |

3.378 |

|

SAU |

42 |

6.430 |

|

ARE |

40 |

2.553 |

|

OMN |

42 |

2.747 |

Source: Data were processing with E-views13

The Wald test is used to assess whether co-movement exists between the variables. The study rejects the null hypothesis that there is no evidence of co-integration (that is, C(1)=C(2)=C(3)=C(4)=0) and accepts the alternative hypothesis that there is a long-run co-movement among the variables explored in the GCC countries inflation rates model (that is, C(1)=C(2)=C(3)=C(4)=0) based on the Wald test result in Table 5, which shows that the variables are statistically significant at 1%. At the 5% threshold established by Pesaran (1997), the F-statistic value of 40.90 is more than the upper band level of (4.85). A long-term co-movement between the variables in the model is shown by the substantial and positive F-statistics value. Refer to Appendices 2, 3, 5, 6, and 7.

Table10. Wald Test

|

Test Statistic |

Value |

df |

Probability |

|

F-statistic |

40.90 |

(4, 240) |

0.000 |

|

Chi-square |

163.63 |

4 |

0.000 |

Source: Data were processing with E-views13

7.4 Panel NARDL model results

Table 11 reports the panel NARDL models' long- and short-term elasticities for a panel of GCC nations. The main goal of this analysis is to examine the asymmetric and non-linear panel relationship between the inflation rate, oil price, openness, government debt, and other explanatory factors including the money supply and government spending. The estimated values of the positive and negative shocks for increasing and decreasing openness on the inflation rate are displayed in the long-run and short-run models. The long-term estimated coefficients of openness with positive and negative shocks are -95.30 and 148.46, respectively. Consequently, the inflation rate would rise by 148.46% for every 1% increase in openness. Openness growth would lower the inflation rate by -95.30% while lowering it by 1%. At the 5% level, the coefficient of growing openness is substantial, and at the 1% level, the coefficient of decreasing openness is significant. Government debt, one of the key explanatory factors, is, however, substantially and adversely correlated with the rate of inflation. To be more specific, the government debt coefficient value is -0.26 and significant at the 1% level. Since the elasticity of this variable is -1.11 and significant at the 1% level, the price of oil is negatively and strongly correlated with the rate of inflation. In the presence of additional explanatory variables such as government debt, openness, oil price, money supply, and government expenditure, the inflation rate adjusts to its equilibrium at a speed of -0.06%, according to the error correcting mechanism (ECM) coefficient, which is -0.06 and significant.

In the short term, the results of the PNARDL model demonstrate that government debt in the first lag has a positive relationship with the inflation rate, that oil price has a positive relationship with the inflation rate, that openness-positive has a negative relationship with the inflation rate, and that open-NEG has a negative relationship with the inflation rate. It also shows that a one-unit increase in the dependent variable (inflation rate) results in a decrease in the independent variables (government debt, degree of openness, and oil price) by 0.03, 0.10, -32.85, and -10.17. These findings suggest that we must identify the positive and negative effects of the independent variables in short-term analysis. In addition, short-term openness exhibits both positive and negative shocks; for example, when openness rises, the inflation rate falls, and vice versa. The positive effect of openness (openness-positive) implies that the movement of the inflation rate in GCC nations is influenced by the difficulty of controlling all components.

Table 11. Long-run and short-run estimations of the Panel N ARDL model

INF is the dependent variable

|

Variables |

Coefficient |

Standard error |

t-statistics |

Prob |

|

Long-run estimation |

||||

|

DEBT |

-0.16 |

0.05 |

-3.21 |

0.001 |

|

GE |

-0.25 |

0.11 |

-2.31 |

0.000 |

|

MS |

0.53 |

0.08 |

6.13 |

0.000 |

|

OP |

-1.11 |

0.23 |

4.71 |

0.000 |

|

OPEN_POS |

148.46 |

18.64 |

-5.81 |

0.036 |

|

OPEN_NEG |

-95.30 |

14.47 |

-6.58 |

0.000 |

|

C |

-10.83 |

1.38 |

7.13 |

0.000 |

|

Short-run estimation |

||||

|

COINTEQ |

-0.06 |

0.09 |

-2.62 |

0.000 |

|

D(INF(-1)) |

0.61 |

0.15 |

3.94 |

0.000 |

|

D(INF(-2)) |

-0.18 |

0.21 |

-0.84 |

0.391 |

|

D(DEBT) |

0.031 |

0.04 |

0.69 |

0.482 |

|

D(DEBT(-1)) |

-0.12 |

0.08 |

-1.97 |

0.051 |

|

D(GE) |

-0.09 |

0.05 |

-2.63 |

0.015 |

|

D(GE(-1)) |

-0.07 |

0.06 |

-1.37 |

0.302 |

|

D(GE(-2)) |

-0.14 |

0.10 |

-2.35 |

0.002 |

|

D(MS) |

-0.12 |

0.05 |

1.63 |

0.025 |

|

D(MS(-1)) |

0.01 |

0.10 |

3.21 |

0.004 |

|

D(MS(-2)) |

0.07 |

0.06 |

1.16 |

0.246 |

|

D(OP) |

0.10 |

0.08 |

2.54 |

0.019 |

|

D(OP(-1)) |

-0.03 |

0.07 |

2.57 |

0.017 |

|

D(OPEN_POS) |

-32.85 |

2.7 |

-3.14 |

0.004 |

|

D(OPEN_POS(-1)) |

-13.04 |

2.3 |

-3.21 |

0.004 |

|

D(OPEN_POS(-2)) |

-35.92 |

2.2 |

-1.33 |

0.199 |

|

D(OPEN_NEG) |

-10.17 |

2.07 |

-2.88 |

0.008 |

|

D(OPEN_NEG(-1)) |

-26.35 |

2.29 |

-1.18 |

0.237 |

|

D(OPEN_NEG(-2)) |

-24.51 |

2.27 |

-2.01 |

0.057 |

Source: Data were processing with E-views13

7.5. Dynamic, Symmetric, and Asymmetric Bootstrap Panel Causality Test

7.5.1 Symmetric Bootstrap panel causality results

By examining the causal relationship between two or more variables, it is crucial to connect economic theory with hypothesis testing. In order to do this, we first used the dynamic symmetrical causality approaches to assess the relationship between the inflation rate and government debt. By doing this, we examined the causal link without taking into account the effects of either positive or negative shocks on the variables. The dynamic symmetric causality analysis's findings point to a reciprocal causal relationship between government debt and inflation in every nation. These outcomes are displayed in Table 12.

Table 12. Dynamic, symmetric, Bootstrap panel causality test (INF, Debt)

|

H0: INF ➢ Debt |

Symmetric Causality |

|

|

Countries |

Test Stat |

Positive Shocks |

|

BAH |

0.021 |

0.721 |

|

KWT |

1.245 |

0.842 |

|

QAT |

7.329 |

0.321 |

|

SAU |

0.128 |

0.458 |

|

ARE |

0.019 |

0.762 |

|

OMN |

0. 211 |

0.437 |

Source: Data were processing with E-views13

Additionally, we used the dynamic symmetrical causality techniques to examine the relationship between openness and the inflation rate. By doing this, we examined the causal link without taking into account the effects of either positive or negative shocks on the variables. The dynamic symmetric causality analysis's findings point to a reciprocal causal relationship between openness and inflation in every nation. These findings are displayed in Table 13.

Table 13. Dynamic, symmetric, Bootstrap panel causality test (INF, OPEN)

|

H0: INF ➢ OPEN |

Symmetric Causality |

|

|

Countries |

Test Stat |

Bootstrap p-Value |

|

BAH |

0.075 |

0.782 |

|

KWT |

1.277 |

0.892 |

|

QAT |

7.315 |

0.384 |

|

SAU |

0.128 |

0.458 |

|

ARE |

0.019 |

0.762 |

|

OMN |

0. 227 |

0.441 |

Source: Data were processing with E-views13

The dynamic symmetrical causality approaches were used to estimate the causal relationship between the inflation rate and oil prices. By doing this, we examined the causal link without taking into account the effects of either positive or negative shocks on the variables. In Bahrain, Kuwait, Qatar, Saudi Arabia, and the United Arab Emirates, the inflation rate and oil price appear to have a bidirectional no causal link, according to the findings of the dynamic symmetric causality study. Oman excluded. These findings are displayed in Table 14.

Table 14. Dynamic, symmetric, Bootstrap panel causality test (INF, OP)

|

H0: INF ➢ OP |

Symmetric Causality |

|

|

Countries |

Test Stat |

Positive Shocks |

|

BAH |

5.729 |

0.057 |

|

KWT |

6.559 |

0.012 |

|

QAT |

11.313 |

0.000 |

|

SAU |

1.749 |

0.081 |

|

ARE |

7.7189 |

0.021 |

|

OMN |

0. 211 |

0.437 |

Source: Data were processing with E-views13

7.5.2 Asymmetric Bootstrap panel causality results

According to (Granger and Yoon, 2002), causality tests necessitate a distinct analysis of the effects of positive and negative shocks on the variables. Because of this, we separated the positive and negative shocks and re-analyzed the causal conclusion. Positive shocks to the macroeconomic indicators and variables' sub-components may accelerate inflation in dynamic asymmetric causation analysis. All of the variables (debt, openness, oil price money supply, and government expenditure) in the GCC countries in 2007/2008 have a strong causal relationship, according to Table 15, which presents the findings of a dynamic asymmetric causality analysis between positive shocks. This is because both economic policies were significantly impacted by the global financial crisis. Additionally, all variables in the GCC countries in 2019 and 2020 have a significant causal link with one another. The cause of this is that COVID-19 had a major impact on both economic policies. Regarding 2016–2017, the effects of the second global financial crisis are to blame.

Table 15. Dynamic, asymmetric, Bootstrap panel causality test

|

Relationships |

BAH |

KWT |

QAT |

SAU |

ARE |

OMN |

|

INF ➢ OPEN |

1984, 1992, 1999,2007 |

- |

2008 |

- |

1993 |

1988,1993,2008 |

|

INF ➢ Debt |

1984,1985,1986,1987,1990,2010 |

1993, 2007,2008, 2016 |

2011,2017 |

2007,2008,2018,2020 |

1984,1985,1986,1987,2016 |

2014,2015 |

|

INF ➢ OP |

1982,1983,1984,2001,2002 |

1986,2016,2018,2020 |

2006,2007,2008,2016 |

2006,2007,2008,2016 |

2006,2007,2008,2016 |

2006,2007,2008,2016 |

|

INF ➢ MS |

1988,2008,2016,2019 |

1992, 2007,2008 |

- |

2006,2007,2008,2018,2020 |

1982,1983,1984,1986,1987 |

- |

|

INF ➢ GE |

1985, 2006,2007,2008,2018,2020 |

2006,2007,2008,2018,2020 |

2006,2007,2008,2018,2020 |

2008,2016,2017,2018,2020 |

- |

2007,2008,2018,2020 |

Source: Data were processing with E-views13

8. Conclusion of results

The analysis uses a Structural Vector Autoregression (SVAR) framework supplemented with Bayesian estimate techniques to include major macroeconomic variables such as GDP, inflation, government spending, tax revenues, consumer spending, the consumer price index, and employment.

Stationarity and cointegration

The panel unit root tests (LLC and IPS) revealed a mix of I(0) and I(1) series, which supported the usage of ARDL approaches. The subsequent Pedroni, Kao, and Fisher co-integration tests revealed the existence of long-run linkages between inflation, government debt, openness, oil price, money supply, and government spending in the GCC region.

PARDL Results

The PARDL model's long-run estimation revealed that government debt, openness, oil prices, and money supply are all favorably and strongly related to inflation rates, while government spending is adversely related. Specifically, a 1% rise in openness and money supply causes inflationary pressures, whereas an increase in government spending reduces inflation. The long-run openness coefficient (74.66) indicates that domestic prices are significantly exposed to global market dynamics.

In the short run, the negative and significant error correction term (ECT = -0.04) supports the presence of a steady adjustment mechanism. However, the short-run coefficients show mixed results: government debt and openness both have a negative correlation with inflation, implying that contractionary fiscal measures or openness-induced competitive price effects may be implemented in the near term.

PNARDL Results

The PNARDL model indicated large asymmetric effects for key variables. Positive shocks to openness, in instance, increase inflation considerably (148.46%), whereas negative shocks cut it (-95.30%), demonstrating that inflation responds nonlinearly to trade integration. Government debt and oil prices have been shown to have negative and significant long-run effects on inflation, implying a deflationary influence, possibly due to better fiscal credibility or oil-export-driven revenue stabilizing local prices. Short-run asymmetries also exist: growing openness is related with lower inflation, whereas negative shocks to openness reduce inflation even further, emphasizing the policy sensitivity of trade openness. Oil prices exhibit a nonlinear inflationary impact, implying that global commodity price movements have a major impact on local inflation in oil-exporting nations.

Bootstrap Causality Tests

The dynamic symmetric and asymmetric bootstrap causality tests confirmed bidirectional causality between inflation and key explanatory variables, especially during economically turbulent periods such as the 2007-2008 global financial crisis, the 2016-2017 oil price shocks, and the COVID-19 pandemic (2019-2020). This underscores the notion that inflation and macroeconomic indices in GCC nations are mutually reinforcing, particularly during periods of structural or global economic crisis.

9- Concluding Remarks and Policy Suggestions

9-1 Conclusions

This paper presents strong empirical evidence that government debt, openness, and oil prices influence inflation trends in GCC countries, both linearly and nonlinearly. The findings show that these variables have both long-term equilibrium and short-term asymmetry in their effects on inflation. The findings reinforce the idea that macroeconomic management in resource-rich and open economies like the GCC must be extremely flexible, particularly during external shocks. The prevalence of asymmetric responses suggests that uniform policy tools may not be adequate or efficient in all situations.

9-2 Policy Implications

Financial Prudence and Debt Management

Although government debt has a mixed impact on inflation, long-term accumulation may create inflationary pressures. To avoid inflation volatility, sound debt management policies must be implemented, with an emphasis on efficient public spending and debt sustainability.

Trade Openness and Price Volatility

The asymmetric impacts of openness imply that more trade liberalization can either raise or cut inflation, depending on external price trends and import-export dynamics. To reduce the risk of inflation from global shocks, policymakers should diversify trade partners, establish exchange rate stability mechanisms, and boost competitiveness.

Oil Price Management and Inflation Targeting

Because oil prices have a considerable impact on inflation in the region, stability funds or counter-cyclical fiscal policies should be strengthened to protect against oil price fluctuations. Furthermore, tying inflation targets to commodity price patterns may boost monetary policy efficacy.

Monetary Policy and Money Supply Control

Given the positive relationship between the money supply and inflation, monetary authorities should emphasize inflation targeting, possibly using rule-based approaches (e.g., Taylor-type rules) to manage liquidity while avoiding overt tightening during deflationary periods.

Crisis Response Policy Frameworks

The study identifies substantial causation linkages during crisis moments. This necessitates adaptive policy frameworks that include early warning systems, scenario modeling, and flexible policy coordination among fiscal and monetary authorities, particularly during external shocks.