International Journal of Business Research and Management

OPEN ACCESS | Volume 4 - Issue 1 - 2026

ISSN No: 3065-6753 | Journal DOI: 10.61148/3065-6753/IJBRM

Chinonso Vincent Nwokoye 1., Igwe, Chijioke Paul2*

1Ulster University Business School London.

2Ulster University Business School London.

*Corresponding author: Igwe, Chijioke Paul, Ulster University Business School London.

Received: March 16, 2025 Accepted: March 24, 2025 Published: April 07, 2025

Citation: Chinonso V Nwokoye., Igwe, Chijioke Paul, (2025) “The Role of Digital Marketing on Customer Satisfaction in The Nigeria Banking Industry; A Case Study of Gt Bank, Lagos State”. International Journal of Business Research and Management 2(3); DOI: 10.61148/IJBRM/07.1044

Copyright: © 2025. Igwe, Chijioke Paul. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

The study looked at how customer satisfaction at GT Bank in Lagos State, Nigeria, was affected by digital marketing. The study employed a survey research design. The research used a structured questionnaire to gather data from GT Bank using a straightforward random sample technique. One hundred case study participants made up the sample size. Regression analysis statistical techniques were used to analyses the acquired data at a significance level of 0.05 percent. The outcome demonstrated a strong correlation between GT Bank's customer happiness and email and social media marketing. Among other things, the report suggested that customer support representatives establish cordial relationships with their clients by implementing digital marketing techniques like email and social media marketing.

1.1 Introduction:

Examining how digital marketing affects customer satisfaction in the Nigerian banking sector is the main goal of this study. Investigating this issue is intriguing since it has the potential to reach specific audiences, boost sales, and generate income. Technological innovation is another significant aspect that fuels the demand for this issue (Macy, 2024). As technology advances, customers may now access banking services online from anywhere at any time. Additionally, it develops new products and services, growing the market for consumers and banks alike. Nowadays, businesses use digital marketing channels to reach potential customers worldwide with their goods and services. Analysing user activity on their website might provide them with new information about the needs as well as their target audience's preferences (Oni et al. 2014).

There is no denying that digital marketing has become a more effective approach to establishing deep connections with customers. Services, which are basically undifferentiated items provided in a competitive market, are what banks typically provide (Lau et al. 2013). Nonetheless, providing services in an effective and efficient manner might help a bank stand out from the competition and attract more devoted customers. Digital marketing allows banks to function more efficiently while growing their customer base, being accessible everywhere, offering convenience, and generating more revenue (Adewoye, 2013). The conventional armchair, brick-and-mortar style of banking has therefore been replaced by digital marketing, which allows customers to do transactions with just a button push from the comfort of their homes (Adewoye, 2013).

1.2 Overview of the Company- GT Bank

The Nigerian multinational financial company Guarantee Trust Bank Plc, commonly referred to as GT Bank or just GTB, has its headquarters located on Victoria Island, Lagos, and provides corporate, investment, retail, online, and internet banking services as well as asset management services. Founded in 1990, GT Bank is one of the top brands in Nigeria (Alder, 2024). It has over 230 branches in Nigeria as well as subsidiaries in London, Cote d’Ivoire, Gambia, Ghana, Liberia, Sierra Leone, Uganda, Kenya, and Rwanda. Over 12,000 professionals are now employed by the Bank, which has ₦4.057 trillion in total assets and ₦661.1 billion in shareholder funds (GT Bank, 2024).

The banking operations of GTB include retail, corporate, commercial, SME, and investment banking. Five segments make up its operation: The public sector, retail, corporate, commercial, and small and medium-sized banking (Owler, 2024). The Retail Banking division offers custody, credit and debit cards, mortgages, savings deposits, investment savings products, private client current accounts, and private banking services. For very big corporate clients and blue-chip companies, the Corporate Banking section offers foreign currency, derivatives, overdrafts, current accounts, deposits, and other credit facilities (Augie, 2019).

For mid-sized and startup company clients, the Commercial Banking category offers products. Businesses and initiatives of small and medium sizes can purchase goods from the SME banking category. Government ministries, departments, and organisations can access banking products from the Public Sector sector. Olutayo Aderinokun and Tajudeen Afolabi Adeola established the business on July 20, 1990, with its main office located in Lagos, Nigeria (Forbes, 2024).

1.3 Background of the Research Problem

The financial sector in Nigeria is complex and fraught with difficulties. Although the country's economy still depends significantly on cash, with a sizable amount of its wealth remaining outside the banking sector, the Central Bank of Nigeria adopted a cashless monetary policy (Ajayi et al., 2025, Omife, Nebo, and Okafor, 2025).

Residents' awareness of the actual presence and handling of cash, a sense of discomfort while utilising digital platforms, and limited infrastructure for electricity and the internet might all be contributing factors. By 2020, Nigeria wants to rank among the world's top 20 economies, thus it's critical to recognise that a country's financial and economic development is greatly influenced by the effectiveness of bank service delivery (Emeh et al. 2017).

Emeh et al. (2017) investigated the use of digital marketing in Nigeria's banking sector, for example, despite the fact that a substantial amount of research has been on the topic: A review. The study discovered a strong and positive relationship between customer loyalty and digital marketing. Piabari et al. (2022) assessed the relationship between digital marketing and bank performance in Port Harcourt. The results showed a strong relationship between the use of certain Port Harcourt banks by customers and different marketing strategies, such as content marketing and social media. Taiwo and Agwus investigated the impact of e-banking on the operational efficiency of Nigerian banks (Victor, 2025). According to the experts, banks would gain more if their customers made more electronic transactions. Nigeria has seen very few of these studies, and the use of digital marketing by Nigerian banks has received less attention. Consequently, the goal of this research is to investigate how Nigeria's banking industry uses digital marketing.

Digital marketing benefits from the use of marketing theories since they enable marketers to create winning plans, comprehend their target market, and adjust to changing conditions (Adewoye, 2013). The RACE Digital Model and the McKinsey 7S Model are among the theories used in this study. Both perspectives are crucial for elucidating how digital marketing affects consumer happiness.

As a result, many bank employees are unable to do business utilising modern technologies, even if digital marketing has made many and significant contributions to bank operations. Furthermore, it seems that low power supplies, inadequate internet infrastructure, poor information delivery, and organisational facility deficits all hinder the benefits that digital marketing offers in enhancing bank performance. Thus, this study examines digital marketing and the commercial performance of Nigerian banks in Lagos State in an attempt to bridge the gap.

1.4 Research Aim, Objectives, and Questions

The primary goal of this research is to examine, using GT Bank as a case study, how digital marketing affects customer satisfaction.

Research Questions

Research Objectives

To address the research questions, the following objectives are drawn up:

1.5 Methodology

A structured questionnaire and a descriptive survey method were used in the study to gather data. Lagos State is home to GT Bank employees. To ascertain the sample size, we will employ judgmental sampling technique. SPSS will be used to do multiple regression analysis on the gathered data. Regression analysis is employed to examine the relationship between digital marketing and consumer satisfaction.

A Google Form will be used to disseminate the survey online, and an Excel spreadsheet will be used to gather the responses. The questionnaire items, which comprise two parts and ten questions, are the study tools (instruments) for this investigation. The first portion is on demographic factors, containing a number of measures that gauge respondents' demographic status, including management level, years of experience, and gender. The following questions form the basis of the second section: This section comprises a number of components to gauge how GT Bank's customer satisfaction in Lagos State is affected by digital marketing strategiesIn order to make sure that the questionnaire's items accurately reflect the variables in the study, the researcher, supervisor, and other specialists will evaluate the instrument's validity and substance. A detailed comprehension of the relevant literature informs the well-structured study's goals, research questions, and hypotheses. Additionally, the supervisor ensures that the enquiries are suitable, clear, and intelligible. However, the Cronbach's alpha approach will be used to assess the instrument's dependability

3.3.2 Data Collection Methods

The intended audience consists of GT Bank workers in Lagos State, Nigeria. Time restrictions will lead to the selection of a sample of 100. In order to divide the population into four groups—25 employees each from the Ikeja, Ojota, Ketu, and Berger branches—the researcher will adopt stratified random sampling. Every branch is located in Lagos State.

Statistical Package for Social Sciences (SPSS) version 25 will be used to analyse the data collected from the research participants. 0.05 is chosen as the significance threshold. By looking at the frequency distributions of all the variables that characterise the participant demographics, the data will be cleaned and checked for missing information, outliers, and wide codes.

The following displays the multiple regression model:

Y= β0+β1X1+β2X2+……βnXn

HO1- There is no significant impact of digital marketing on customer satisfaction at GT Bank.

H1- There is significant impact of digital marketing on customer satisfaction at GT Bank.

CS= β0+β1X1+β2 X2

Where:

CS= Customer satisfaction (dependent variable)

Β1….β3= coefficient

Β0= constant

X1= Social media marketing

X2= Email marketing

1.6 Research Significance

This study will close the gap by examining the impact of digital marketing on customer satisfaction, drawing on the empirical research already evaluated. The main reason this study is important is the topic's pertinence. The study would be beneficial to any business looking to put the best plan into action in order to achieve the most goals in fiercely competitive markets. All businesses using conventional marketing will likewise remark favourably on this study. The study will facilitate communication with consumers regarding skill development and customer satisfaction.

The country's banking industry is a major component of its financial system. The study will enable the industry to improve performance levels and employ various digital marketing tactics. For scholars and future researchers, the research findings will also offer fundamental knowledge on how digital marketing affects corporate success. Furthermore, it will add to the body of existing knowledge in the topic of study.

2.0 Literature Review

According to the Digital Marketing Institute, digital marketing is the process of using digital technology to provide integrated, focused, and quantifiable communications that aid in attracting and retaining clients while fostering closer bonds with them (Rizal et al, 2017). Interactive and direct marketing are both included in digital marketing. Customers are treated as unique people by direct marketing, which characterises them based on both their behaviour and character. Interactive marketing works to overcome individual differences and is able to gather and retain individual replies (Kim and Kim, 2021).

The term "digital marketing" describes the practice of promoting a good or service using online platforms like social media. Improving the internet exposure of our brand is the responsibility of a digital marketing agency (Aryal, 2018). Through the use of technological techniques, digital marketing analyses customer wants and efficiently meets them via the Internet or other similar communication channels (Astoriano et al, 2022).

By using digital marketing, businesses may respond more quickly to the demands and understandings of their consumers, establish productive connections with them, and be flexible and adaptive to changes in the external environment (Slavola, 2022). Digital marketing makes it possible to communicate interactively with customers, making it more sensitive to their knowledge and expectations of information seeking and reception. In turn, interactive communication opens up possibilities for creating a dynamic environment with shifting spaces, personalised navigation based on user preferences, dynamic design, the employment of highly skilled computer code, mobile technologies, and ongoing innovation (Krymov et al, 2019).

This section aims to provide the reader with a better understanding of the significance of digital marketing, the primary variable in this research project. After examining the several definitions of digital marketing, it will be summarised as the use of digital tools like social media to educate consumers about a company's offerings, which ultimately boosts sales.

2.1 Customer Satisfaction

Consumer satisfaction is a metric that assesses how satisfied consumers are with a business's goods, services, and capabilities. Business performance improves when customers are satisfied. In both everyday and professional contexts, the term "performance" is frequently invoked. It has evolved into a duty for all parties involved, regardless of their area of activity. Its enhancement has turned into a problem for every business worried about its existence and reputation in the industry it works in (El Hachimi et al, 2021).

The banking industry is typically under pressure as a result of consumers' transferring purchases to online platforms. This is especially problematic for brick and mortar establishments, which struggle to keep up with the pace of change. For instance, Sabanoglu (2021) found that among UK businesses, 36% see an internal lack of digital skills as the primary barrier to digital transformation. According to Sabanoglu (2021), 16% of those surveyed said that other difficulties included compartmentalised departments and a lack of communication.

In the fast-paced digital world of today, companies of all sizes need to be online to be competitive. However, because they believe that more conventional methods would be sufficient to maintain their business, many organisations continue to downplay the significance of digital marketing. Unfortunately, businesses who do not have a digital marketing plan may have a variety of adverse consequences, including a drop in revenue, a decrease in brand recognition, and a loss of customer engagement (Pansari, and Kumar, 2017, Chaffey, and Smith, 2022).

2.3 Relevant Theoretical studies

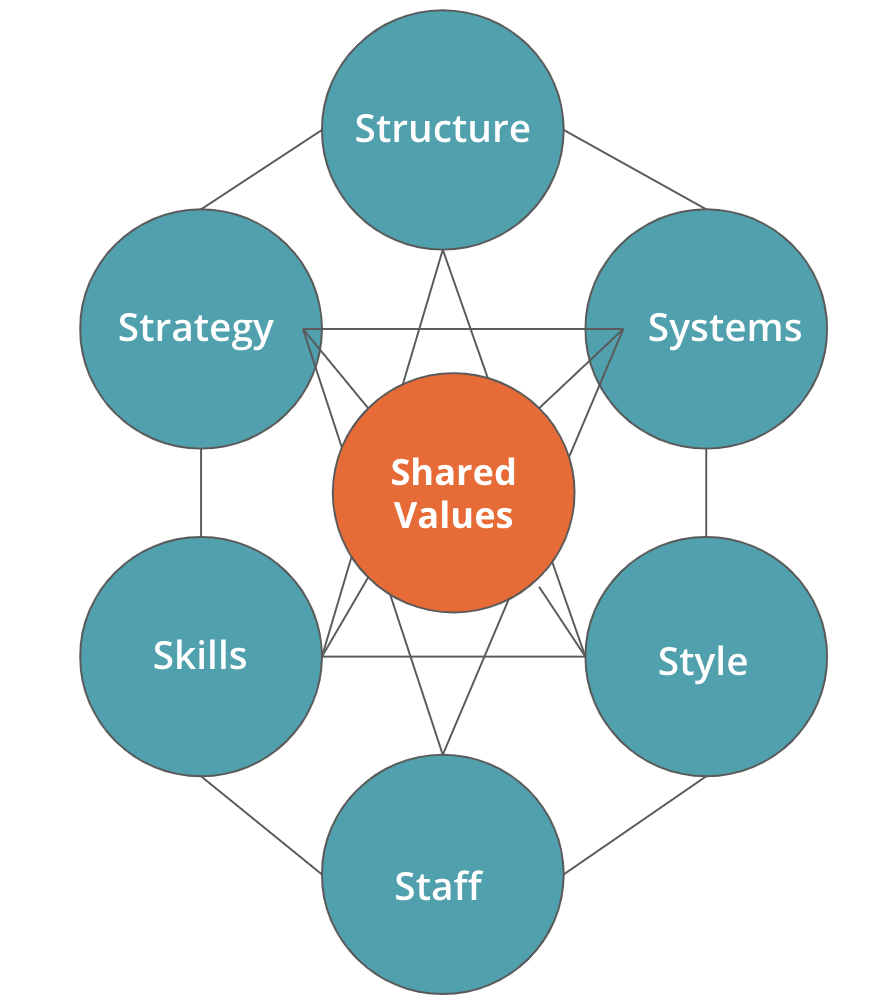

A technique that examines a business's "organisational design" is called the McKinsey 7S Model (Alwan, and Al-Zu‟bi, 2016).” The model aims to illustrate how an organisation may attain effectiveness by utilising the interplay of seven essential components: employees, organisation, plan, ability, framework, common principles, and fashion. The McKinsey 7s Model focusses on the interdependence of the aspects classified by "Soft Ss" and "Hard Ss," suggesting that altering one component has a cascading impact on maintaining an effective balance. The critical way that changes in the founder's values affect every other component is reflected by placing "Shared Values" in the "centre." (Lundén, and Utberg, 2017).

The McKinsey 7S model can be used when organisational changes are being implemented that could affect a few of the common values (Phelan et al. 2013). Let's say that a business intends to combine. Since new employees will be joining the organisation, it will have an impact on how it is set up. The company's structure and strategic decision-making will also be impacted when fresh ideas enter through synergy (Sewandono, et al., 2025, Zaki, et al., 2025).

The structure, personnel, and strategy would be the main sources of inconsistency in this situation, which may be identified using the McKinsey 7s model (Roumieh, and Garg, 2014). The business may decide how best to reorganise and integrate the modifications in a way that expedites the merger process after determining the pertinent areas and carrying out a thorough investigation and analysis of the effects the changes will have on the business (Suwanda and Nugroho, 2022).

Figure 1: 7S Model

Source: (Suwanda and Nugroho, 2022).

Implication

The aforementioned McKinsey 7S Model may assist organisations such as Gt Bank in identifying performance gaps in their operations. This management model may be used by the organisation to determine the difference between their present performance and their desired future state. The model allows the company to create a roadmap for achieving its business plan. For instance, according to Fadun's (2014) research, GT Bank has centred its strategy on its brand image, and in the banking industry, its main rivals have not been able to overtake her. This implies that as a company works in a dynamic and unpredictable business environment, strategic management is advantageous to it. Therefore, the practical conclusion is that a firm's existence and relevance in the global economic environment depend on its ability to evaluate, formulate, and implement organisational objectives through effective strategic management.

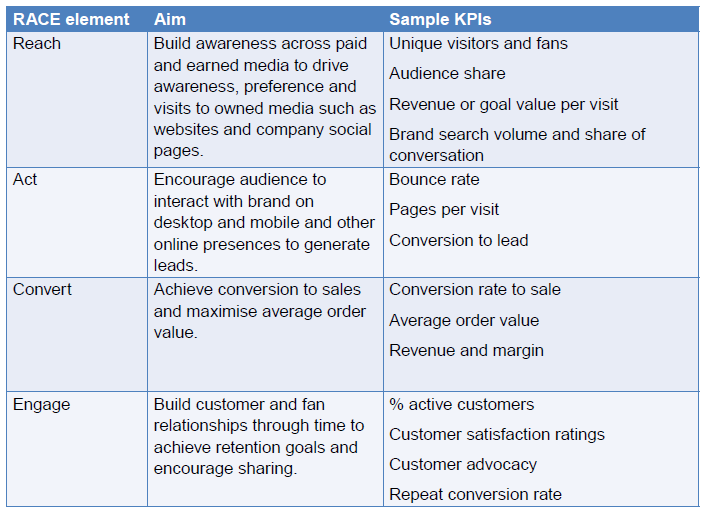

The RACE marketing planning model seeks to provide companies with a user-friendly framework for developing a digital or omnichannel marketing approach that tackles the challenges of engaging and connecting with online audiences to increase sales, whether they are made online or offline. Figure 1 below illustrates the RACE Framework's components in connection to its objectives and example KPIs (Hanlon and Chaffey, 2023).

Table 1: RACE Elements

Source: (Hanlon and Chaffey, 2023).

Digital marketing activities, or RACE, are a series of four stages that assist companies in communicating with customers at each step of the customer lifecycle. The plan also includes an initial phase that includes assigning resources for "digital transformation," creating a complete integrated digital strategy, setting targets, and providing governance (Chaffey, 2023).

Implication

Gt Bank and other companies may use the RACE Framework, a strategic approach to digital marketing, to efficiently plan and carry out their online marketing initiatives in order to achieve their objectives. For example, GT Bank uses eye-catching photos, imaginative graphics, and captivating films to draw in their target market. The business has established a devoted and passionate online following by continuously producing interesting material (Ambassify, 2024).

2.4 Relationship between Digital Marketing and Customer Satisfaction: Empirical Evidence

One of the earlier studies on digital marketing was conducted by Basnet (2023), which looked at how digital marketing affected organisational performance through a multiple case study of Pashmina companies in Apex, Dhaulagiri, Nepal. Investigating how digital marketing affects the Pashmina industry's organisational performance in Nepal, particularly with regard to revenue creation and customer happiness, is the main objective of this study. The researcher uses methods for both quantitative and descriptive analysis. Using a well-structured questionnaire, a random sample of Nepal's Pashmina businesses was surveyed for the study. The principal discovery reveals a noteworthy positive impact on the functioning of every Pashmina industry in Nepal. This implies that these industries' performance has benefited greatly from the use of digital marketing.

The performance of a few Port Harcourt banks and digital marketing were examined by Piabari et al. in 2022. The study's research design was a descriptive survey. In order to gather data, the study used a structured questionnaire instrument and a judgemental sampling technique, focussing on three money deposit institutions in Port Harcourt: First Bank Plc, Access Bank Plc, and First City Monument institutions. Ten respondents were chosen from each of the three banks, making the sample size thirty. The units of analysis are general managers, managers, internal control managers, and consumers. Statistical techniques for basic regression analysis and Pearson product moment correlation (PPMC) were used to analyse the data at the 0.05 percent significant level. The findings indicated a strong correlation between social media marketing, content marketing, and other strategies with the patronage of particular Port Harcourt banks.

Abdulrazak (2022) looked at the importance of digital marketing and how it affects small and medium-sized businesses' ability to compete in the marketplace. Five (5) SMEs were part in this study, which used a qualitative research technique. To assist gathering primary data, semi-structured interviews were used. Respondents gave as much information as they could, which was crucial to the study's execution. Additionally, secondary data and material pertinent to the study were obtained from websites, peer-reviewed publications, and articles. According to the study's findings, digital marketing is a novel and effective strategy for attracting, retaining, and expanding clientele.

Waed (2021) sought to investigate the effects of digital marketing strategies on the organisational performance of Jordanian mobile phone carriers. The researcher use both quantitative and descriptive analytic techniques. However, information about the influence of digital marketing strategies on organisational performance was gathered through a well-structured questionnaire that was applied to a random sample of telecom companies in Jordan. The questionnaire had 40 questions based on the systematic variation of the study variables and five sub-dimensions: performance of websites, mobile devices, social media, email, and organisation. In contrast, the sample size that was chosen includes 178 workers who are managers, team leaders, or supervisors in Jordanian telecom enterprises. Although the findings indicated that all kinds of digital marketing have a minor impact on the telecommunications company's performance, the survey sample thought that this influence was present, with a mean score of 3.652 (SD=0.7224). The primary finding was that, over the past five years, all of Jordan's telecom companies have shown significant improvement in performance, indicating that digital marketing has had a very good or exceptional influence on these businesses' operations. The most significant finding is that all types of digital marketing have been shown to improve the outcomes of digital marketing and have an impact on the telecom company's performance. Furthermore, it has been shown that the performance of the business is significantly impacted by more powerful tools; this implies that certain digital marketing tools are more effective than others.

According to Liam (2020), Liam, Hui, and Carsten, (2023) and James, (2020) online marketing helps SMEs in South Asia. According to the report, e-marketing draws in managers, investors, scholars, and potential investors. It effectively interacts with e-book, banking, and utility users. Company performance is improved by Facebook, Instagram, and Twitter, the research claims. SMEs in South Asia may benefit from digital marketing in terms of sales, competitiveness, and market access. Digital marketing self-esteem was higher among younger panellists, according to the study. South Asian SMEs have success thanks to digital marketing. Vusal (2020) demonstrated that digital branding may be used for cross-platform branding. This approach customises the user experience without sacrificing brand integrity. Reaching customers who research, communicate, and connect with companies online improves company identification, trust, and brand visibility. It promotes brand exposure, content consumption, leads, and consumers. Through social engagement, sharing, clicks, suggestions, and feedback, digital branding expands brand exposure and reach.

Mohammed and Ahmad (2020) looked at how effective digital marketing is for small and medium-sized businesses in the United Arab Emirates. Finding the empirical link between digital marketing and company performance among UAE SMEs is the aim of this research report. In order to identify the suggested framework, a research of SMEs' marketing and IT managers was undertaken. Measurement and structural equation modelling were used to examine the gathered data on SMART-PLS, which was founded on the findings of a research looking into the relationship between digital marketing and business success. One important component of company performance is seen to be the environment. Based on statistical analysis, the research concluded that while hypothesis H1 was accepted, H2 and H3 were rejected. In 2020, Omar examined the role that effective digital marketing plays in helping small and medium-sized businesses (SMEs) improve their company performance. This study employs a cross-sectional design and a quantitative methodology. The questionnaire form as a research instrument is based on the domains in the identified variables. 300 SME owners that operate enterprises in the Klang Valley and range in age from 18 to 55 make up the sample. Smart PLS and SPSS software were used to analyse the data. Based on the data, SME entrepreneurs' company performance is significantly correlated with their business purpose, product promotion, marketing benefits, and product reputation. The investigation using structural equation modelling revealed that the effectiveness of digital marketing has a major impact on company performance. This illustrates how the metrics that gauge digital marketing have a beneficial impact on company performance and aid in the construction of a more efficient system.

Nurul and Wahyuni (2020) also sought to determine how digital marketing affected the perceived quality and intellectual capital of micro, mid, and medium-sized businesses in East Java. The study employed a survey method for explanatory research, distributing questionnaires quantitatively and analysing the results using PLS. results. According to the findings, MSMEs have shortcomings in perceived quality, thus training pertaining especially to digital marketing—which incorporates perceived quality and intellectual capital—is required to enhance organisational performance. Among the unorganised sectors, MSME contributes to the survival and growth of the local economy. The research challenges align with the empirical investigations mentioned above. The discrepancy between this study and earlier literature is shown in the next section.

Asif (2017) shown that digital marketing is essential to the future of enterprises. It helps marketers target and market their company and offers more than just portal ads. Companies are aware that consumers desire digital interaction. Digital media provides advertisers with low-cost product branding and several touchpoints. It increases consumer engagement, brand recall, and customer retention. Research indicates that in order to research products and brands, consumers want online resources. Marketers may use this project report to get more knowledge about digital marketing and create successful strategies, as businesses must have a digital presence to thrive.

According to Basnet (2023) citing Arvind and Shanker's research, Indian mall culture and hypermarkets like Big Bazaar are driven by distinctive shopping experiences. Rich customers in India are looking for fresh products. Businesses should take consumer influencers into account and implement a comprehensive digital marketing plan since digital media has emerged as a significant competitor to traditional media. The potential of digital marketing is demonstrated by India's quick internet growth. In this evolving market, companies need to understand the lifestyles, attitudes, and technological impact of their customers and implement digital strategies to meet their expectations. Iman and Zakhaev (Basnet, 2023) shown that in the Indian hotel industry, social networking, email marketing, video, and search engines significantly impact customer awareness, patronage, and loyalty. According to the study, these electronic marketing techniques can increase customer interactions and influence consumer behaviour, which will improve patron purchases and the performance of Indian hotels. argues that consumer influencers should be a part of comprehensive digital marketing initiatives.

On the whole, in order to satisfy consumers' needs and benefit from digital marketing platforms, it is essential to comprehend client expectations, functionality, marketing tactics, and service delivery. India's internet explosion demonstrates the enormous possibilities of digital marketing. To thrive in this expanding sector, businesses need to comprehend the lifestyles, attitudes, and technological capabilities of their clientele. In the rapidly evolving digital market, digital strategies that satisfy customer expectations are crucial for survival and success.

2.5 Literature Gap

The majority of study conducted in the past ten years on digital marketing has focused mostly on the digitalisation revolution of digital marketing. Digital marketing has been the subject of several studies involving various areas of businesses, including Basnet (2023), Piabari et al. (2022), Abdulrazak (2022), Mohammed and Ahmad (2020), Omar (2020), and Nurul and Wahyuni (2020). A decade separated the major studies on digital marketing, with the exception of a few articles and papers that were investigated between the mid-2000s and the mid-2010s.

But in order to close the gap, this study uses ideas like the McKinsey 7S model and the RACE model to illustrate how digital marketing and consumer happiness are related. Additionally, this study examined more recent books and publications from 2017 to 2023 in order to comprehend the research gap. The majority of research published since 2023 has focused on how post-corona affects the difficulties and obstacles small and medium-sized businesses face when implementing digital marketing. More research has been done on digital marketing, particularly social media and brand recognition, but less on developing brand equity through digital channels other than social media (Ebrahim, 2020).

3.0 Data Analysis, Presentation And Interpretation

The results and conclusions are provided in this chapter in order to fulfil the goals of this investigation. Data analysis was done using the Statistical Package for Social Sciences (SPSS). The study's primary and sub-dimensions were identified using descriptive statistics like means and standard deviations, and at a significance level of α ≤ 0.05, inferential statistics were employed to ascertain whether the overall effect of digital marketing strategies on GT Bank's customer satisfaction varied statistically significantly.

3.1 Descriptive Statistics

A sample of one hundred workers from various GT Bank branches in Lagos State participated in an online survey to provide data. The characteristics of the sample are calculated in terms of frequency and percentages. According to the table below:

|

Table 1: Gender |

|

|||

|

|

Frequency |

Percent |

||

|

|

Male |

47 |

47.0 |

|

|

Female |

53 |

53.0 |

||

|

Total |

100 |

100.0 |

||

The above table shows that (47%) of the study sample members were male and the female percentage was (53%) indicating that GTB has gender diversity.

|

Table 2: Work Experience |

|

|||

|

|

Frequency |

Percent |

||

|

|

Below 4 years |

57 |

57.0 |

|

|

5 to 17 years |

27 |

27.0 |

||

|

Above 17 years |

16 |

16.0 |

||

|

Total |

100 |

100.0 |

||

Table 2 shows the differences in the staff’s working experience. As a result, 57% of the workers has below 4 years of experience, 27% has 5 to 17 years of experience, while 16% of them has above 17 years of experience. This implies that the company is more creative in its decision making on digital marketing strategy due to diverse working experience.

|

Table 3: The company’s social media platforms are easily accessible by the customers |

|||

|

|

Frequency |

Percent |

|

|

|

Strongly Agree |

37 |

37.0 |

|

Agree |

44 |

44.0 |

|

|

Neutral |

10 |

10.0 |

|

|

Strongly Disagree |

5 |

5.0 |

|

|

Disagree |

4 |

4.0 |

|

|

Total |

100 |

100.0 |

|

Table 3 shows that 37% strongly agreed with the assertion, 10% were neutral, 5% strongly disagreed, and 4% disagreed. However, majority of the respondents (44%) are of the view that the company’s social media platforms are easily accessible by the customers. This indicates a positive result for this study.

Table 4: Digital marketing makes it possible for businesses to communicate their message and provide customers with

important information.

|

|

Frequency |

Percent |

|

|

|

Strongly Agree |

55 |

55.0 |

|

Agree |

40 |

40.0 |

|

|

Neutral |

4 |

4.0 |

|

|

Disagree |

1 |

1.0 |

|

|

Total |

100 |

100.0 |

|

Table 4 shows that 40% agreed with the assertion, 4% were neutral, and 1% disagreed. However, majority of the respondents (55%) are of the view that digital marketing makes it possible for businesses to communicate their message and provide customers with important information. This indicates a positive result for this study.

|

Table 5: By increasing brand awareness, building a solid online presence, and delivering consistent brand messaging, digital marketing influences customer loyalty and trust in a good way |

|||

|

|

Frequency |

Percent |

|

|

|

Strongly Agree |

46 |

46.0 |

|

Agree |

43 |

43.0 |

|

|

Neutral |

8 |

8.0 |

|

|

Strongly Disagree |

1 |

1.0 |

|

|

Disagree |

2 |

2.0 |

|

|

Total |

100 |

100.0 |

|

Table 5 shows that 43% agreed with the assertion, 8% were neutral, and 1% strongly disagreed and 2% disagreed. However, majority of the respondents (46%) are of the view that by increasing brand awareness, building a solid online presence, and delivering consistent brand messaging, digital marketing influences customer loyalty and trust in a good way. This indicates a positive result for this study.

|

Table 6: Instant feedback and real-time communication are made possible by digital marketing |

|||

|

|

Frequency |

Percent |

|

|

|

Strongly Agree |

52 |

52.0 |

|

Agree |

35 |

35.0 |

|

|

Neutral |

11 |

11.0 |

|

|

Strongly Disagree |

2 |

2.0 |

|

|

Total |

100 |

100.0 |

|

Table 6 shows that 35% agreed with the assertion, 11% were neutral, and and 2% strongly disagreed. However, majority of the respondents (52%) are of the view that instant feedback and real-time communication are made possible by digital marketing. This indicates a positive result for this study.

|

Table 7: Social media platforms allow the business to interact directly with its clients, responding to their queries, concerns, and offering tailored assistance |

|||

|

|

Frequency |

Percent |

|

|

|

Strongly Agree |

47 |

47.0 |

|

Agree |

41 |

41.0 |

|

|

Neutral |

8 |

8.0 |

|

|

Strongly Disagree |

1 |

1.0 |

|

|

Disagree |

3 |

3.0 |

|

|

Total |

100 |

100.0 |

|

Table 7 shows that 41% agreed with the assertion, 8% were neutral, and 1% strongly disagreed and 3% disagreed. However, majority of the respondents (47%) are of the view that social media platforms allow the business to interact directly with its clients, responding to their queries, concerns, and offering tailored assistance. This indicates a positive result for this study.

|

Table 8: The business may give its consumers what they want and consider their thoughts via |

|

|||

|

|

Frequency |

Percent |

||

|

|

Strongly Agree |

50 |

50.0 |

|

|

Agree |

36 |

36.0 |

||

|

Neutral |

13 |

13.0 |

||

|

Disagree |

1 |

1.0 |

||

|

Total |

100 |

100.0 |

||

Table 8 shows that 36% agreed with the assertion, 13% were neutral, and 1% disagreed. However, majority of the respondents (50%) are of the view that the business may give its consumers what they want and consider their thoughts via email marketing, which can increase client loyalty. This indicates a positive result for this study.

|

Table 9: A successful email marketing plan is essential for increasing engagement |

|||

|

|

Frequency |

Percent |

|

|

|

Strongly Agree |

45 |

45.0 |

|

Agree |

45 |

45.0 |

|

|

Neutral |

9 |

9.0 |

|

|

Disagree |

1 |

1.0 |

|

|

Total |

100 |

100.0 |

|

Table 9 shows that 13% were neutral with the assertion, and 1% disagreed. However, majority of the respondents (90%) are of the view that a successful email marketing plan is essential for increasing engagement and creating enduring client connections. This indicates a positive result for this study.

|

Table 10: By making email marketing more relevant, convenient, and valuable, |

|||

|

|

Frequency |

Percent |

|

|

|

Strongly Agree |

44 |

44.0 |

|

Agree |

44 |

44.0 |

|

|

Neutral |

10 |

10.0 |

|

|

Disagree |

2 |

2.0 |

|

|

Total |

100 |

100.0 |

|

Table 10 shows that 10% were neutral with the assertion, and 2% disagreed. However, majority of the respondents (88%) are of the view that by making email marketing more relevant, convenient, and valuable, the company may enhance brand loyalty and open and click-through rates. This indicates a positive result for this study.

|

Table 11: Email marketing increases engagement with customers |

||||

|

|

Frequency |

Percent |

|

|

|

|

Strongly Agree |

38 |

38.0 |

|

|

Agree |

49 |

49.0 |

|

|

|

Neutral |

10 |

10.0 |

|

|

|

Disagree |

3 |

3.0 |

|

|

|

Total |

100 |

100.0 |

|

|

Table 11 shows that 38% strongly agreed with the statement, 10% were neutral, and 3% disagreed. However, majority of the respondents (49%) are of the view that email marketing increases engagement with customers. This indicates a positive result for this study.

|

Table 12: Marketing goods and services online can lead to customer satisfaction |

|||

|

|

Frequency |

Percent |

|

|

|

Strongly Agree |

34 |

34.0 |

|

Agree |

48 |

48.0 |

|

|

Neutral |

14 |

14.0 |

|

|

Strongly Disagree |

1 |

1.0 |

|

|

Disagree |

3 |

3.0 |

|

|

Total |

100 |

100.0 |

|

Table 12 shows that 34% strongly agreed with the assertion, 14% were neutral, 1% strongly disagreed and 3% disagreed. However, majority of the respondents (48%) are of the view that marketing goods and services online can lead to customer satisfaction. This indicates a positive result for this study.

4.4 Test of Hypotheses and Discussion of Findings

The goal of this study is to critically and comprehensively address the research topic by testing one hypothesis. The data will be analysed using a multiple regression analysis to determine whether the hypothesis should be accepted or rejected. Because it is the most widely used statistical method for linking a collection of two or more variables, regression analysis was selected (Kaya and Guler, 2013). Email and social media marketing will be used to gauge the effectiveness of digital marketing in relation to consumer happiness.

HO1- There is no significant impact of digital marketing on customer satisfaction at GT Bank.

H1- There is significant impact of digital marketing on customer satisfaction at GT Bank.

|

Table 13: Correlation between digital marketing and customer satisfaction |

||||

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

|

1 |

.900a |

.810 |

.806 |

.449 |

|

a. Predictors: (Constant), Digital marketing |

||||

The type of association between customer happiness and digital marketing is displayed in Table 13. Using p = 0.000, the Pearson correlation (r) was 0.900 and significant at the 5% level. Consequently, it is clear that customer happiness at GT Bank and digital marketing are positively correlated. Therefore, the degree of association suggests that the variables have a very significant link with one another.

|

Table 14: Impact of Digital Marketing on Customer Satisfaction |

||||||

|

Model |

Sum of Squares |

df |

Mean Square |

F |

Sig. |

|

|

1 |

Regression |

83.201 |

2 |

41.600 |

206.412 |

.000b |

|

Residual |

19.549 |

97 |

.202 |

|

|

|

|

Total |

102.750 |

99 |

|

|

|

|

|

a. Dependent Variable: Customer satisfaction |

||||||

|

b. Predictors: (Constant), social media and email marketing. |

||||||

Customer satisfaction was positively and significantly impacted by digital marketing channels, including email marketing and social media, as Table 14 demonstrates. With an F-value of 206.412 and a significance level of 5%, the model is both completely accurate and moderately well fitted.

|

Table 15: Correlation between social media marketing, email marketing and customer satisfaction |

||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

||

|

B |

Std. Error |

Beta |

||||

|

1 |

(Constant) |

.013 |

.129 |

|

.098 |

.922 |

|

Social media marketing |

.115 |

.069 |

.076 |

1.660 |

.100 |

|

|

Email marketing |

.948 |

.050 |

.877 |

19.131 |

.000 |

|

|

a. Dependent Variable: Customer satisfaction |

||||||

The findings indicate a linear association between the independent variables (email marketing and social media) and the dependent variable (consumer happiness). Customer satisfaction will thus be 0.013 if all independent variables (social media and email marketing) are set to zero. It is clear from the R-squared result (0.810) that the independent variables only account for 81.0% of the variable variance. Digital marketing platforms have a big and beneficial influence on client happiness, it will be found.

The correlation between GT Bank's customer happiness and digital marketing is seen in tables 13, 14, and 15. The outcome reveals a 90.0 percent correlation coefficient and a significant value of 0.000 below the 0.05 threshold. This leads to the acceptance of the alternative hypothesis and the rejection of the null hypothesis. This suggests that GT Bank's customer happiness and digital marketing—including social media and email marketing—have a substantial link. According to Ayuba and Aliyu (2015), electronic marketing has greatly benefited Nigerian consumers' banking services, especially in the areas of increased customer loyalty and efficient service provision. It is also possible to draw the conclusion that, out of all the independent variables examined, ATMs have the most impact on consumer spending, followed by mobile phones and social media. The degree of confidence for this claim is 99%.

Furthermore, the findings of this investigation are consistent with those of Basnet (2023). One of the earlier studies on digital marketing was conducted by Basnet (2023), which looked at how digital marketing affected organisational performance through a multiple case study of Pashmina companies in Apex, Dhaulagiri, Nepal. Investigating how digital marketing affects the Pashmina industry's organisational performance in Nepal, particularly with regard to revenue creation and customer happiness, is the main objective of this study. The researcher uses methods for both quantitative and descriptive analysis. Using a well-structured questionnaire, a random sample of Nepal's Pashmina businesses was surveyed for the study. The principal discovery reveals a noteworthy positive impact on the functioning of every Pashmina industry in Nepal. This implies that these industries' performance has benefited greatly from the use of digital marketing.

The performance of a few Port Harcourt banks and digital marketing were examined by Piabari et al. in 2022. The study's research design was a descriptive survey. In order to gather data, the study used a structured questionnaire instrument and a judgmental sampling technique, focusing on three money deposit institutions in Port Harcourt: First Bank Plc, Access Bank Plc, and First City Monument institutions. Ten respondents were chosen from each of the three banks, making the sample size thirty. The units of analysis are general managers, managers, internal control managers, and consumers. Statistical techniques for basic regression analysis and Pearson product moment correlation (PPMC) were used to analyse the data at the 0.05 percent significant level. The findings indicated a strong correlation between social media marketing, content marketing, and other strategies with the patronage of particular Port Harcourt banks.

Abdulrazak (2022) looked at the importance of digital marketing and how it affects small and medium-sized businesses' ability to compete in the marketplace. Five (5) SMEs were part in this study, which used a qualitative research technique. To assist gather primary data, semi-structured interviews were used. Respondents gave as much information as they could, which was crucial to the study's execution. Additionally, secondary data and material pertinent to the study were obtained from websites, peer-reviewed publications, and articles. According to the study's findings, digital marketing is a novel and effective strategy for attracting, retaining, and expanding clientele.

Waed (2021) sought to investigate the effects of digital marketing strategies on the organisational performance of Jordanian mobile phone carriers. The researcher use both quantitative and descriptive analytic techniques. However, information about the influence of digital marketing strategies on organisational performance was gathered through a well-structured questionnaire that was applied to a random sample of telecom companies in Jordan. The questionnaire had 40 questions based on the systematic variation of the study variables and five sub-dimensions: performance of websites, mobile devices, social media, email, and organisations. In contrast, the sample size that was chosen includes 178 workers who are managers, team leaders, or supervisors in Jordanian telecom enterprises. Although the findings indicated that all kinds of digital marketing have a minor impact on the telecommunications company's performance, the survey sample thought that this influence was present, with a mean score of 3.652 (SD=0.7224). The primary finding was that, over the past five years, all of Jordan's telecom companies have shown significant improvement in performance, indicating that digital marketing has had a very good or exceptional influence on these businesses' operations. The most significant finding is that all types of digital marketing have been shown to improve the outcomes of digital marketing and have an impact on the telecom company's performance. Furthermore, it has been shown that the performance of the business is significantly impacted by more powerful tools; this implies that certain digital marketing tools are more effective than others.

Mohammed and Ahmad (2020) looked at how effective digital marketing is for small and medium-sized businesses in the United Arab Emirates. Finding the empirical link between digital marketing and company performance among UAE SMEs is the aim of this research report. In order to identify the suggested framework, a research of SMEs' marketing and IT managers was undertaken. Measurement and structural equation modelling were used to examine the gathered data on SMART-PLS, which was founded on the findings of a research looking into the relationship between digital marketing and business success. One important component of company performance is seen to be the environment. Based on statistical analysis, the research concluded that while hypothesis H1 was accepted, H2 and H3 were rejected.

In 2020, Omar examined the role that effective digital marketing plays in helping small and medium-sized businesses (SMEs) improve their company performance. This study employs a cross-sectional design and a quantitative methodology. The questionnaire form as a research instrument is based on the domains in the identified variables. 300 SME owners that operate enterprises in the Klang Valley and range in age from 18 to 55 make up the sample. Smart PLS and SPSS software were used to analyse the data. Based on the data, SME entrepreneurs' company performance is significantly correlated with their business purpose, product promotion, marketing benefits, and product reputation. The investigation using structural equation modelling revealed that the effectiveness of digital marketing has a major impact on company performance. This illustrates how the metrics that gauge digital marketing have a beneficial impact on company performance and aid in the construction of a more efficient system.

Findings, Conclusion And Recommendation

The goal of the current study is to investigate how GT Bank in Lagos, Nigeria's customer satisfaction is affected by digital marketing. Four goals were specified in order to accomplish the primary goal of the study including to look at how GT Bank's customers are satisfied with digital marketing; to research different types of digital marketing strategies; to evaluate the difficulties in implementing digital marketing; and to recommend more digital marketing methods to GT Bank. An online survey was created with Google Form and sent to GT Bank staff members in Lagos State. Multiple regression analysis of the data demonstrates that digital marketing has a significant influence on GT Bank customers' happiness.

According to the study's conclusions, GT Bank has to create a thorough digital marketing plan in order to get the most out of digital marketing. According to the results, email marketing and social media are the most often used components of digital marketing strategy. Therefore, The study's conclusions confirm that GT Bank customers' happiness is impacted by digital marketing in all of its forms. The results are important because they imply that different types of digital marketing (such as email and social media marketing) have an effect on the company's customers' level of satisfaction and that digital marketing is fundamental to achieving goals in the field of digital marketing.

Additionally, the current study reviewed earlier studies on digital marketing and how it affects Nigerian banks' performance in all of its forms. The results showed that Nigerian banks' performance is impacted by the features of digital marketing partnership in all of its manifestations.

Conclusion

Research Question 1: What impact does digital marketing have on customer satisfaction at GT Bank?

The results indicate that one important strategy that GT Bank and other organisations may use to increase customer satisfaction is digital marketing. Despite the obstacles banks encounter in implementing digital marketing, banking services have far surpassed the human interaction in physical locations. Nigerian banks' service performance has significantly improved after the introduction of digital marketing. The growth of online banking, automated teller machines (ATMs), and mobile applications on phones for conducting banking operations such as money transfers, bill payments, balance checks, etc., all highlight this.

5.4 Recommendations: In light of the aforesaid findings, the following actions are advised:

Limitations and future research work

A study's limits are its flaws or constraints that may compromise the reliability, applicability, or thoroughness of the results. The research's shortcomings are delineated by these constraints, which also point out elements that might compromise the precision or relevance of the findings.

Restricted scope: The main goal of this study is to investigate how digital marketing affects organisational results, particularly employee happiness. Other important aspects of organisational performance, such employee satisfaction, company reputation, or market domination, could not be taken into account due to the narrow focus. Therefore, the findings might not provide a comprehensive understanding of the entire impact of digital marketing.

Specificity: The study's results are restricted to GT Bank, a single commercial bank. Finding GTB's unique traits, market dynamics, and customer behaviors that might set it apart from other businesses is the main goal of this study. The similar analysis should thus have been carried out on other institutions in the banking sector. The study's findings would have been more robust as a result.

Absence of qualitative analysis: The study's goals do not incorporate qualitative analysis methods, including thematic analysis, which might raise the validity of the findings. Regression analysis alone may limit how thorough the insights are and how well they may be used to draw meaningful conclusions.

Suggestions are recommendations made to help someone make decisions or take certain actions. The purpose of suggestions is to offer succinct, practical advice to assist people or organizations in making wise decisions or achieving their goals.

Demonstrate email marketing's positive effects on client happiness and income creation to demonstrate how effective it is as a promotional tool. With the use of targeted segmentation, automation, and personalized content, this study seeks to investigate successful strategies and suggested tactics for carrying out email marketing campaigns.

Despite its mediocre reviews, look into the possibilities of social media marketing since it is important to understand its positive impact on organisational results. In order to improve consumer engagement, this article offers recommendations for social media platform optimization. These include tactics like using graphic material, forming influencer relationships, and actively interacting with customers.

Promote internet marketing as a very successful means of product or service promotion. Examining how well online marketing works to increase customer happiness is the goal of this article. The study will examine how website marketing significantly affects customer happiness and emphasize how well customers respond to it. To maximize the influence of website marketing on organisational performance, it is essential to stress the importance of user-friendly website design, intuitive navigation, educational content, and optimized conversion funnels.