International Journal of Business Research and Management

OPEN ACCESS | Volume 3 - Issue 2 - 2025

ISSN No: 3065-6753 | Journal DOI: 10.61148/3065-6753/IJBRM

Saurav Kumar

Senior Faculty, Corporate Secretaryship Department, K.B Womens College, Hazaribag, Jharkhand, India.

Corresponding author: Saurav Kumar, Senior Faculty, Corporate Secretaryship Department, K.B Womens College, Hazaribag, Jharkhand, India.

Received: July 29, 2024

Accepted: November 29, 2024

Published: January 03, 2025

Citation: Saurav Kumar, (2025) “A look Inside the shopping bags of the New Indian consumers: Where is the future Indian consumer headed?”. International Journal of Business Research and Management 2(2); DOI: 10.61148/IJBRM/07.1017

Copyright: © 2025 Saurav Kumar, this is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

As the global economy is gradually transitioning from the respond phase to the recovery phase, India is also looking at riding on the festive wave and positive consumer sentiments to return to normalcy. Between the complete lockdown, the relaxed stay at home orders, and the gradual unlocking of the economy, quite a few things have changed in the consumer industry landscape and economic activity has picked up. Although economies across the world are in various stages of re-opening, workplaces and factory floors in India have again started bustling with increasing levels of activity. However, the normal acts of visiting a store, eating out, staying in a hotel, or taking a flight have become a cause of concern for people across different age groups. Consumers are likely to spend with caution and save more to prepare for worse times. On the other hand, businesses will likely be averse to investing in capital-intensive projects and have curtailed hiring due to economic uncertainties. The journey to resume normalcy seen before COVID-19 hit the economy will be fraught with challenges related to personal and financial well-being. The interplay between personal safety and consumer sentiment is affecting consumers’ spending behaviour. The spend on internet and mobile has also reduced as people are now returning to their workplaces and may not use internet connection as frequently as they did during the lockdown at home. The paper aims to grasp the conceptual framework regarding diversion in consumer buying behaviour and modern retailing in India.

Introduction

Dobre, Dragomır and Preda (2009) fragmented buyer creativity for showcasing advancement. Different studies have demonstrated that crosswise over item classes, trailblazers tend to be: feeling pioneers, hazard takers, more at risk of acquire data from broad communications than through verbal, receptive new plans and alter, moderately youthful then on. Advertisers have to distinguish the section of the market that's destined to embrace another item when it's the initially presented.

Oghojafor and Nwagwu (2013) analyzed the impact of socioeconomic variables on store choice for grocery products. The study was conducted in context to Lagos state of Nigeria. This study implemented a descriptive and cross-sectional research design. Convenience sampling technique was accustomed select 275 female respondents. Questionnaire was used because the study instrument. The collected data were analyzed through the applying of statistical techniques like Pearson moment coefficient of correlation and therefore the Chi-square. The study concludes that the selection of retail outlet for groceries by Nigerian women isn't influenced by their socioeconomic variables like income, the extent of education, form of employment, legal status and family size.

Vij, P. (2013) made a study to analyse the behaviour of consumer in buying the products from unorganized and arranged retail stores. Again, the aim of the study was to search out out the satisfaction level of consumer both in organized and unorganized retail stores. This study implemented qualitative methodology for collecting primary data. The study identified some significant findings. The primary finding is that unorganized retailers are affected in terms of business and profit.

Kumar and Purkayastha (2013) examined a study on retail loyalty schemes influencing consumers buying behaviour. Loyalty cards or membership cards are one amongst the foremost popular tools of consumer loyalty programs. As marketers grapple with ways to multiply their customer base and stop customer defection, they have a tendency to indicate increasing affinity towards the reward programs to retain and reinforce their loyal customers. This is often more visible within the retail sector, where the issuance of membership cards to the consumers has become a standard feature.

Kalaiselvan (2013) highlighted the importance of commercial for creating a call on purchasing. The study location was U.S. during this respect, the responsible factors for pushing sales growth were in terms of certain offers, contribution of publicity, public relation, etc.

Mathur et al. (2013) Examined the variables between conventional and modern retail format. The study was disbursed in Udaipur and Kota to spot the factor that impacts the buyer buying behaviour in conventional store and modern retail mall. The findings illustrated that there's major impact on consumer buying behaviour in both conventional store and modern retail format. Moreover, the study also portrays that family is that the major influence in India, where joint family is taken into account as significant societal feature.

The consumer landscape shifted noticeably in India in 2023 as inflation, agricultural distress, downtrading, aspirational buying and premiumisation defined the consumption patterns. Urban markets have been the drivers of growth with modern trade and ecommerce leading the way as consumers at the lower end hesitated to spend while the affluent splurged on premium goods. Yet, green shoots of recovery were seen too amid hopes of a revival in overall consumption in 2024. The Indian consumer market has higher disposable income the development of modern urban lifestyles. Increase in consumer awareness has affected buyer’s behavior in cities, towns and even rural areas. According to a 2010 report by McKinsey & Co., India is set to grow into the fifth largest consumer market in the world by 2025. Rising incomes in the hands of a young population, a growing economy, expansion in the availability of products and services and easy availability of credit all has given rise to new consumer segments and a rising acceptability of debt, whether it is mobile phones, credit cards, apparel or organized retail, people clearly seem to be spending more, particularly on discretionary items. The credit facility from business houses has been increasing at a rapid rate. This shows the terrific cut-throat competition in the ever changing market. In any business concern, changing consumer behaviour may be a big challenge in sustainable growth of the business. In developing country like India, there's have to formulate and successfully implement strategies associated with consumer behaviour because there are fewer resources to fulfill the essential requirements of the business. Changing consumer behaviour is a complication within the growth of business because it ends up in heavy losses because of old-fashioned stock of the organization. Consumer behaviour is complex and really often not considered rational. An extra challenge is that consumer personalities differ across borders and also between and within regions. As small towns rise on India's consumption map, companies can expect more consumers shopping online especially for premium products since the hinterland has been underserved by traditional retail in categories such as apparel, electronics and jewellery. At the end of 2023, even as offline retail operated at full strength, more than 50% of total festive sales came through online platforms against 45% in 2022, consulting firm Grant Thornton Bharat estimated. Sales growth for online retailers has been prolific in the last decade. The e-commerce industry in India is expected to grow to 200bn $ (US) by 2026 from 39bn US$ in 2017 at a staggering annual growth rate of 51%, the highest ever witnessed on Earth (India Brand Equity Foundation (IBEF), 2018; Nigam et al., 2020). In terms of Internet users, India has about 493 million active users, about 45% of the total population. This number is expected to grow at rapid speed owing to the widespread penetration of cheap Chinese smartphones and rising household incomes (Priya et al., 2018; Kantar IMRB, 2019). The paper aims to grasp the conceptual framework regarding diversion in consumer buying behaviour and modern retailing in India.

Less anxiousness amongst consumers

The entire world is undergoing a collectively anxious phase. One piece of good news for India is that its anxiety levels have decreased in wave 12 (31 percent), compared with wave 1 (41 percent). However, anxiety levels have gone up from wave 11 (27 percent). This may be due to an increase in COVID-19 cases as factories, shops, offices, and markets have reopened, and movement and people contact have increased. Anxiety parameters comprising health and safety concerns, and financial and employment apprehensions vary for consumers at the different age groups covered in the survey. People across age groups continue to have high health and safety concerns. These concerns indicate how safe people feel while buying groceries from a near-by store, dropping kids to school, and watching a movie in a theatre on a weekend, which were part of their routine life until recently. However, concerns around visiting a store and engaging in person-to-person service have eased for the 18-34 and 35-54 age groups. Safety perception in terms of eating out and attending in-person events has improved in these groups. On an interesting note, in the 55+ age group, the number of people who feel safe staying in a hotel and taking a flight has almost doubled in wave 12 (65 percent and 68 percent, respectively), compared with wave 1 (35 percent and 35 percent, respectively). At the start of the pandemic, people were less willing to travel due to high health, financial, and employment safety concerns. About two-thirds (close to 66 percent) of the people in this age group also feel safe going to restaurants, attending in-person events, and engaging in person to person services. The percentage of people who feel safe visiting a store in wave 12 is the highest in this age group (74 percent: age 55+, 58 percent: age 35-54; and 52 percent: age 18-34).

Easing financial and employment concerns

People expect fewer job cuts in wave 12 (58 percent) compared with wave 5 (78 percent) on account of lower anxiousness amongst Indian consumers because of positive attitude and sentiments sparked by festivities. However, financial concerns continued to weigh high on minds of those aged more than 55 as the fear of losing job is maximum in this age group. This fear stems from the fact that these people are nearing their retirement age, and mostly holding high paying profiles; they could be relieved early from their services. More than 50 percent people continue to tighten their purse strings and are deferring any big purchase decisions. The pandemic-induced uncertainty is leading people to delay their decisions to purchase big cars, gold and diamond jewellery, and luxury brands, as well as invest in real estate. Financial safety concerns, along with restrictions on large public gatherings and enforcement of social distancing norms, have started a trend of minimalist weddings as people are saying no to extravagant and lavish weddings. People’s financial concerns are directly correlated with their employment concerns, as more than half the people surveyed suspect that this worldwide pandemic will cost them their jobs and eventually jeopardise their financial situation. However, fewer people (31 percent in 18-34 age group, 22 percent in 35-54 age group, and only 9 percent in 55+ age group) are concerned about returning to their workplaces. These numbers reveal an interesting trend that people in the higher age group are keen on returning to their workplaces as they have a low job safety perception. Employment safety perception also influences consumers’ decision to make upcoming payments. On one hand, 40 percent people in the 18-34 age group are skeptical about making advance payments as most of these are either at the entry or middle level of their career and not optimistic about their future job prospects. On the other hand, 64 percent people at the end of the spectrum (older and retired consumers) are not willing to spend much on discretionary items to prepare themselves for worse times given the uncertainty caused by the pandemic.

Improvement in net spending intent

The pandemic has not only taken over the world economy by surprise but has also altered spending and shopping behaviour and plans of consumers for both discretionary and non-discretionary items. Economies across the world are at different stages of recovery and reopening, and have varying spending intent. However, India, along with the US and China, reported positive spending intent as the country has approached the festive/holiday season. The following figure confirms that household goods and groceries still account for a major part of the consumer spending plans in wave 12.

People are still prioritising purchase of household goods and groceries. Expenses on medicines and health care have gone down, implying less anxiousness amongst people from what was observed in wave 5 and 1. However, in wave 12, across all age groups, spends on essentials (53 percent) and groceries (50 percent) is expected to decrease from wave 1 (55 percent and 56 percent, respectively) as people are no longer indulging in panic buying and stocking up. The spend on internet and mobile has also reduced as people are now returning to their workplaces and may not use internet connection as frequently as they did during the lockdown at home. For more discretionary items, such as clothes and footwear, and electronics, net spending intent has improved in wave 12 as people have joined in the festivities of Durga Puja, Diwali, and the upcoming wedding season. It is interesting to note that spending plans for these items were quite dismal in wave 11 (9 percent for clothes and footwear, and 11 percent for electronics). Now more people are queuing up in stores to buy clothes and footwear. One noteworthy observation is that in the 55+ age group, spending intent that was negative for some discretionary items, such as furnishing (-25 percent), restaurant/takeout (-34 percent), electronics (-20 percent), and travel (-30 percent), in wave 1, has now turned positive in wave 12 (34 percent, 20 percent, 31 percent, and 23 percent, respectively). This could be attributed to the higher anxiety level at the start of the pandemic − the elderly people were bracing themselves for the worst. Overall, the purchase intention has increased across both the discretionary and non-discretionary categories as well as the online and offline channels.

E-commerce to transform the consumer market landscape

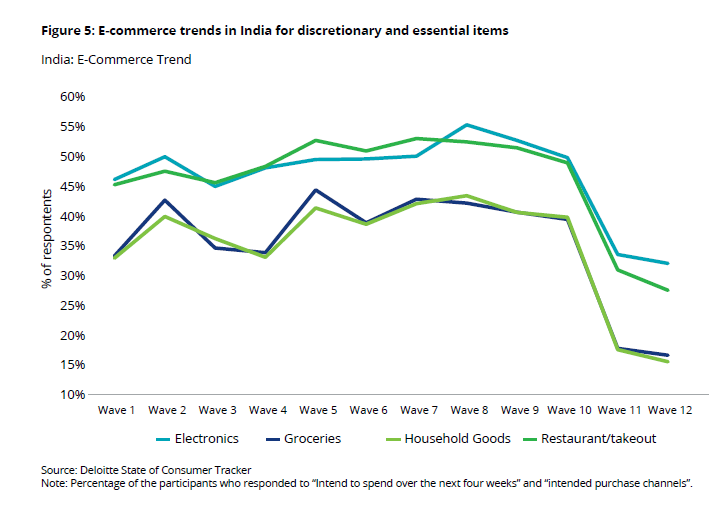

In the retail segment, there is a visible transition towards the e-commerce and digital platforms, and contactless retail formats, such as buy-online-pickup- in-store (BOPIS). E-commerce is picking up as consumers prefer touchless transactions and are averse to using point-of-sale terminals to avoid risk of catching infection. Since the onset of the pandemic, some retailers have started offering the BOPIS option. The trend of BOPIS is consistently increasing as this option offers a win-win proposition for both consumers and retailers. Customers can get better deals and find it convenient as they may return the item on the spot if needed. After the COVID-19 crisis, a furniture retail company and a hypermarket chain have started offering BOPIS service as it leads to decreased delivery cost and time, and fewer complaints (related to returning or replacing an item). When consumers visit stores to pick-up their goods, some may be tempted to look around and fill their cart with things they did not originally intend to buy. The factors fueling this transition include health and safety concerns, convenience, increased tech-savviness amongst people across age groups, especially the 55+ age group. In this age group, the number of stockpilers has increased by 20 percent to reach 75 percent in wave 12, compared with 55 percent in wave 1. The same age group prefers giving more weightage to locally sourced items even if they cost more (80 percent in wave 12 and 69 percent in wave 1). Bargain hunters have also increased from 72 percent in wave 12, compared with 41 percent in wave 1, as more elderly people have started exploring internet for shopping. Interestingly, this category has seen a deceleration in the other two age groups that are considered more tech-savvy. In wave 12, only 49 percent bargain hunters (65 percent in wave 1) exist in the 18-34 age group, indicating that people are not increasing their spend on non-discretionary items. After unlock 5.0 and due to the festive season, the number of active cases is increasing. This is leading to a rise in online purchases. One thing is common across age groups − preference to spend more on items of convenience and opting brands that have responded well to the crisis. E-commerce trends in India were promising in the first six months, i.e., wave 1−8 (since the onset of the pandemic), but online sales for discretionary and essential items dipped in waves 11 and 12. It is noteworthy to mention that the last two waves coincide with unlock process and festive/holiday season during which people visited stores for festive purchases in India.

Road ahead for the travel and hospitality industry

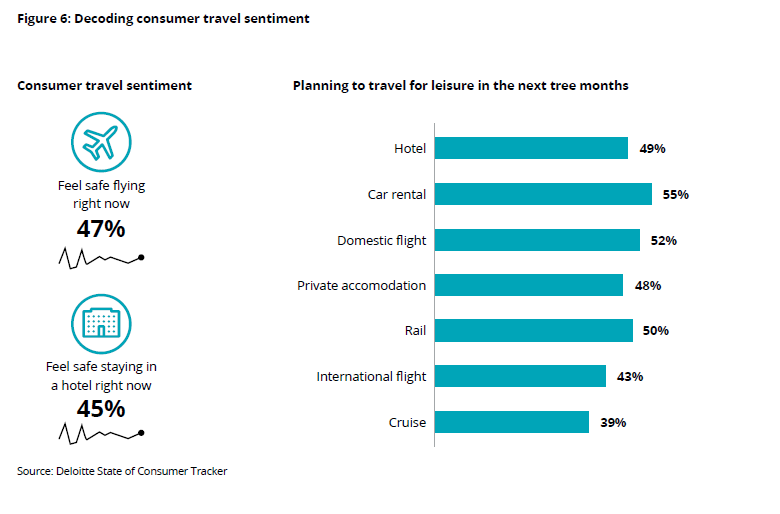

The global pandemic has set the travel and hospitality industry on a journey to reach the “next normal”. And, how soon the industry will reach that level by redirecting its strategies and re-channelising its efforts and resources cannot be predicted. When it comes to travelling, the safety perception still looks bleak. A majority of the people are still not comfortable travelling for leisure. They have put their travel plans to international destinations in the backburner. They are preferring staycations, and scouting for nearby places or weekend gateways to get a break from their regular schedules. Pre-wedding shoots and post-wedding travels (honeymoon, etc.) may also be restricted to domestic destinations (green zones) or those international destinations where the epidemic curve has almost flattened or is rapidly flattening. In the 18-34 age group, 41 percent people feel safe flying right now and 38 percent are comfortable staying in a hotel. In the 35-54 age group, less than 45 percent feel safe taking a flight or staying in a hotel. Surprisingly in the 55+ age group, more than 65 percent people feel safe flying or staying in a hotel because of lower anxiety levels compared with wave 1.

Demand for leisure travel may pick up in time for the festival/wedding/holiday season. Hotel demand remains constant while demand for other travel-related services sees sharper increases.

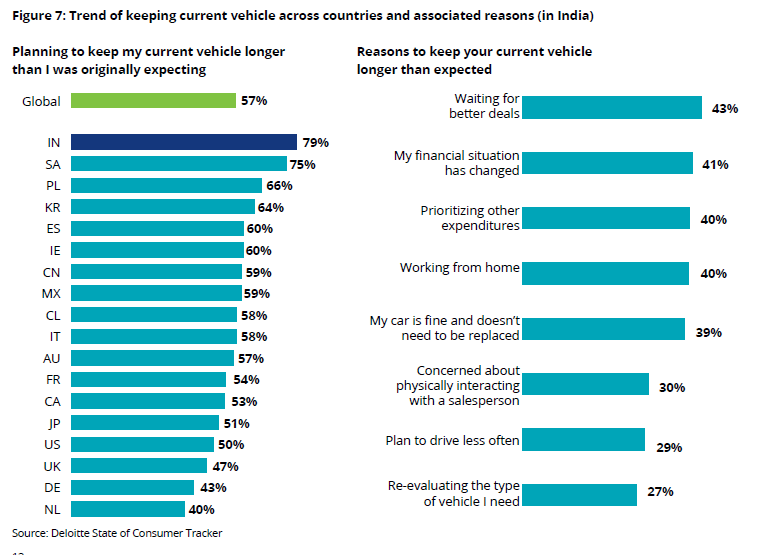

Mobility of the automobile sector

Six in 10 people are putting off regular maintenance for their vehicles. But in the 55+ age group, 8 in 10 people are redeploying budgets they have earlier kept aside for vehicle maintenance due to high financial and employment concerns. More than 75 percent people across age groups plan to keep their vehicles longer than they were originally expecting.

A heavily disrupted automobile sector is striving to court consumers back into the new vehicle segment. Although reaching the activity level seen before COVID-19 may take longer, the sector will see more demand for pocket-friendly, compact, and small and middle-range vehicles compared with large luxury cars. This trend is also validated by the financial concerns that are leading people to postpone big purchase decisions – buying a big car or replacing the old car is one of them. Moreover, shifts in the work culture also influenced this trend. Now some organisations have completely adopted the work from home model, while some are partially (2-3 days in a week) operating from offices. Such a situation, coupled with movement restrictions, warrants minimal use of cars. However, a significant spurt is expected in the sale of old vehicles. More people are crowding the shops of used car dealers to negotiate the best price for vehicles of their choice. This transition also indicates how people’s perception about safety and mobility is shifting. To observe social distancing norms (necessitated by COVID-19), people have started giving weightage to the idea of owing a vehicle. They are still wary of sharing a ride with strangers and consider personal vehicles much safer and hygienic than public transport. Ride-hailing service providers will have to wait longer for witnessing green shoots of recovery or an increase in activity. People may also consider buying two-wheelers instead of four-wheelers to conserve money. The two-wheelers and three-wheelers segment, especially in tier 2,3, and 4 cities, may also register growth in demand and sales. Across the age groups, consumers from the lower- and middle-income segments may prefer getting a two-wheeler or three-wheeler home, rather than a small car. In this way, this decision will not only tide them over until the financial uncertainty lessens but also boost their travel safety perception.

Result & Findings

Although it has become evident from our past surveys that the retail industry will keep on encountering challenges on the road to recovery, retailers’ traditional approach to attract customers may become obsolete in this “new normal” scenario. Here are the top five suggestions that may help the consumer and retail segment to thrive in the new normal:

Resetting priorities: Realigning and rebooting their business models, and adapting (by being agile) to changes faster are what retailers need to rebuild a growth path.

Going beyond traditional hiring models: The pandemic has introduced a transformation in the work culture. Quite a few organisations have permanently moved to the work from home models, cutting their real estate cost (rent, etc.) and administrative overheads. This transformation has also brought about a change in the new hiring processes. Now organisations are actively engaging gig economy (freelancers) and contractual workers and roping them in projects to avoid increasing their fixed cost and burden.

Ensure customers’ safety: The travel industry has started offering touchless onboarding and following every safety protocol to promise travellers a safe and comfortable experience. Although people are travelling for business and other unavoidable circumstances, they are still thinking twice before boarding a flight for leisure travel.

Automotive sector to drive on the two- and three-wheelers and small car segments: The sector may focus on these segments in the short-term to stay afloat. It should also expect an upsurge in the used vehicle segment in large and small towns. In view of these trends, automobile companies should realign their marketing and sales strategies to tap the consumer base in tier 2,3, and 4 cities.

Adopt omni-channel approach: The retail segment should embrace this approach that involves a mix of the offline (physical stores) and online (e-commerce, digital) channels. In other words, retailers need to connect with consumers at every touchpoint and offer them a wholesome “phygital (physical+digital)” experience to attract and retain them. This has become even more important in the present times when people need to maintain social distancing and take other precautions required for flattening the pandemic curve. Our survey findings reveal that the share of e-commerce is expected go up further in the overall retail channel mix. If used effectively, e-commerce and digital channels have the potential to put retailers out of their misery and accelerate their growth to help them return to normalcy in the post-pandemic world.

Conclusion

This season seems to have lifted people’s mood, spirit, and sentiments, compelling them to leave the comforts of their homes and flock to stores to check out festive deals. Consumers may also look at buying small or used cars or two-wheelers, instead of opting for new and expensive cars. This news might offer some respite to automobile companies. The travel for leisure would be restricted to close-by and domestic destinations as concerns regarding health and safety have still not lessened considerably.