International Journal of Business Research and Management

OPEN ACCESS | Volume 2 - Issue 1 - 2025

ISSN No: 3065-6753 | Journal DOI: 10.61148/3065-6753/IJBRM

Shibeshi Fekadu Tolesa1*, Barasa Fekadu Tolesa2

1Mattu University, College of Natural Resource Management and Agricultural Economics, Department of Agricultural Economics, Bedele, Ethiopia.

2Departments of Public Health, College of Health Science, Wollega University, Nekemte, Ethiopia.

*Corresponding author: Shibeshi Fekadu Tolesa, Mattu University, College of Natural Resource Management and Agricultural Economics, Department of Agricultural Economics, Bedele, Ethiopia.

Received Date : September 27, 2024

Accepted Date : December 23, 2024

Published Date : January 02, 2025

Citation : Shibeshi Fekadu Tolesa , Barasa Fekadu Tolesa (2025) “ An examination of ethiopian data on the coffee value chain from a systemic perspective.”. International Journal of Business Research and Management 2(2); DOI: http;//doi.org/112.2024/07.1021.

Copyright: © 2025 Shibeshi Fekadu Tolesa , This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Ethiopia's principal export crop is coffee. Currently, one of the most profitable exports for nations in East Africa, including Ethiopia, Uganda, Kenya, and Tanzania, is coffee. Ethiopia is recognized as the source and major hub of Arabica coffee varietal. Global coffee production is insignificant, with over 70 nations and approximately 25 million growers producing coffee. Seventeen percent of coffee producers worldwide are from Ethiopia. Ethiopia, which produces 4.46 percent of the world's coffee, is the world's fifth-largest producer, behind only Brazil, Vietnam, Colombia, and Indonesia. the biggest and most prolific grower in Africa, making up around 43.15% of the continent.Ethiopian coffee varieties vary greatly in terms of genetic variety. The nation has also captured the attention of the world because of its inherent.More than 60% of the world's coffee is produced by the top three countries—Brazil, Vietnam, and Colombia together. Ethiopia is the eighth-largest supplier of coffee to the world market, accounting for 3–3.7 percent.Sixty countries import coffee from Ethiopia. The top 10 countries to import Ethiopian coffee, in terms of value, were Italy, Germany, Saudi Arabia, Japan, Belgium, South Korea, China, the United Arab Emirates, and Taiwan. They make up 84% of the whole. Japan moved up from sixth place in 2020–2021 to fourth place in the world for coffee imports in 2021–2022.

1. Introduction:

Nowadays, coffee is grown all over the world in emerging nations, mostly in tropical regions. It is regularly shipped, mostly in green form (60 kg bags of green beans), to industrialized nations in Europe, North America, Australia, and Japan, where it is mixed and roasted to make a daily drink[1-2]. The 25 coffee-producing nations in Africa are home to over 716 million people, and in several of those nations, coffee is a vital commodity for smallholder producers' income creation as well as for export earnings [2].

Ethiopia's main export crop is coffee [3]. One of the most profitable exports for East African nations nowadays is coffee, which includes Ethiopia, Uganda, Kenya, and Tanzania. Over the past fifty years, coffee has averaged 60% of total export earnings [4]. Ethiopia is acknowledged as the source and major center for the Arabica coffee varietal [5].

Ethiopia's Kaffa region is the birthplace of coffee, as it grows naturally there. In the fourteenth century, it started to be traded with Yemen, and by 1700, Arabica coffee seeds were coming from the ports of Aden and Mocha. Some were planted in 1708 on Bourbon (now Reunion) Island by French missionaries, and by 1817, over 3,000 tons were produced annually.With over 25 million growers operating in more than 70 countries, Ethiopian coffee producers make up 17% of all coffee producers worldwide. Ethiopia, which produced 4.46 percent of the world's coffee, was the world's fifth-largest producer, after Brazil, Vietnam, Colombia, and Indonesia. Africa's largest and leading producer, making up about 43.15% of the continent [6-7].

Ethiopian coffee varieties exhibit significant genetic diversity. Because of its Arabica coffee, an indigenous kind, and its inherent quality and potential for coffee production, the nation has also caught the attention of the international community. Nearly 25% of the nation's population lives in farming households, and over a million of them are dependent on coffee exports and production. Additionally, it provides over 25% of the GDP, 40% of all export earnings, 25% of jobs for both urban and rural residents, and 10% of all government revenue[6,8].

Four main production strategies are used in Ethiopia to produce coffee: semi-forest coffee (30-35%), forest coffee (8–10%), cottage or garden coffee (50–57%), and contemporary coffee plantations(5%) [3,6,9]. Even though the Ethiopian economy depends heavily on coffee, market conditions in this industry have not been favorable, especially for smallholder coffee growers. This is because, during the past few decades, there hasn't been a significant change in the way that production and processing are done[2,10].

Both domestically and internationally, Ethiopian coffee is sold, with the majority of export sales occurring via the recently formed commodities exchange market and through speciality market channels run by coffee cooperative unions. Generally, the Commodity Exchange Market should handle all Ethiopian coffee. However, cooperatives have been allowed to avoid the coffee auction since 2001, opening the door for direct export sales[10-11].

Farmers were discouraged from entering the coffee industry by the lengthy coffee marketing chain. Because of this, there are several middlemen in the current coffee marketing chain. Growers sell their wet and dried coffee cherries to town collectors, small town collectors, and local collectors who purchase their coffee from growers and transport it to larger collectors.

Only one-third of Ethiopia's output made it to the market in the country's agricultural markets prior to 2008, which were marked by high transaction costs and risks[12]. The Coffee Standard and Quality Inspection and Auction Centers (CSQIAC) of Ethiopia oversee the production and export of all coffee through the system. With its own operational rules, regulations, and methods, the National Coffee Board of Ethiopia (NCBE) was in charge of inspecting, arranging, and managing the classification, grading, and auction sale of coffee supplied to central markets in Addis Ababa and Dire Dawa[12].

Ninety-five percent of Ethiopia's produce comes from small-scale farmers who arrived at the market with little knowledge and are therefore at the mercy of merchants in the closest market they are familiar with, unable to bargain for better pricing or reduce market risks. Despite the government's engagement in coffee marketing, farmers still face many obstacles[3,13]. Farmers, for instance, expressed dissatisfaction with the government's lax supervision of coffee prices, claiming that suppliers and collectors set their own rates, which are typically less than the government-stated market price.

The coffee value chain and marketing system is one of the most important issues to take into consideration when planning for sector development[13-14] Numerous research on Ethiopia's agricultural marketing system in general and coffee in particular have been conducted in light of this fact. Value chain growth is generally viewed as benefiting from the connection of small-scale producers to markets[5,15].However, Ethiopia's agricultural markets are dispersed and poorly integrated into a wider market system, which raises transaction costs, reduces incentives for farmers to produce for the market, and results in insufficient value chain integration[13].They added that although the government addresses the commercialization of coffee,

In addition, a number of authors have carried out case studies on the value chain of coffee and the influence of cooperatives as participants in the value chain in different regions of Ethiopia. for instance, carried out research on the coffee value chain in the West Arsi Zone of Ethiopia's Nensebo District[16]. Research on the variables affecting farmers' coffee market outlet performance in Ethiopia's Jimma zone [12,14]. A current Essara Woreda, Dawuro Zone, Ethiopia, forest coffee market channel[17]. Research on the costs and profit margins of coffee marketing in South West Ethiopia was [12,17].

1.2. Objectives of the Review:

1.3. Significance of the Review:

The Ethiopian coffee value chain is reviewed, along with its challenges and prospects. It is anticipated that the data will offer significant insight into the nation's coffee value chain, prospects, and constraints. Numerous entities, including government and non-governmental organizations, dealers, producers, policymakers, national and international research institutes, development organizations, and extension service providers, can benefit from the information gathered by this review.

2. Discussion:

2.1. Definition of Terms:

The term "value chain" refers to the full set of value-adding operations needed to move a good or service through all of the stages of production, including the acquisition of inputs and raw materials. "Actors connected along a chain producing, transforming, and bringing goods and services to end-consumers through a sequenced set of activities" is defines as a value chain[12,18-19]. Value chains are composed of separate business entities that work closely together as a strategic network[20].

Product creation, quality control, cost management, research and development, facilities management, customer service, order fulfillment, product marketing, and many other activities are all included in the value chain, according to Evans[21]. A value chain is a series of goal-oriented manufacturing component combinations that, from inception to ultimate consumption, produce a marketable good or service [21-22]. This includes activities such as marketing, distribution, design, manufacturing, and support services all the way up to the final customer. A "value chain" in agriculture, as defined by a group of participants and actions that transfer a basic agricultural product from field production to final consumption, adding value along the way[17,23],. A value chain might be a network of independent companies or a vertical link.

A value chain is a type of supply chain where participants actively work to increase their mutual competitiveness and efficiency. To accomplish a shared goal of satisfying customer needs and boosting profitability, they invest time, energy, and resources in addition to building connections with other stakeholders [12,5].The acquisition and utilization of resources, including cash, labor, supplies, machinery, buildings, land, administration, and management, are elements of inputs, transformation processes, and outputs. Costs and profits are influenced by the way value chain activities are executed. As they transform inputs into outputs, the majority of organizations perform hundreds, if not thousands, of tasks. There was a two categories of for all firms: primary and supportive, which are necessary for all firms to perform[24].

The term "marketing chain" refers to the flow of goods from producers to consumers that involves the participation of economic actors who play complementary roles in order to satisfy both producers and customers. Formal and informal market agents can both be a part of a marketing chain.

Market and supply chains: Agricultural products are produced by a vast number of farmers and subsequently eaten by a large number of households. Between the farm gate and the final consumer, products are bought and sold several times, with the exception of those used on the farm or sold locally. Between these two locations, the commodity is moved, stored, cleaned, graded, and processed. The route that should be followed from the point of original manufacturing to the point of ultimate consumption is known as the market chain.

Supply chain is a more extensive path that goes from raw materials to finished commodities that are delivered to clients. In short, he described it as a value-delivery network. Commodity supply chains expand in a free market to reflect their[25].

2.2. Coffee value chain, Challenges and Opportunity in Ethiopia

2.2.1. Coffee value chain and actors in Ethiopian:

Every significant player in a given value chain is shown on a value chain map. It explains the several supply chains that transform raw materials into completed goods before delivering those goods to clients, as well as the different markets or niches that products are targeted at. Key informants—those with extensive knowledge of the value chain—may give information for the creation of draft value chain maps, which can then be improved upon as new data becomes available. When looking for value chain actors to interview, they are quite beneficial[18,26].

A value chain is a supply network that links suppliers of raw materials, producers, distributors, and consumers to move a product from idea to final use. The coffee value chain strategy to development in Ethiopia is centered on addressing significant barriers at every stage of the supply chain, as opposed to concentrating on a particular group (such as growers) or geographic area. A difficult regulatory environment, inadequate public infrastructure (roads, telecommunications, electricity, etc.), a lack of information or shaky connections to end markets, and/or inadequate coordination between firms are common examples of constraints. Successful economic growth often necessitates a value-chain approach since smallholder farmers and micro and small businesses will only benefit in the long run if the industry is competitive overall[3,14,16,27].

A people who supply inputs, create, process, market, and consume agricultural products as value chain actors[28]. They could be either indirect or direct participants in the value chain, such as credit agencies, business service and government, researchers, extension agents, and rural and urban farmers, cooperatives, processors, traders, retailers, cafes, and consumers, who offer financial or non-financial support services[12,19,28].

A value chain may involve input suppliers, producers, assembly traders (also known as primary wholesalers; they typically purchase from farmers and itinerant collectors and resell to wholesalers), retailers (who sell goods to customers), wholesalers (who deal with larger volumes than collectors and assemblers and frequently serve essential storage services), and collectors (small and mobile traders who visit villages and rural markets)[29].

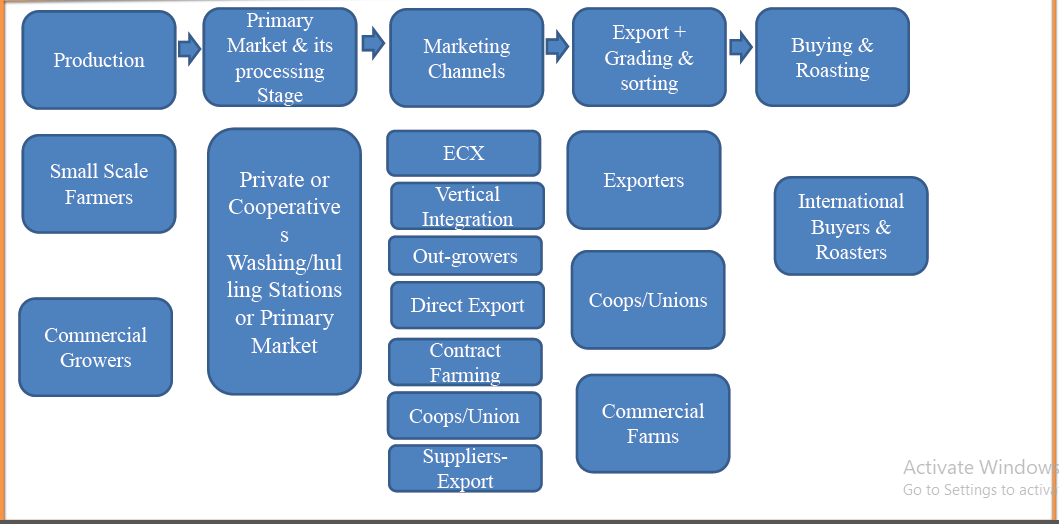

Figure-1: Ethiopian coffee value chain

Source: ECTA (2023); Singh, S.N. (2022); Temesgen, K. (2021)

Cooperatives and traders purchase coffee from smallholder growers. Cooperatives typically trade coffee through their cooperative union, but they can export it directly or through the ECX. Coffee can be directly exported by larger smallholders (with a minimum of a 2ha coffee farm), though this is not common. Within the cooperative value chain, producers and foreign buyers will almost certainly interact directly[2,15,20,24,29].

2.2.1.1. Coffee value chain participants and their responsibilities.

2.2.1.1.1. Coffee Collectors:

Coffee collectors are crucial in getting coffee from remote areas to the market and adding value by producing more coffee[26,29-31].These individuals are in charge of gathering a substantial amount of coffee from small-scale growers at the farm gate and delivering it to processors and wholesalers. A total of 177.58 Qtls of coffee were bought from smallholder coffee producers through collectors. The main markets that collectors access are wholesalers and processors[3,9,11].

The most important players in the coffee value chain are those who buy coffee, pulp or not, and then sell it to suppliers or independent retailers so that it can be processed and marketed further. Coffee collectors contribute significantly to the market by increasing the volume of coffee and facilitating the delivery of coffee from remote areas[32].

A study on marketing expenses, margin, and benefit indicates that coffee collectors had the lowest cost per 17kg, at 7.97 birr [14,22,32].Coffee growers bear the highest costs, with wholesalers coming in second at 104.98 birr and 48.67 birr per 17 kg, respectively. Compared to growers and collectors, the average coffee wholesaler retained a higher yearly total net advantage. The estimated yearly net benefits of a typical coffee grower, collector, and wholesaler were birr 3879.88, 1708.28, and 390257.06, respectively. This implies that the wholesale coffee market is very lucrative. Producers get a smaller portion of wholesale prices than farmers in other parts of the nation..

Gathering coffee from each producer, compiling it till it reaches a particular volume, and then distributing it to their various suppliers are the main responsibilities of these collectors. The personal interaction between two partners (provider and collector) determines who is a collector instead of any set legal requirements. But they don't start doing business until they've received formal approval from the appropriate authority (the farm market development office) to operate as legitimate traders[3,6,30].

2.2.1.1.2 Traders (Suppliers):

Ethiopian coffee value chain suppliers are those who purchase coffee from collectors (both legal and illicit) and sell it to either foreign importers or exporters at the Addis Ababa auction market[3,7,16,23].Suppliers purchase red coffee cherries from producers or collectors, prepare the beans, and then put them up for auction. They have sophisticated processing equipment, including hulling and washing machines. Both wet and dry processing are done by the processors. When coffee cherries are collected and processed wet, they are pulped right away, fermented in tanks, and then cleaned in clean water to get rid of the mucilage. After that, it was sorted to guarantee the proper moisture content and sun-dried on tall tables.

2.2.1.1.3. Exporters:

Coffee is exported to the global market by exporters following manufacturing and processing. The central market of Addis Ababa was home to exporters who bought coffee from cooperative unions, private growers, and private dealers before selling it to consumers around the globe. Through ECX, these exporters bought coffee from the central auction market. State farm growers export coffee to foreign markets independently, therefore these coffee exporters do not purchase their beans from state farmers. Because of their relationships with importers outside the nation, they are crucial in their search for foreign markets. They imbue commodity coffee with a feeling of place. Given that they can sell coffee directly to foreign importers, unions, independent merchants, and state-owned producers might all function as exporters[10,33].

After the coffee reform, Ethiopian coffee export performance started to rise in 2017.About 35–40% of the coffee is cleaned. The top three coffee kinds, Sidama, Nekemte, and Jimma, accounted for 70–75% of exports[7,34]

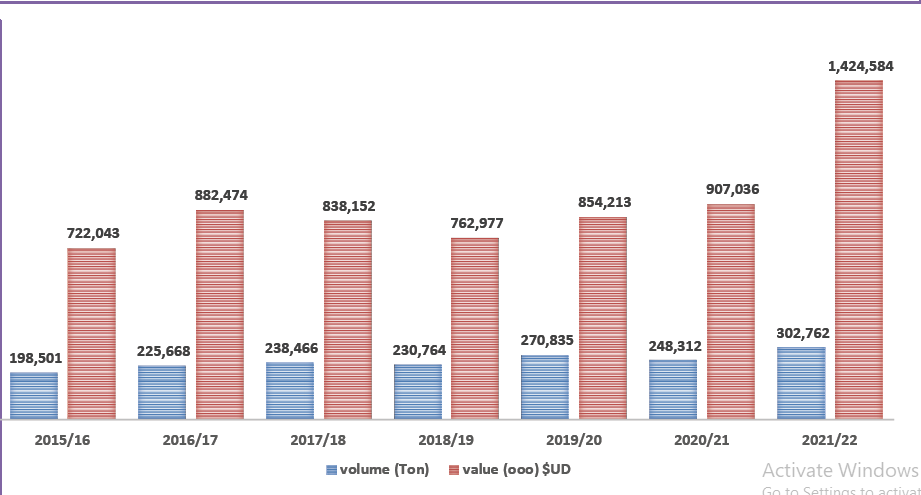

Figure 2:Ethiopian Coffee Export

Source: ECTA, (2023)

In order to increase business earnings, exporters buy coffee from different coffee vendors around the nation and resell it to consumers abroad. Because it unites customers including wholesalers, processors, and exporters to carry out efficient marketing of coffee and other export commodities, the government-established exchange market, or ECX, is crucial to market facilitation[3,35].

In the 2017–18 marketing year alone, Ethiopia exported coffee worth a record 917 million US dollars. Recent market trends indicate that traceability and certification are now essential requirements for raising Ethiopian coffee's price and marketability. The government set up new marketing channels and certifying bodies in response to consumer demand.

|

Item |

2016/17 |

2017/18 |

2018/19 |

2019/20 |

|

Total export value |

$2.75 |

$2.65 |

$2.76 |

$2.74 |

|

Total value of Agriculture export |

$2.35 |

$2.27 |

$2.32 |

$2.13 |

|

Agricultural exports share out of total exports |

86 |

86 |

84 |

78 |

|

Coffee exports |

$0.812 |

$0.722 |

$0.897 |

$0.917 |

|

Coffee exports share of total agricultural exports (%) |

35 |

32 |

39 |

43 |

|

Coffee exports share of total exports (%) |

30 |

27 |

33 |

34 |

Table: 1 Values of Coffee Exports as a Share of Total Exports (billion)

Source: USDA, 2019, Annual Coffee Report

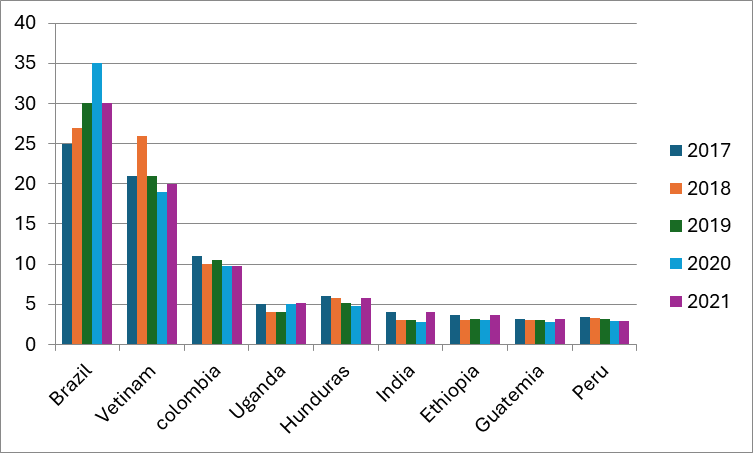

The top three (Brazil, Vietnam, and Colombia) together account for more than 60% of the world's coffee Ethiopia ranks eighth in terms of coffee supply to the global market, with a proportion of 3 to 3.7%.

Figure-3: Ethiopia’s Position in the Global Coffee Market (2017-2021)

Source: USDA, 2019, Annual Coffee Report

2.2.1.1.4. Importers:

Actors from abroad who buy coffee from different Ethiopian producers are known as imports. The United States, Germany, Japan, and the Netherlands are Ethiopia's main coffee importers. These overseas importers add value to the coffee they get, sell it directly to wholesalers, and subsequently to retailers[32-34].

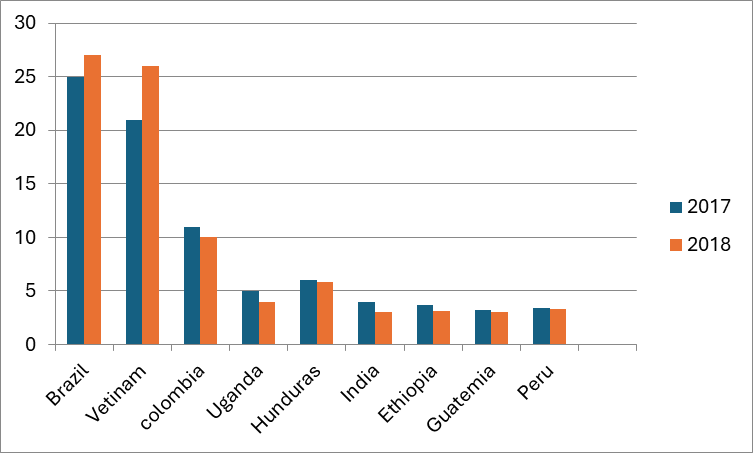

Sixty countries import coffee from Ethiopia.The top 10 countries to import Ethiopian coffee, in terms of value, were Italy, Germany, Saudi Arabia, Japan, Belgium, South Korea, China, the United Arab Emirates, and Taiwan. They make up 84% of the whole. Japan moved up from sixth place in 2020–2021 to fourth place in the world for coffee imports in 2021–2022.

Figure-4: Ethiopian Coffee Destination Countries (2021/22)

Source: USDA, 2019, Annual Coffee Report

2.2.1.1.5. Domestic Wholesalers and Retailers:

Ethiopian wholesalers are important participants in the coffee value chain since they buy coffee straight from home producers or small-scale growers. Coffee is picked, dried, and hulled by small-scale farmers in Ethiopia before being shipped to markets. Small-scale growers greatly enhance the value of coffee by doing this. In this instance, shops will carry out the hulling task, adding value to the coffee prior to selling it to customers [25,32].Because they lack the necessary financial and informational capabilities, retailers are renowned for making little transactions. They are the main players in the channel, supplying consumers with small amounts of coffee. An estimated 113.99 Qtls of coffee were purchased from smallholder coffee producers through these actors[3,7,35].

Individuals who trade coffee without a license. Instead, they are able to trade other cereal items legally. They supply coffee to the great majority of local customers, making them unlawful coffee sellers. These local retailers mostly handle the following coffee value chain activities: collecting, transportation, processing (sometimes), and packing. Nevertheless, the tasks they carry out depend on where they get the products[2,5,32].

2.2.1.1.6. Consumers:

Consumers are the primary end users of commodity coffee. There are various coffee consumers along the coffee value chain in Ethiopia. These are both domestic and international consumers. Domestic consumers buy directly from small-scale farmers and coffee collectors around the country[2-3,9,12].Consumers are the last purchasers of coffee, typically from shops for consumption purposes, and thus are the final link in the chain. The overall volume of coffee sold to this market actor is expected to be 13 Qtls, provided by smallholder coffee producers[3].

2.2.1.1.7. Local processors:

Local coffee processing is done by large-scale private investors, traders, and cooperatives. At the processing station, the aforementioned actors perform both dry and wet processing. Hulling, pulping, sorting, grading, packing, and weighing are steps in the coffee processing process. Cooperatives, large-scale private coffee investors, and individual coffee merchants handle this kind of local processing. The machines utilized for this kind of processing are therefore owned by cooperatives, large-scale investors, and private dealers. Clay poet tea and coffee shops process locally[34].

2.2.1.1.8. Service Providers at Each Value Chain:

Ethiopian commodities market, government input suppliers, Woreda level administration bodies, development agents, transporters, financial service providers (Commercial Bank of Ethiopia, Savings and Credit Association, and other non-governmental organizations) are some of the service providers that make up Ethiopia's coffee value chain[2-3,18].

The Ethiopian coffee value chain contains a wide range of participants, including state farms or smallholder coffee farmers, primary collectors, suppliers, processors, service cooperatives, unions, exporters, and several government agencies. In actuality, suppliers receive collections from collectors, transport goods to the auction (where exporting is prohibited), and the auction then selects exporters to bid on. Generally speaking, an auction house should handle all Ethiopian coffee. The Ethiopian Commodity Exchange (ECX) regulations prohibit a company from engaging in two or more value chain tiers. The seven groups of generic functions are as follows: trading, exporting green coffee, input supply, production, primary marketing, primary processing, and secondary processing[36].

2.2.1.1.9. Processors:

These are the players in the market, and their main objective is to increase profits by improving the product. These players purchase large quantities of coffee from collectors and smallholders, then sell it to exporters through ECX. This actor spent 303.16 Qtls in the study region[3,5].

2.3. Challenges and opportunity of coffee value chain in Ethiopia.

2.3.1. Challenges of Coffee Value Chain in Ethiopia

2.3.1.1 Coffee Price Volatility:

Due to weather, disease, and other factors, the amount of coffee produced worldwide varies annually, which makes the market for coffee intrinsically unstable and subject to significant price fluctuation. For those who depend on coffee as their primary source of income, this price volatility has major consequences. It also makes it challenging for coffee growers to project their earnings for the next growing season and set aside money for their households and farms. Farmers are less motivated and have fewer resources to invest in agricultural maintenance, such as replacing elder trees or using pesticides and fertilizers, when prices are low.

Children are frequently pulled out of school to assist the family by working on the farm or in the unorganized sector when prices fall below production costs because farmers find it difficult to pay for medical care and school fees while simultaneously producing enough food to feed their families. Because of this, low-input-low-output cycles and structural poverty have become entrenched for the majority of coffee growers in developing nations due to the instability of the coffee market and inadequate production infrastructure and services[18,20,37].

2.3.1.2. Problems Related with Quality:

Numerous factors affect the quality of coffee,and the Policy Analysis and Economic Research Team (2008). Producers (humans) and nature (coffee variety, soil characteristics, moisture and manure supply, etc.) are primarily responsible for them. Height, rainfall intensity and length, soil type, pH, genetic origin, production area location, herbicides and pesticides, timing and techniques of harvesting, packing, and other natural phenomena are examples. The process of ensuring high-quality coffee starts with the seedlings and ends when the coffee is sold on the global market. Nonetheless, there are a number of serious quality problems with Ethiopian coffee's supply to both domestic and international markets—both wet-processed and sun-dried. Ethiopian coffee cannot effectively compete in the worldwide market due to this quality issue[14,18,29.34].

Most of these problems have an impact on and are connected to attaining ideal quality by using appropriate time, space, and quality distributions. The largest quality issues with Ethiopian coffee that have been found are issues like:

Coffee quality is severely impacted by all of these problems, making it unprofitable and uncompetitive in both home and international markets. Among other things, the main causes of these problems are:

2.3.1.3. Inadequate Supply Response due to Insufficient Prices:

In comparison to the final border pricing of the food in the neighborhood market, farmers receive far lower prices. The marketing intermediaries receive the lion's share of the marketing margin. Similar to this, coffee exports do not get the right price on the global market. This now acts as a deterrent to farmers producing coffee. Numerous studies show that in years when prices were very low, like in the early 2000s, many farmers switched from growing coffee to other high-value cash crops, including chat. Consequently, the entire supply of coffee has not grown to its full potential. This is referred to as the coffee producers' poor supply response.

2.3.1.4. Problems Related With Information and Promotion:

Ethiopian coffee is the least advertised and promoted coffee in the world market, despite its excellent quality. There's evidence that roasters know Ethiopian coffee tastes better, but they can't sell it because we haven't approached them. For instance, one of the issues with Ethiopian coffee marketing is the lack of effort put in to ensure trade mark rights for the greatest and most well-known Ethiopian coffee varietals, most of which are world-class and of excellent quality. Additionally, exporters are inexperienced and ignorant of the coffee industry[32,35,38].

Coffee market supply was influenced by household head education level, amount of coffee produced, availability of extension services, coffee price, proximity to the closest market, household non-farm income, and availability of market information[33-34,39].Ethiopia's coffee industry has challenges related to sustainability, legislation, and structure.

2.3.1.5. Structural challenges:

2.3.1.6. Policy environment:

2.3.1.7. Sustainability:

2.3.2. Opportunities of coffee value chain in Ethiopia:

Ethiopia boasts good agricultural supplies, low labor costs, optimum temperatures, suitable altitude, adequate rainfall, and fertile soil. The nation has the ability to produce all varieties of coffee from the many global sources of coffee growth, and can do it in a sustainable manner[30.33.36,39-40].

Grounds for optimism:

Create an enabling policy environment:

Stimulate local consumption:

Ethiopia is a big consumer of Arabica coffee in addition to being a major producer and exporter of the bean. The majority of coffee drinkers in Africa come from Ethiopia. Ethiopian culture is strongly ingrained with coffee ("coffee ceremony").

3. Conclusions:

Given the growing demand from consumers for premium coffee, Ethiopia has a great opportunity to overtake the global high-value coffee market. Ethiopia does not benefit from this commodity, nevertheless, for two reasons: little value is added, and quality declines throughout the value chain. Most coffee is exported in its unroasted form to be consumed outside of Ethiopia. The performance of Ethiopian coffee exports begins to improve in 2017 (after the coffee reform).Of the coffee, 35–40% is cleaned. With a percentage of 70–75% exported, the top three coffee varieties were Sidama, Nekemte, and Jimma.

About 65 percent of the country's exports are made up of this small amount. Ethiopian green coffee is therefore less expensive than green coffee from other nations on the global market, even if it has a comparative flavor advantage. More than 60% of the world's coffee is produced by the top three countries—Brazil, Vietnam, and Colombia together. Ethiopia is the eighth-largest supplier of coffee to the world market, accounting for 3–3.7 percent.Sixty countries import coffee from Ethiopia.The top 10 countries to import Ethiopian coffee, in terms of value, were Italy, Germany, Saudi Arabia, Japan, Belgium, South Korea, China, the United Arab Emirates, and Taiwan.They make up 84% of the whole. Japan moved up from sixth place in 2020–2021 to fourth place in the world for coffee imports in 2021–2022.

In addition, performers do not receive enough pay for the value and expertise of their work. The main causes of poor quality include procedures employed during and after harvesting, such as gathering, processing—both dry and wet—storing, and shipping.

Author contribution: This research was primarily conducted by me with no additional authors engaged.

Competing interests: The authors state that they have no competing interest..

Ethical approval: This is not applicable.