International Journal of Business Research and Management

OPEN ACCESS | Volume 4 - Issue 1 - 2026

ISSN No: 3065-6753 | Journal DOI: 10.61148/3065-6753/IJBRM

Kosisochukwu Rosebeth Anekwe1., Igwe, Chijioke Paul2*

1Ulster University Business School London.

2Ulster University Business School London.

*Corresponding author: Igwe, Chijioke Paul, Ulster University Business School London.

Received: March 16, 2025 Accepted: March 24, 2025 Published: April 07, 2025

Citation: Kosisochukwu R Anekwe., Igwe, Chijioke Paul, (2025) “The Impact of Organisational Culture on Employee Performance and Productivity in The Uk Financial Sector”. International Journal of Business Research and Management 2(3); DOI: 10.61148/IJBRM/07.1043

Copyright: © 2025. Igwe, Chijioke Paul. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

This study examines the impact of organizational culture on employee productivity within multinational banking corporations (MNCs) in the UK, focusing on institutions such as Lloyds, Barclays, NatWest, HSBC Holdings, and Standard Chartered. Through a descriptive survey research design, data was collected from 260 participants and analysed using SPSS with both descriptive and inferential statistics. The research identifies key cultural elements, including recruitment culture, team orientation, career development, and communication practices, which significantly influence employee performance. The findings show that recruitment culture has the strongest positive correlation with productivity, with employee involvement in decision-making and alignment with the organization’s mission playing pivotal roles in enhancing job performance and retention. The study concludes that organizational culture is a critical factor in boosting employee efficiency and productivity. It recommends a shift toward a more flexible and participatory organizational structure, improved communication channels, and a focus on career development programs to foster a high-performance culture in UK banking MNCs. The research also highlights the need for policy reforms that integrate cultural elements to enhance employee motivation and reduce turnover. Additionally, the study suggests areas for future research, including expanding the scope to other sectors and utilizing longitudinal methods for a more dynamic understanding of organizational culture’s impact on employee productivity

1.0 Introduction and background of study

Over the past decade, organizational culture has emerged as a key component influencing HRM and productivity in the fiercely competitive and rapidly evolving global market. As stated by Li et al. (2018), organizational culture seeks to supervise and manage worker actions and behaviours with an aim of accomplish company objectives through cooperation, harmony, and coordinated efforts. While organisation culture is considered a key in driver of employee performance, majority of organisation have witnessed an increasing trend of work-exist and low-workforce productivity. Nwakoby et al. (2019), this trend is as a result of inefficiencies and failures are associated with cultural orientations within organizational structures. Therefore, to be successful, Soomro et al. (2024) suggest that an organization must possess the critical ability to create and maintain an organizational culture. According Driskill (2018), this entails set of common presumptions, values, and beliefs that control how a company interacts with its internal and external environments. The interactions between organisational actors and external stakeholders are significantly influenced by these shared values . As such, presence of a strong organisational culture will significantly improve job satisfaction, engagement, and productivity.

Organisational culture is described by Calciolari et al. (2018) as a concept built upon shared traditions, inclinations, and both unwritten and written procedures that were established in the past but continue to be regarded as genuinely significant. Organisations establish distinct cultures to represent their existence, values, and operational guidelines for both the entity and its members. Previous research (Aboramadan et al., 2020; Kalkan et al., 2020; Yun et al., 2020) indicates that organizational culture impacts various important organizational characteristics. Al-Swidi et al. (2021) literature suggests that organizational culture not only affects individual attitudes and behaviours but also has a documented influence on overall organizational performance.

According to Jackson (2021), employees who are content and inspired in their positions are likely to provide superior services compared to those who are not. Consequently, Bawa (2017) notes that employee motivation is crucial for achieving high productivity and desired outcomes. This can be viewed as fundamental to an organisation's ability to reach its goals. Previous studies have indicated that a motivated workforce is one of the most vital internal resources contributing to a company's success. Motivation not only enhances work productivity and service quality but also aids in retaining skilled employees (Anakpo et al., 2023; Prasetyo et al.,2021; Saluy et al., 2021). Furthermore, these researchers have shown that factors such as management policies, leadership approaches, and employee engagement significantly influence worker productivity and performance.

The financial and professional services (FPS) sector serve as a crucial driver of economic growth in the UK. Employing 2.5 million individuals nationwide, with over 1.1 million in financial services (FS) and more than 1.3 million in associated professional services, the industry generated £278bn in economic output, accounting for 12% of the UK's total economic production, and contributed £100bn in tax revenue (ONS, 2024). While the UK maintains a leading position globally in various financial domains, including banking, insurance, and asset management, it must continually strive to remain competitive on the world stage. In the UK, organisational culture is often prioritised as a means to achieve results. According to Consultancy.uk (2021), 70% of UK CEOs have emphasised the importance of culture within their firms over the past five years, although this figure is 12% lower than their global counterparts. Given these considerations, this research aims to examine the impact of organisational culture on employee job performance, with a particular emphasis on the UK's financial sector.

1.2 Problem Statement

In today's world, organisations must navigate environments marked by swift technological advancements, intense global competition, and shifting customer demands. In light of these complexities, Ling et al. (2020) suggests that cultural orientation is considered one of the crucial elements for organisational success and maintaining a competitive advantage. For decades, researchers (Gorton et al., 2022; Jackson, 2021) have asserted that an organisation's culture significantly influences its performance. However, Chen et al. (2021) contend that the majority of studies rely primarily on a qualitative perspective of culture as the foundation for organisational culture research. Additionally, Tannady, and Budi, (2023) indicates that most scholars have proposed three levels of workplace culture: artefacts, espoused values, and basic underlying assumptions. This framework is among the more renowned models of corporate culture. Furthermore, various studies have explored different organisational culture categories or cultural profiles of organisations (Gutterman, 2024; Hofstede, 1994). While these concepts are important, Groysberg et al., (2018) argues that there is a necessity to embrace a competing framework of company culture with divergent value orientations in examining employee productivity and performance.

For several decades, scholars (Chiwawa, 2022; Ling et al., 2020) have maintained that an organization's culture has a considerable impact on its success. It is claimed that while some cultures are more useful and should be kept, others are considered "bad" or "weak" and should be changed. Gutterman (2024) identify essential presumptions that support the notion that organizational culture influences employee performance: one is that an organization has a distinct culture; two, culture and performance are inextricably linked; and three, an organization's culture may be modified to improve performance. At the meso level, some studies adopt a process approach to theorizing the various stages employees go through when deciding to quit (Porter and Rigby, 2021). Others, adopting organisational culture models, have concentrated on the causes and antecedents to employees quitting their jobs. Jolly et al. (2021) argue that extant research also emphasizes employees’ job attitudes and job characteristics as fundamental precursors of increased turnover. Among these are low job autonomy, poor supervisor support, limited job mobility, inadequate training, unsatisfying work, and high stress. Together, these bodies of research suggest that organisation cultural orientation, “the effective ways of interrelating that create connections between people” in the workplace, could tip the balance between people staying or leaving. Yet there is limited research exploring the impact of organizing culture on workforce turnover and addressing under what conditions, and to what extent, relational practices could induce workforce turnover in organizing.

Work turnover and employee leave rates in the UK financial sector average 15% per year, with most organizations experiencing an increase (Statista, 2024). Employers bear a high cost for this tendency, which has a negative impact on performance, productivity, and competitiveness (De Meulenaere et al., 2021). Furthermore, Villiers (2021) contends that the financialization of corporate governance in the UK financial industry has weakened corporations' commitment to their employees. According to Speer et al. (2019), this has been hazardous to workers' interests as well as enterprises' long-term existence and performance. Yet, few studies have been conducted to investigate the impact of organizational culture on employee productivity and performance in the United Kingdom Financial Sector. As a result, there is a need to address these concerns of organizational cultural orientation by stressing long-term performance rather than short-termism, workforce engagement, performance, and productivity.

1.3 Research Aim, Questions and Objectives

The main aim of the study was to examine the impact of organizational culture on staff productivity and performance within the UK financial sector. The study through various case studies aims to show the dominant feature of organizational culture driving staff productivity, their relationship, as well as recommendation for driving staff productivity and performance.

1.3.1 Research Questions

1.3.2 Objectives

The specific objectives of the study were as follows.

1.4 Study Rational and Value

The purpose of this study is to better understand the relationship between employee job satisfaction, dedication to managerial collaboration, efficiency, and corporate culture in the UK financial sector. The UK banking industry is critical to the national economy of the United Kingdom, contributing substantially to employment and GDP. However, the industry faces the same issues as the rest of the economy, such as retention of talent, competition, and the rapid expansion of innovations in workforce management. This study will aid the management of financial organisations in the UK by determining the impact of organizational culture on staff productivity and performance. Thus, management might alter the organization's culture and redesign it in a way that it brings out the best in each employee and also enhance their productivity.

Similarly, additional study will be undertaken on this relationship in the context of five international corporations: Standard Chartered, Barclays, HSBC, Lloyds, and NatWest. Finishing this study will improve current research and provide valuable information to analysts and managers. To improve overall performance and wealth, a superb business culture must be established and sustained. A successful commercial enterprise requires a strong corporate culture. Growth, profit, productivity, and, more broadly, execution improvement all contribute to a company's overall performance. Given that organizational culture is a vital component of every business venture technique example, its features assumption needs a comprehensive understanding.

Furthermore, this study will be valuable to international business studies and scholarly bodies as it will support existing theories and add to the literature, allowing scholars and researchers to propose hypotheses for further evaluation and generalization in other locations and sectors.

1.5 Research methodology

Employees in the UK financial industry will make up the study's population. About 1.54 million people worked in the UK's finance and insurance industry as of the second quarter of 2024 (D. Clark, 2024). Given the size of the population, for this study, a stratified random sampling technique was employed. By ensuring that workers from the top, middle, and lower levels of management are fairly represented in the sample, this approach offers a more thorough understanding of the ways in which organizational culture affects performance at various management levels. Five top multinational corporations were chosen as the case study organizations for the inquiry based on their assets in the UK financial sector as reported by Statista (2024). The combined board diversity of these companies, which included Standard Chartered, HSBC, Lloyds, and, averaged 39.7% (Statista, 2024).

The study employed entire population sampling approaches. This is a purposive sample strategy where the researcher selects the entire population that shares specific qualities, such as knowledge or experience (Barran and Jones, 2016). Since the study target population for HSBC Holding, Barclays, NatWest, Standard Chartered Group, and Lloyds was determined to be 438 078 employees as of 2023 (Statista, 2023), a stratified random sampling technique was used to purposefully pick effective sample size suitable for the study. A total of 1200 participants were randomly selected from the target population and were stratified to include top, middle, and lower management. The Taro Yamane formula is utilized to ascertain the sample size, ensuring representativeness and accuracy of estimates.

Given that n=N/(1 + N(e)²);

Where N = Required Sample Size, N = Total Employee Population in the 5 Selected UK financial Sector MNCs. E = the error term and then n = (1 + 1200 (0.05) ²) = 300

Therefore, based on the calculation a sample size of 300 participants is considered sufficient for research involving a relatively large population. Therefore, the study’s determined sample size of 300 participants was sufficient and representative of the population.

The investigator gathered both primary and secondary data. A survey questionnaire with structured questions was used as the data collection tool in this study. In large-scale survey research, questionnaires are used to gather information about the beliefs, behaviors, and experiences of research participants (Quinlan et al., 2019). There were three sections on the questionnaire. The questionnaire's Section A gathered the respondents' demographic data. Information about organizational culture was covered in Section B, and information about worker productivity was covered in Section C. 39 statement items modified from DOCS were used to evaluate organizational culture, the study's independent variable.

The first step in the data analysis process was to thoroughly clean the data. Prior to data analysis, the questionnaire's completeness was verified. Analysis was done on the data gathered from primary sources. Information was edited and transformed into numerical codes that represented characteristics or metrics of variables. SPSS version 21.0 was used to analyse the gathered data and test research hypotheses. Frequencies, percentages, means, and standard deviations were among the descriptive statistics used to display the respondents' demographic data. The data was presented using frequency distribution tables and pie charts.

Additionally, the hypotheses were tested and the significance of the relationship between the independent and dependent variables was ascertained using inferential statistics, specifically multiple regression analysis. The researcher was able to determine the factors influencing employee productivity based on the predictor variables by using regression coefficients. The significance of the findings was revealed through the interpretation of the results.

1.6 Literature review and Empirical Review

Globally, scholars have undertaken empirical investigations into the connection between organisational culture and worker productivity across various related fields. However, limited research has been conducted within the Nigerian Food and Beverage sector regarding this relationship. Nevertheless, the studies examined, despite being carried out in different countries, often reached similar conclusions. Nwakoby et al. (2019) conducted a study in Nigerian deposit banks in Nigeria with an aim of determining the extent to which organisational culture has a significant impact on the performance of employees through survey research design. The result showed that bureaucratic culture does not have a significant impact on employee performance of deposit-taking banks. Another result is that the culture of innovation has a significant impact on the employee performance of deposit-taking banks. The study therefore recommended, among other things, that management of deposit-taking banks should develop cultures that improve performance while keeping the interests of their customers and employees at heart.

This involvement encompasses the inclusion of staff at all levels in decision-making and problem-solving processes. By engaging employees in organisational procedures, it ensures that they can consciously identify with their workplace roles and closely align their performance with the organisation's objectives. To establish a strong organisational culture, management should foster high levels of employee engagement and participation in key organisational activities (Nzuva and Mwende Kimanzi, 2022). It is crucial to acknowledge that when employees take part in organisational decision-making, they tend to have a heightened sense of responsibility and accountability for their actions.

Langat and Lagat (2017) investigated the impact of organisational ownership and culture on employee performance in selected Kenyan banks. Their findings revealed that involvement and consistency positively influence employee performance. The study employed an explanatory research design to meet its objectives. Stratified and simple random sampling techniques were used to determine the sample size, while data collection was accomplished through questionnaires. The reliability of the instrument was assessed using Cronbach's alpha. The researchers analysed the data using descriptive and inferential statistics. Correlation and multiple regression analyses uncovered causal relationships between organisational culture, performance, and other selected variables. The study concluded that consistency and involvement enhance employee performance. It recommended that organisations aiming to improve employee performance should seek employee input on work-related and organisational matters.

ASSEFA (2021) suggests that organisations with robust, well-coordinated, and integrated cultures are more likely to succeed. A consistent organisation maintains its mindset, establishes a structure based on consensual support, and implements an internal governance system. Employee behaviour is guided by a set of established principles, and despite differing opinions, managers and subordinates are skilled at reaching agreements (Etebu and Oweisanda, 2024). Mburu (2020) note that consistency, stemming from a shared mentality and higher conformity standards, represents a stable attitude and a powerful force for internal integration.

Laike (2017) conducted an explanatory study to examine how the four organisational culture dimensions in the Denison model affect performance management practices at the Economic Commission for Africa. The research employed simple random and purposive sampling techniques to determine the sample size. A questionnaire was used to collect primary data, which was then analysed using descriptive and inferential statistics. The relationship and effect between variables were determined through correlation and regression analysis. Adaptability is crucial for business success as an organisational cultural dimension. This concept emphasises the need for organisations to maintain a framework of norms and beliefs that supports their ability to perceive and respond to environmental signals, translating them into internal behavioural changes. This foundation significantly enhances an organisation's prospects for success, development, and growth. Interestingly, well-integrated organisations are often the most challenging to imitate. Cherian et al. (2021), characterise adaptable organisations as those that align with their environment's needs, recognise and act on potential changes, take calculated risks, and learn from mistakes. These organisations continuously improve their systems to enhance efficiency and deliver value to customers.

Employee performance, on the other hand, is the completion of a task when evaluated against the specified criteria of completeness, accuracy, speed, and cost. Performance is defined as the degree to which an employee completes the organizational task at work (Cascio, 2016). Since both employee performance and organizational output determine overall performance, employee performance is critical to an organization's growth and development. Employee performance is influenced by a number of factors, and organizational culture is regarded as one of the most important ones on which an employee's performance depends. The relationship between organizational culture and employee performance has been empirically documented in a number of studies.

Organizational culture is a mode composed of various propositions such as beliefs, values, and norms. The ideas found are developed by a particular group to investigate how to interact with the external environment and offer answers to problems that are both internal and systemic. The idea that different organizational cultures create different levels of employee satisfaction and performance is the foundation for the study of how culture affects employee performance in the workplace (Janićijević et al., 2018). Understanding what motivates employees from an influencing standpoint and balancing it with work and behavioral preferences is therefore the more methodical approach to take. The growth and success of an organisation are based on the creativity, commitment, as well as input of the team.

The four cultural types that emerged from the quadrants are Clan, Adhocracy, Market, and Hierarchy. If not appropriately and intentionally developed and envisioned, organizational culture may have a negative or positive effect on workers' job performance (Saad and Abbas, 2018). The workplace environment and employee behavior within an organization are significantly shaped by organizational culture.

1.6.1 Organisation Culture

Organisational culture, as defined by Anitha and Begum (2016), encompasses the fundamental assumptions a group develops or uncovers whilst addressing external adaptation and internal integration challenges. These assumptions, once proven effective, are deemed valid and imparted to new members as the proper approach to perceiving, thinking, and feeling about such issues. Conolly et al. (2017) suggest that organisational culture manifests in three distinct layers: values, artefacts, and basic assumptions. Each layer is resistant to change and can persist even at the expense of some employees who established them.

Jackson (2021) further describes organisational culture as the collective values shared amongst members regarding organisational practices, the common norms and values concerning task execution, and the accepted behavioural standards that must be strictly adhered to when carrying out assignments within the organisation. These shared beliefs and values provide guidance in decision-making, task structuring, and social interactions both within and outside the organisation.

Typically, organisational culture is established by managers and founders, as well as through a system encompassing social norms, interactions with external stakeholders, regulatory bodies, and other crucial elements in the external environment.

1.6.2 Job Satisfaction, Motivation, and Engagement

When examining organisational contexts, job satisfaction emerges as a crucial element (Carvalho et al., 2018). Recent research on motivation indicates that educators now concur that job satisfaction stems from evaluations of work performance (Williams, 2022). Consequently, organisations aiming for favourable business outcomes must equip their staff with the necessary knowledge, skills, and expertise to optimise productivity. Job satisfaction encourages employees to apply their full potential and intellect towards effectively achieving objectives. Conversely, Agu, et al. (2020) highlighted that factor not contributing to job satisfaction led to subpar performance, diminished quality, increased absenteeism, higher turnover rates, and more workplace accidents. Job satisfaction manifests as an individual's positive or negative sentiment. It arises when a person obtains desirable outcomes or reaches a specific goal. These feelings may diminish if the desired outcomes or goals remain unmet (Amin, 2017). According to Aryani and Widodo (2020), job satisfaction encompasses attitudes or emotions of like or dislike, particularly in relation to work responsibilities or operational aspects.

1.7 The United Kingdom Financial Sector

The UK’s financial and related professional services industry is a critical driving force of growth and jobs across the country. Office of National Statistics (ONS) report in 2024 indicates that as of 2024, there were approximately 1.54 million people employed in the finance and insurance sector in the UK, compared with 1.16 million in 1997 (ONS, 2024). New report by TheCityUK underlines the significant contribution the industry makes to the national economy in every region and nation, and makes clear its potential to unleash faster growth boost through targeted policy action (TheCityUK, 2024). According to the report the industry contributed approximately £132 billion to the UK economy as of 2024, which represented about 7% of the UK's GDP.

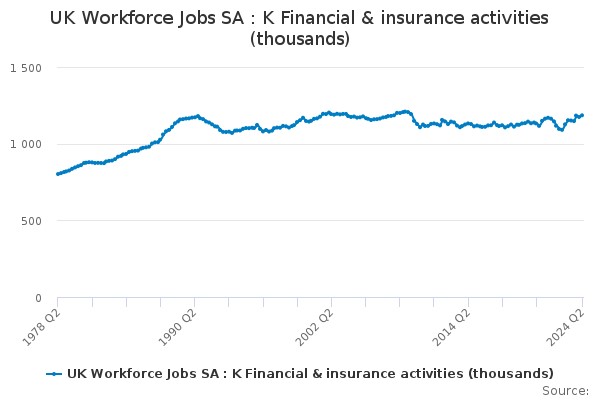

Fig 1.0: UK Workforce Statistics (ONS, 2024)

Over the last decade, Suddaby et al. (2017) found that the scandals within the UK Financial Service sector have impacted their legitimacy and raised questions whether a workplace compliance culture exists or not. Several institutional changes at the regulatory and normative levels have targeted stakeholders’ concerns regarding compliance culture and led to changes in the legitimation process. However, the country continues to be a dominant financial hub, although the 2008 global crisis, the post-Brexit pressures and constant technological transformations have introduced uncertainties around regulatory frameworks and market access (Bussmann and Niemeczek, 2017). In general, the number of people employed has consistently increased, with noticeable dips in employment occurring although job relocation data indicates that the financial services industry is more resilient than anticipated following Brexit. Moreover, ONS (2024) report indicates that employment in the financial services industry has stagnated. Shome (2018) shows that this paradox, that fewer jobs appear to have relocated to Europe whilst at the same time fewer jobs have been created has been labelled a ‘curious case’ of ‘missing’ financial sector jobs.

Multinational financial firms in the UK are fostering adaptive organizational cultures that prioritize continuous learning and employee development, recognizing the pivotal role of an engaged and skilled workforce in driving improved performance (Shenaaz Gani and Tafirei Mashamba, 2022). By cultivating an inclusive leadership ethos that empowers employees to voice their perspectives and contribute to decision-making processes, these firms create an environment that fosters a sense of ownership and shared responsibility for organizational success. A recent study conducted by the Chartered Institute of Personnel and Development (CIPD) revealed that companies with highly engaged employees experienced a 21% increase in profitability, underscoring the tangible benefits of prioritizing employee motivation (CIPD and Young, 2023). This approach according to Suddaby et al., (2017) not only enhances employee satisfaction and retention rates but also fosters a culture of innovation and agility, enabling firms to swiftly adapt to the ever-changing regulatory landscape and market dynamics. Furthermore, these firms are investing in ongoing professional development opportunities, equipping employees with the necessary skills and knowledge to navigate the complexities of the financial sector. A survey by PwC found that 70% of employees consider training and development opportunities as a key factor in their decision to stay with an employer, highlighting the direct impact of such initiatives on talent retention and organizational stability (PwC, 2024). By fostering an environment that values continuous learning and growth, these firms are cultivating a workforce that is not only highly motivated but also equipped to tackle the sector's evolving challenges, ultimately contributing to sustained organizational success.

Multinational financial firms operating in the UK's highly competitive and regulated landscape have recognized the pivotal role of a robust, adaptable organizational culture in driving employee motivation and, ultimately, improved performance. By proactively shaping their cultural environments, these firms aim to cultivate a sense of engagement and productivity among their workforce. CIPD and Young (2023) delved into the strategic initiatives undertaken by UK financial sector organizations to foster adaptive cultures that promote employee motivation. The authors shows that companies are shifting from implementing collaborative decision-making processes to encouraging open communication and continuous learning, demonstrating a commitment to creating an environment that empowers and inspires their employees. Petricevic and Teece (2019) suggests that by aligning their cultural values with the ever-evolving demands of the financial sector, these organizations are better equipped to navigate the complexities of the industry while simultaneously nurturing a motivated and high-performing workforce. Therefore, the cultivation of a strong, adaptive organizational culture serves as a catalyst for sustained success, enabling these multinational firms to thrive in an increasingly competitive global market.

1.8 Model and Hypotheses Development

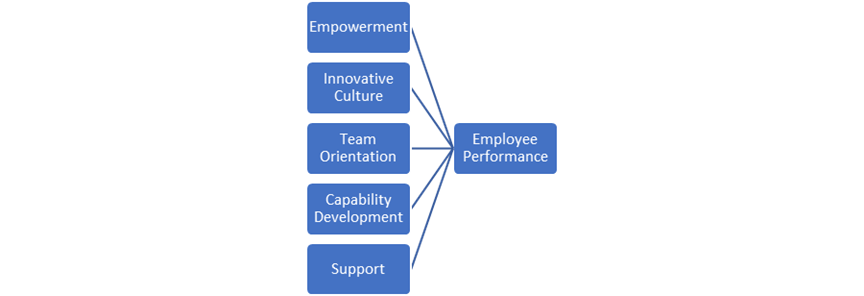

A conceptual framework is a written or visual product that outlines important concepts, variables, determinants, or factors to be examined as well as the assumed relationship they possess. Organizational culture which encompasses team orientation, empowerment, organizational support, capability development, innovation, organizational learning, and rewards—was chosen as the independent variable to create the conceptual framework. The dominant direction of influence is depicted by the pointed arrows in Figure 2.2. The Denison Model's four organizational culture dimensions that directly impact worker productivity were used to identify the independent organizational culture variable.

Fig 1.1: Study Conceptual Model

Based on the above model the following hypotheses were proposed.

H1: Empowerment has a significant effect on worker productivity and performance

H2: Innovation and risk taking has a significant effect on worker productivity and performance H3: Team orientation has a significant effect on worker productivity and performance

H4: Capability development has a significant effect on worker productivity and performance

H5: Recognition and reward culture has a significant effect on worker productivity and performance

H6: Recruitment culture has a significant effect on worker productivity and performance

1.9 Gaps in Literature

Although previous research acknowledges that organizational culture has a broad impact on worker performance, there is a glaring lack of detailed research on how specific organizational culture traits like flexibility, leadership style, creativity, and teamwork, either positively or negatively impact precise measures of worker productivity and performance in the UK financial industry. Numerous studies have provided a thorough summary of the effects of organizational culture, but they fall short in their analysis of the ways in which various cultural characteristics manifest themselves in relation to performance indicators like employee engagement, job satisfaction, efficiency, and innovation. Consequently, it is important that this study fills this knowledge gap by empirically examining the particular organizational culture components that are prevalent in the financial industry and their differences.

1.10 Findings, Analysis and Discussion

A total of 300 questionnaires were distributed to the determined sample size of top, middle, and lower management staff from top 5 UK listed financial sector MNCs including Lloyds bank, Barclays, NatWest, HSBC Holding, and Standard Chartered Bank. As previously stated in the methodology, the investigator created the surveys using a Google Forms and distribute them through a Google Link to respective WhatsApp’s and emails of the recruited respondents. The findings on Table 1.0 below indicates that a total of 267 questionnaires were filled and returned out of the 300 distributed surveys. The investigator also noted that a total of 7 questionnaires were inaccurately filled while others contained omission errors and were not included in the study. Therefore, the total completed and accurately filled surveys were reduced to 260 valid questionnaires, representing 86.67% were used for data analysis.

|

|

Survey No. |

Percentage |

|

Not Returned |

33 |

11% |

|

Omitted |

7 |

2.33% |

|

Completed |

260 |

86.67% |

|

Total |

300 |

100% |

Table 1.0: Survey Return Rate

Respondents Profile Analysis

The demographic information of the study participants is shown in this segment. From a total of 260 responses, the respondents background information was as indicated on Table1.1 below.

|

Categories |

Count (N) |

Percent (%) |

|

Sexual Orientation |

|

|

|

Male |

102 |

39.2 |

|

Female |

154 |

59.2 |

|

Prefer Not to Say |

4 |

1.5 |

|

Age Group |

|

|

|

20-29 Years |

69 |

26.5 |

|

30-39 Years |

135 |

51.9 |

|

40-49 Years |

35 |

13.5 |

|

50 Years and Above |

21 |

8.1 |

|

Education Achievement |

|

|

|

Diploma |

21 |

8.1 |

|

Degree |

126 |

48.5 |

|

Master’s Degree |

93 |

35.8 |

|

PhD and Above |

20 |

7.7 |

|

Company |

|

|

|

HSBC Holding |

39 |

15.0 |

|

Barclays |

54 |

20.8 |

|

Lloyds Banking Group |

79 |

30.4 |

|

NatWest Group |

29 |

11.2 |

|

Standard Chartered |

59 |

22.7 |

|

Organizational Position |

|

|

|

Top Management |

42 |

16.2 |

|

Middle Management |

162 |

62.3 |

|

Lower Management |

56 |

21.5 |

|

Experience |

|

|

|

Below 1 Year |

56 |

21.5 |

|

2-3 Years |

112 |

43.1 |

|

4-5 Years |

55 |

21.2 |

|

6 Years and Above |

37 |

14.2 |

|

Department |

|

|

|

Technical & Production |

37 |

14.2 |

|

Sales & Marketing |

98 |

37.7 |

|

Supply and Procurement |

53 |

20.4 |

|

HR |

39 |

15.0 |

|

Finance |

33 |

12.7 |

|

|

|

|

Table 1.1: Surveyed Respondents Background Data

Table 1.1 findings on sexual orientation shows that females participants made up the majority of the survey population estimated to be 59.8% (N=159), they were followed by males who were estimated to be 39.2% (N=102) while 1.5% preferred to disclose their gender. The findings also show that the sample population is predominantly composed of youths which was cumulatively estimated to be 78.5% of the surveyed respondents, with 26.5% aged 20-29 with a minimum age of 20 years, 51.9% fell in the age range 30-49 years, 13.5% indicated their age range to be 50 years and above.

Table 1.1 also shows the proportion of employees in the five selected banking MNCs in the UK financial sector. Based on the results 30.4% of workers were from Lloyds Banking Group, the were followed by 22.7% participants from Standard Chartered Bank, and 20.8% of participants from Barclays Bank. On the other hand, HSBC Holding and NatWest Group had the lowest number of surveyed respondents 15.0% and 11.2% respectively.

The majority of the surveyed had at least achieved a masters level education and were cumulatively estimated to be 92.3%, according to Table 1.1. This implies that the respondents are knowledgeable enough to respond to questions about employee productivity and organizational culture. With a cumulative estimate of 85.8% staff indicating that their work experience range of 1–5 years, the finding on Table 1.1 demonstrates that the respondents had enough experience to offer perceptions on the organizational culture of the business. Moreover, the findings also indicated that a cumulative 78.5% of the total survey population were from the lower and middle management while only 21.5% were from the top management level.

Reliability

Before conducting the descriptive analysis, a reliability and validity test was first conducted. According to Jiddah et al. (2016), reliability is the measurement of the consistency of findings when employing the same concepts or procedures in various manners. The Cronbach alpha was employed to evaluate the reliability of the measurements for the seven variables. Table 4 below shows that the Cronbach alpha coefficients varied from 0.92 to 0.94, with an overall reliability of 0.940 representing. Although there is contention on the definition of a reliable score, alpha scores exceeding 0.60 are deemed acceptable, especially when the construct has fewer than 10 items and the scale is novel as per Sürücü and Maslakci (2020). Moreover, scores with alpha value over 0.70 signify a high reliability of study items to explain the investigation’s research questions as explained by Hajjar (2018). As shown on Table 1.2 below, an overall alpha value of .940 for the 7 items were deemed valid and that the internal consistency of these items was suitable for explaining the impacts of organisational work culture on UK banking MNCs staff job productivity and performance.

|

Item Code |

Item Name |

Cronbach's Alpha |

|

ECQM |

Empowerment Culture |

.931 |

|

TOQM |

Teamwork Orientation |

.929 |

|

DCQM |

Development Capability |

.932 |

|

ICQM |

Innovation and Creativity |

.933 |

|

RRQM |

Recognition and Reward |

.930 |

|

RCQM |

Recruitment Culture |

.934 |

|

PPQM |

Employee Productivity and Performance |

.928 |

|

Overall |

|

.940 |

Table 1.2: Survey Item Reliability Statistics

Dominant Work Culture

In this section, the investigator required workers to rate dominant features of organizational work culture in the five UK banking MNCs including Barclays, HSBC, Lloyds, NatWest, and Standard Chartered from 1=least dominant to 5= most dominant. The findings on Table 1.3 below encompasses the means as well as first and last observed values for items including Capability Growth, Teamwork Culture, Innovation and Creativity, and Recruitment Culture.

|

Report |

||||||

|

Companies |

Empowerment Culture |

Innovative culture |

Team orientation |

Developmental capability |

Recruitment culture |

|

|

HSBC Holding |

Mean |

2.85 |

3.36 |

3.46 |

3.13 |

3.21 |

|

N |

39 |

39 |

39 |

39 |

39 |

|

|

First |

Moderately Dominant |

Moderately Dominant |

Moderately Dominant |

Moderately Dominant |

Moderately Dominant |

|

|

Last |

Dominant |

Dominant |

Most Dominant |

Dominant |

Most Dominant |

|

|

Barclays |

Mean |

2.83 |

3.59 |

3.78 |

3.67 |

3.26 |

|

N |

54 |

54 |

54 |

54 |

54 |

|

|

First |

Dominant |

Most Dominant |

Most Dominant |

Dominant |

Most Dominant |

|

|

Last |

Most Dominant |

Most Dominant |

Most Dominant |

Most Dominant |

Most Dominant |

|

|

Lloyds Banking Group |

Mean |

3.10 |

3.42 |

3.58 |

3.75 |

3.58 |

|

N |

79 |

79 |

79 |

79 |

79 |

|

|

First |

Least Dominant |

Most Dominant |

Slightly Dominant |

Dominant |

Moderately Dominant |

|

|

Last |

Most Dominant |

Most Dominant |

Most Dominant |

Most Dominant |

Dominant |

|

|

NatWest Group |

Mean |

3.07 |

3.62 |

3.83 |

3.52 |

3.72 |

|

N |

29 |

29 |

29 |

29 |

29 |

|

|

First |

Dominant |

Most Dominant |

Most Dominant |

Most Dominant |

Dominant |

|

|

Last |

Most Dominant |

Most Dominant |

Most Dominant |

Most Dominant |

Dominant |

|

|

Standard Chartered |

Mean |

3.58 |

4.02 |

4.17 |

4.00 |

3.83 |

|

N |

59 |

59 |

59 |

59 |

59 |

|

|

First |

Least Dominant |

Moderately Dominant |

Moderately Dominant |

Dominant |

Most Dominant |

|

|

Last |

Most Dominant |

Most Dominant |

Most Dominant |

Most Dominant |

Most Dominant |

|

|

Total |

Mean |

3.11 |

3.60 |

3.77 |

3.67 |

3.53 |

|

N |

260 |

260 |

260 |

260 |

260 |

|

|

First |

Dominant |

Most Dominant |

Most Dominant |

Dominant |

Most Dominant |

|

|

Last |

Most Dominant |

Most Dominant |

Most Dominant |

Most Dominant |

Most Dominant |

|

Table 1.3: Dominant Features of Organisation Work Culture Statistics

The findings on Table 1.3 indicates that Standard Chartered regularly surpassed other banks, achieving the highest mean scores across all factors, particularly in empowerment culture (M=3.58), Innovative Culture (M=4.02) and development capability (M=4.00). HSBC Holdings received the lowest scores in several criteria, notably in empowerment culture (2.85) and Innovation and Creativity (3.36). The Team Orientation Culture was identified as the most prominent attribute of organisational culture among all the banks (M=3.77), whereas empowerment recorded the lowest overall mean score (M= 3.62).

Organisational Culture and Performance Variables Analysis

In this section, respondents rated views on various statements relating to how organisational work culture relates to productivity and performance were presented. An aggregate of six independent variables including employee empowerment culture, recognition and reward culture, team orientation, recruitment culture, capability development culture, creativity and innovative culture, and teamwork orientation culture along with employee performance and productivity as a dependent variable. The findings were as indicated on Table 1.4 below.

|

|

Descriptive Statistics |

||||||||||

|

|

|

N |

Range |

Sum |

Mean |

Std. Deviation |

Skewness |

Kurtosis |

|||

|

|

|

||||||||||

|

PPQM |

|

260 |

3.67 |

1006.50 |

3.8712 |

.71612 |

-.296 |

.151 |

-.135 |

.301 |

|

|

ECQM |

|

260 |

4.00 |

959.25 |

3.6894 |

.81665 |

-.403 |

.151 |

-.052 |

.301 |

|

|

TOQM |

|

260 |

4.00 |

991.25 |

3.8125 |

.71874 |

-.270 |

.151 |

-.090 |

.301 |

|

|

DCQM |

|

260 |

3.00 |

1013.75 |

3.8990 |

.66136 |

-.105 |

.151 |

-.774 |

.301 |

|

|

ICQM |

|

260 |

3.00 |

983.75 |

3.7837 |

.68073 |

.094 |

.151 |

-.756 |

.301 |

|

|

RRQM |

|

260 |

2.50 |

992.25 |

3.8163 |

.67475 |

-.014 |

.151 |

-.990 |

.301 |

|

|

RCQM |

|

260 |

4.00 |

978.00 |

3.7615 |

.74846 |

-.354 |

.151 |

.343 |

.301 |

|

|

Valid N (listwise) |

|

260 |

|

|

|

|

|

|

|

|

|

Table 1.4: Organisational Work Culture and Productivity Variable Statistics

Of the six elements of company culture, growth capability received the greatest mean score and the lowest mean deviation (M=3.8990, SD=0.66136), implying that most of the participants showed great agreement. The outcomes imply a possibility in implementing programs based on staff skills. Most respondents say that their company actively supports and helps in an always culture of learning among its employees. According to the poll, employees of companies can adjust to changes in their organizations generated by the always changing organizational culture. Furthermore, participants strongly agreed with the statements concerning recognition and recruiting (M=3.8263, SD=0.67475). Most employees also thought the commercial bank actually encourages creativity innovation (M=3.7837, SD=0.68078). According to the findings, most employees believed the bank sufficiently encourages the development of entrepreneurial talents among its employees. Most of the participants (M=3.7615, SD=0.74846) list recruiting and selection as one of the important cultural aspects. This implies that regardless of their diverse socioeconomic and biological traits, the workplace of banks is welcoming to every employee. Based on staff roles, bank employees say that authority is distributed from person to person or team to team (M=3.8125, SD=0.71874).

Correlation

The study sought to determine if worker productivity is much influenced by features of organizational work culture. The Pearson’s correlation coefficient (r) was used to ascertain the relationship between study variables and to ascertain the direction (positive or negative) and strength (-1.0 to +1.0) of the associations. According to Haimanot (2018), correlations values above 0.71 are considered strong while correlations below 0.30 are considered low. With values ranging from 0.889** to 0.978**, Table 1.5 below reveals that the output correlation has a significant (2-tailed) value of 0.000, p < 0.01, 0.05.

|

Correlations |

||||||||

|

|

PPQM |

ECQM |

TOQM |

DCQM |

ICQM |

RRQM |

RCQM |

|

|

PPQM |

Pearson Correlation |

1 |

|

|||||

|

Sig. (2-tailed) |

|

|

||||||

|

N |

260 |

|

||||||

|

ECQM |

Pearson Correlation |

.702** |

1 |

|

||||

|

Sig. (2-tailed) |

.000 |

|

|

|||||

|

N |

260 |

260 |

|

|||||

|

TOQM |

Pearson Correlation |

.683** |

.804** |

1 |

|

|||

|

Sig. (2-tailed) |

.000 |

.000 |

|

|

||||

|

N |

260 |

260 |

260 |

|

||||

|

DCQM |

Pearson Correlation |

.731** |

.690** |

.685** |

1 |

|

||

|

Sig. (2-tailed) |

.000 |

.000 |

.000 |

|

|

|||

|

N |

260 |

260 |

260 |

260 |

|

|||

|

ICQM |

Pearson Correlation |

.703** |

.667** |

.697** |

.670** |

1 |

|

|

|

Sig. (2-tailed) |

.000 |

.000 |

.000 |

.000 |

|

|

||

|

N |

260 |

260 |

260 |

260 |

260 |

|

||

|

RRQM |

Pearson Correlation |

.748** |

.665** |

.725** |

.709** |

.707** |

1 |

|

|

Sig. (2-tailed) |

.000 |

.000 |

.000 |

.000 |

.000 |

|

|

|

|

N |

260 |

260 |

260 |

260 |

260 |

260 |

|

|

|

RCQM |

Pearson Correlation |

.738** |

.665** |

.641** |

.664** |

.639** |

.686** |

1 |

|

Sig. (2-tailed) |

.000 |

.000 |

.000 |

.000 |

.000 |

.000 |

|

|

|

N |

260 |

260 |

260 |

260 |

260 |

260 |

260 |

|

|

**. Correlation is significant at the 0.01 level (2-tailed). |

||||||||

Table 1.5: Correlation Statistics

Table 1.5 shows that employee productivity (r =.702**, p < 0.000) is much favorably connected with an empowering culture. This implies that the second dimension will correspondingly rise as one variable increases. Teamwork orientation and worker productivity showed a really strong positive connection (r =.683**, p = 0.000). As is the relationship between creativity and productivity (r =.703**; p < 0.000), development capability and productivity among employees in the UK banking sector have a notable relationship (r =.731**; p < 0.000). Recognition of workers also showed a positive strong correlation with productivity (r =.748**, p = 0.000). Recruitment and employee productivity showed a notable positive connection (r =.738**, p = 0.000). In overall there was a significant relationship between organizational work culture and worker productivity in the five selected UK banking MNCs.

Regression

A multiple regression analysis at a 0.05 significance level was adopted to show how the independent variables such as capability development, teamwork orientation, innovativeness, empowerment, and recognition culture explains the variation in employee productivity and performance in the UK banking sector. Table 1.6 shows the result of the study model.

|

Model Summaryb |

|||||||||

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

Change Statistics |

||||

|

R Square Change |

F Change |

df1 |

df2 |

Sig. F Change |

|||||

|

1 |

.844a |

.712 |

.705 |

.38874 |

.712 |

104.322 |

6 |

253 |

.000 |

|

a. Predictors: (Constant), RCQM, ICQM, ECQM, DCQM, RRQM, TOQM |

|||||||||

|

b. Dependent Variable: PPQM |

|||||||||

Table 1.6: Study Model Summary Statistics

Based on R value (R=0.844, p=0.000), it was suggested that organizational work culture and employee productivity and performance had a favorable link. Furthermore, found was that the six corporate work culture factors sufficiently accounted for employee productivity variation. An R2 of 0.705 and the relevance of F change at 0.000 help to support this. This implies that, in cases when all other factors are kept constant, the model fitness finds that flexible work schedules explain 70.5% of the variations in the dependent variable.

|

ANOVAa |

||||||

|

Model |

Sum of Squares |

df |

Mean Square |

F |

Sig. |

|

|

1 |

Regression |

94.590 |

6 |

15.765 |

104.322 |

.000b |

|

Residual |

38.233 |

253 |

.151 |

|

|

|

|

Total |

132.823 |

259 |

|

|

|

|

|

a. Dependent Variable: PPQM |

||||||

|

b. Predictors: (Constant), RCQM, ICQM, ECQM, DCQM, RRQM, TOQM |

||||||

Table 1.7: ANOVA Statistics

The F statistic of 104.322 and the reported p value of <0.000, both of which were below the traditional significance level of 0.05, indicate that flexible work schedules were a strong predictor of employee performance, as indicated by Table 1.7 above.

Moreover, the coefficient Table 1.8 below indicated the Beta values of the study variables as indicated below.

|

Coefficientsa |

||||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

Collinearity Statistics |

|||

|

B |

Std. Error |

Beta |

Tolerance |

VIF |

||||

|

1 |

(Constant) |

.124 |

.159 |

|

.777 |

.438 |

|

|

|

ECQM |

.127 |

.054 |

.145 |

2.339 |

.020 |

.297 |

3.368 |

|

|

TOQM |

-.010 |

.064 |

-.010 |

-.150 |

.881 |

.274 |

3.646 |

|

|

DCQM |

.217 |

.060 |

.201 |

3.646 |

.000 |

.375 |

2.667 |

|

|

ICQM |

.154 |

.057 |

.147 |

2.714 |

.007 |

.390 |

2.563 |

|

|

RRQM |

.247 |

.062 |

.233 |

3.981 |

.000 |

.333 |

3.004 |

|

|

RCQM |

.250 |

.050 |

.262 |

5.031 |

.000 |

.421 |

2.378 |

|

|

a. Dependent Variable: PPQM |

||||||||

Table 1.8: Coefficients Statistics

Table 1.8 indicates that at 0.01, 0.05 significance level, 5 of the six organizational work culture variables showed a positive significant variation in worker productivity in the UK banking sector at 0.01, 0.05 significance level. Using the Unstandardized beta value, recruitment culture showed the highest variation in worker productivity (β = 0.250, t=5.031, p = 0.000); second is recognition and recruitment culture (β = 0.247, t=3.981, p = 0.000). Moreover, capability development culture significantly predicts worker productivity (β = 0.217, t=3.646, p= 0.000), it was followed by innovation and risk-taking culture (β = 0.154, t=2.714, p = 0.007), at 0.05 significant level employee empowerment predicted the variation in worker performance (β = 0.127, t=2.339, p = 0.020). on the other hand, only teamwork orientation was found to have a negative low predictive power on workers productivity (β = -0.010, p = 0.881). Based on this finding, the final regression model given Y = βо + β1 G1+ β2 G2+ β3 G3…β4 G6 was determined as follows;

Worker Productivity and Performance = .159 + .250 G1+ .247 G2-.217 G3 +.154 G4 +.127 G5 +-.010 G6.

Therefore, from the regression finding on Table 4.9 indicates the summary of hypotheses.

|

No |

Hypotheses |

Correlation |

Regression |

Decision |

|

H1 |

Recruitment culture has a significant effect on worker productivity and performance |

(r =.738**, p = 0.000) |

(β = 0.250, t=5.031, p = 0.000) |

Accepted Null Hypothesis |

|

H2 |

Recognition and reward culture have a significant effect on worker productivity and performance |

(r =.748**, p = 0.000) |

(β = 0.247, t=3.981, p = 0.000) |

Accept Null Hypothesis |

|

H3 |

Capability development has a significant effect on worker productivity and performance |

(r =.703**; p < 0.000) |

(β = 0.217, t=3.646, p= 0.000) |

Accept Null Hypothesis |

|

H4 |

Innovation and risk taking has a significant effect on worker productivity and performance |

(r = .720**; p < 0.000) |

(β = 0.154, t=2.714, p = 0.007) |

Accepted Null hypothesis |

|

H5 |

Empowerment has a significant effect on worker productivity and performance |

(r =.702**, p < 0.000) |

(β = 0.127, t=2.339, p = 0.020) |

Accept Null Hypothesis |

|

H6 |

Teamwork orientation has a significant effect on worker productivity and performance |

(r =.683**, p = 0.000) |

(β = -0.010, p = 0.881) |

Reject Null Hypothesis |

Table 1.9: Hypotheses Findings Summary

Discussion of Findings

This study sought to provide answers on the extent to which the six organizational culture variables affect employee performance in the UK banking MNCs. The research findings are accentuated, discussed and summarized according to the study’s specific objectives. Employees are vital to culture and serve as crucial touchpoints for improving worker productivity. The UK banking MNCs investigated in this study encountered desire of their employees to possess enhanced expertise, professionalism, honesty, variety of thinking, and the capacity to transcend conventional methodologies. This is in line with literature finding from Erciyes (2017) study on organisational culture with professional organizations yield analogous findings. According to the study component of fulfilling that objective involved recruiting individuals who had successfully completed pertinent examinations, were members of an authorized professional organization, and possessed diverse skill sets. Certain banks intentionally recruited individuals from outside the financial services sector to introduce diverse personalities, especially in fields like human resources, change management, and business growth.

Dominant Work Culture

The efficacy of organizational learning can be affected by organizational culture, which serves as a framework or lens for cognition. A vital component that fosters organizational learning is the culture that drives change. Organizations necessitate a flexible culture to promote collaboration and learning among their members, especially in a competitive environment (Mousavi et al., 2015). Setiawan and Iskak (2023) asserts that learning is a constructive process integral to organizational culture. Although organizational culture is crucial for facilitating the learning process, organizational learning is primarily a process or journey rather than a final destination for development. Consequently, modifications in organizational culture are essential (Nzuva and Mwende Kimanzi, 2022). The objective of organizational culture is to maintain the organization's success and viability by balancing the necessity for suitable external environmental adaptations with the imperative to uphold internal cohesion. To address the necessity for consistency and predictability alongside the requirement for change, the principle of balance is adhered to.

Organisational Culture and Employee Productivity

The research aimed to evaluate the impact of company work culture on staff productivity within banking MNCs in the UK. The overall findings from multiple regression indicate that the work culture within banking organizations in the UK significantly affect employee efficiency and productivity, aligning with prior research develop Nwakoby et al. (2019). Moreover, the results regarding the mission of organizational culture align with the theoretical cultural models such as the X and Y theory, Denison Organisational Culture Model, and the Maslow Hierarchy of Need as explained by Nguyen-Phuong (2019) cross-cultural management publication which indicated that firms exhibiting superior performance possess a strong understanding of their goals and mission, hence enabling them to monitor their objectives to enhance productivity.

The data analysis results indicate that recruitment culture significantly affects worker productivity. Employee performance is not much influenced by the organizational structure. This study contradicts the results of Kampini (2018) which clearly indicate that the business actively engages employees and incorporates them in decision-making to enhance goal attainment. Consequently, employees maintain their commitment and exhibit a greater willingness to remain with the firm long-term, underscoring the importance of low employee attrition as noted by Taunk et al. (2022). The culture of engagement enhances productivity and employees' capacity to align with the organization's mission and objectives, hence affecting staff productivity levels. This is supported by Kiziloglu (2021) study which argues that workers' comprehension of the organization's mission and objectives is the initial step in guaranteeing familiarity with its direction, facilitated through staff involvement activities during the performance year and review.

Employee performance can be much influenced by career development for several reasons. This was supported by Etebu and Oweisanda (2024) suggesting that workers who have a clear, realistic goal they feel encouraged are more driven to improve their skills and abilities in particular professions. This can so greatly raise their general success. The awareness and improvement of employees' deficiencies made possible by career development programs helps to explain how career development influences employee performance and helps to enable the fulfillment of particular goals or roles. They thus understand their limitations and learn ways to overcome them under the direction of their superiors. Furthermore, scholars argue that a career development program inside a company can effectively evaluate and control staff performance, capabilities, and areas needing improvement to fulfill a designated position. Underperforming staff members are encouraged by this program to raise their performance and reach their goals.

The finding indicated that team orientation culture did not have any significant impact on employee productivity. However, several scholars like Mahmood et al. (2023) contest this finding suggesting that every employee must cooperate as a whole to enable the smooth flow of activities required for achieving set goals and objectives, therefore enabling an organization to properly implement its planned plans. Regarding whether the client is the main focus of the daily operations of the company and whether the organizational communication channels are simple and clear, the responses were objective.

The study revealed that employee performance on timeliness, work quality, and productivity was much influenced by company culture. These results match Mburu (2020) study showing that job happiness and employee performance can be improved by organizational culture. Appropriate organizational cultures will motivate employees to actively carry out their duties, thereby improving the whole performance of the companies. Their happiness resulting from a good work environment, polite interactions, and general comfort explains this. They would also go for organizational goals before going for personal ones.

1.11 Conclusion and recommendations

The main aim of the study was to conduct a descriptive cross-sectional survey that investigated how the efficiency and performance of top, middle, and lower management workers from UK Financial sector including Lylods bank, Barclays, NatWest, HSBC Holding, as well as Standard Chartered. were influenced dominant features of organizational work culture. The results from 260 return and completed survey indicate that worker productivity and efficiency in these listed MNCs was significantly affected by an effective company culture. The self-administered surveys using different organizational culture including recognition, team work orientation, recruitment, development capability, innovation and creativity all were positively correlated to worker productivity and had a significant impact. Employees of the company show their participation in decision-making, which helps them grow their identities and absorb the goal of the banking MNCs, therefore improving workplace output. They are thus at ease operating for the organization for a long period. On the other hand, individuals who spend a lot of time comfortably in a company have lower output.

Moreover, employees' experiences at the workplace clearly showed how well they could translate the Assembly's vision and goals into higher production. This study yields two primary conclusions. That there is need for concentration of UK banking stakeholders on carrying out major reforms in order to boost the low efficiency to yields an increase in job productivity outcomes. This study's findings reveal that a workplace atmosphere and culture that is consistent, goal-oriented, and participatory determines employee effectiveness. Policymakers should set strong organizational culture practices in local governments, including reward-based systems as well as rules of compliance, so enhancing cultural dynamics and motivating worker productivity. Local authorities have to link their objectives with the work environment if they are to enable staff members to change their execution of tasks. Good integration will raise employee productivity in a company.

In recommending, the organizational structure should be reviewed to enable a more flexible and less bureaucratic culture, that is, a Matrix structure. Laid down rules and procedures should be flexible enough to accommodate the opinions and creativity of employees. One way to do this is to review the organization’s communication channels. During monthly staff meetings, employees should be granted session to speak on innovative ways to move the company forward. Management should also develop an internal media- blog where anonymous feedback and innovative ideas from the employees can be assessed. Currently, the employees feel that supervisors are always right and prefer to perform tasks as dictated by the supervisor. This may not always be true. Hence, while performing assigned tasks, employees should be encouraged to respectfully yet professionally present their opinions and suggestions if they do not quite agree with the supervisors’ directives. The blog idea and feedback mechanism should be implemented after the pandemic, possibly during the next financial year. The idea should be introduced during the first meeting and implemented throughout the year. At the end of the financial year, the employees’ productivity in terms of job completion time and quality should be compared to the performance of the previous year. Creating and managing the blog will require financial and time commitments.

UK banking MNCs have long-term goal orientation, management should communicate the firm’s long-term plans and vision to employees during hiring and staff meetings such as breakfast and town hall meetings. A mantra that aligns the firm’s goals with those of the employees should be developed. This will impress the firms’ strategic orientation on the hearts of the employees and go a long way to boost their performance. Employees should perceive their position as a useful link in the organization’s chain. They should perform their job efficiently at the expected time so as to increase their chances of remaining with the firm for a very long time. Thereby, increasing job retention and reducing employee turn-over.

1.12 Limitations and Areas of Further Studies

This study was limited to only top 5 listed banking multinationals in the UK including, Standard Chartered Bank, HSBC Holding, Lloyds, Barclays, and NatWest. Further studies should be undertaken on other multination financial firms in the UK including the fast-developing fintech companies to validate their dominant organizational work culture and how these cultures impact not only productivity of employees but also talent retention and employee intention to stay or leave their work.

Secondly, the study was theoretically limited to Hofstede (1980) 6-D model, Denison Organisational Culture model, and the Competing framework. Further studies on organizational culture and workers productivity should adopt a robust framework such as Max Weber's work on bureaucracy in the early 20th century, Frederick Taylor's scientific management theory, and Edgar Schein's model of organizational culture, introduced in the 1980s as explained by Guillén (1994) book on management models and Liu and Tang (2023) study on the influence on organizational work engineering, encompassing research on fundamental characteristics and components of organizations, organizational objectives, organizational structure, organizational leadership, and organizational decision-making, all inspired by organization theories and their inspirations.