International Journal of Business Research and Management

OPEN ACCESS | Volume 4 - Issue 1 - 2026

ISSN No: 3065-6753 | Journal DOI: 10.61148/3065-6753/IJBRM

Agim Berisha

College of Business, Economic Faculty, Republic of Kosovo.

Corresponding author: Agim Berisha, College of Business, Economic Faculty, Republic of Kosovo.

Received: July 24, 2024

Accepted: August 01, 2024

Published: August 08, 2024

Citation: Berisha A, (2024) “Public Expenditures and The Impact of Public Investments on The Economy: The Case of Kosovo and Western Balkan Countries”. International Journal of Business Research and Management 1(3); DOI: 10.61148/IJBRM/07.1016

Copyright: © 2024 Agim Berisha, this is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

The budget represents the main instrument of public financing. The budget is one of the most important economic instruments available to the Government of Kosovo. In the framework of government policies, the issue of government spending is considered quite important. The purpose of the study is to analyze the progress of the structure of public expenditures, as well as the effect of public expenditures on the economy in recent years. In order to maintain fiscal stability, attention should be paid to how much the expenses burden the budget and where their expenses are directed. In this aspect, the way of spending budget funds and the orientation of government spending for productive purposes and investment projects remains important. Methodology: For the finalization of this paper, the submitted material has the following support: Local and foreign literature, as well as reports and publications from the Ministry of Finance, which deal with the issues of public spending in the Republic of Kosovo and the countries of the region. Likewise, the local statistical source, the method of analysis and synthesis, tabular and graphic separately, comparative method, etc. were used. Results: Special attention is paid to the comparison of public expenditures and public investments in Kosovo over the years, as well as in the countries of the Western Balkans. Through this study, we aim for the given conclusions and recommendations to be taken into consideration and serve actors in the field of public finance.

1. Introduction

When we talk about public expenditures, we must keep in mind that their volume, structure and use are not the same in all countries. Public spending varies depending on the economic and financial situation of each country. In the framework of government policies, the issue of government spending is considered quite important. In this paper, the main objectives consist of:

Analysis of the progress and structure of public expenditures in Kosovo in recent years.

To analyze the financing and the impact of spending on the economy in recent years.

Until the last few years, the fiscal policy as an integral part of the economic policy was not sufficiently in function of stimulating the private sector, but mainly oriented towards filling the budget coffers.

The research questions of this study include:

RQ1: How much does public spending affect the economy?

RQ2: What is the effect on the economy and the participation of public investments in BPV?

The study is structured as follows. Section 1 presents the introduction, including the main purpose of the paper, research questions and hypotheses. In section 2, the literature review is presented. Section 3 demonstrates the methodology and methods. Section 4 of the paper provides the result and discussion, as well as the correlation between public expenditure and GDP. Section 5 concludes the study.

2. The methodology used

To achieve the objectives within this study, the analysis method and the comparative method are mainly used, examining in dynamics the issue related to the progress of public expenditures in the Republic of Kosovo.

For the finalization of this paper, the presented material has the following support:

a) Local and foreign literature, as well as reports and publications from the Ministry of Finance, which deal with issues of public spending in the Republic of Kosovo.

b) The local statistical source was used, the method of analysis and synthesis, tabular and graphic separately, comparative method, etc.

3. Literature review

According to D. Curtis & I. Irvine, (2021), Macroeconomic theory and models emerged from an earlier major financial collapse and crisis followed by the depression years of the 1930s. Although today's economies are larger and more complex, they still operate on the same basic principles. An important indicator in the economy of a country is the Gross Domestic Product-GDP. The most important economic indicator in the System of National Accounts is the Gross Domestic Product-GDP, which represents the performance of a country's economy in a certain period (Agency of Statistics of Kosovo, 2015). Gross domestic product (GDP) is the market value of all final goods and services produced within an economy in a given period of time (N. Gregory Mankiw, Macroeconomics, 2010). This definition has four parts (Parkin Powell Matthews, economics, 2005):

Market value.

Final goods and services.

Produced within a country.

In a given time period.

This global macroeconomic indicator, in a more real and objective way, expresses the level of economic development or non-development of each country. In economic theory, we still do not have a clear definition of what we should understand by economic development. In other words, economic development expresses the achieved level of productive forces of the national economy for a certain period of time (Limani Musa, Macroeconomic, Pristine, 2013). Economic development has a dynamic, not static character, it always affects the quantitative and value changes of material goods, services, i.e. the permanent increase of the Gross Domestic Product (GDP) and the living standard of the population and the general standard of the country. Economic growth is considered one of the central macroeconomic stabilizing objectives (Mancellari Ahmet, Haderi Sulo, Kule Dhori, Qirici Stefan, Introduction to Economics, Tirana, 2002). Economic growth represents the overall increase in the production of an economy (Case, E. Karl & Fair, C. Ray, & Oster, M. Sharon, Principles of Macroeconomics, 2012). Economic growth is the increase in production, production capacities and all other components of an economy. Therefore, economic growth is considered as the ability of a country's economy to produce more goods and services for consumers (Mancellari Ahmet, Haderi Sulo, Kule Dhori, Qirici Stefan, Introduction to Economics, Tirana, 2007). Economic growth represents the growth of the real gross domestic product of a country and the change in the production capacities of the country (Riinvest, Economic Sustainability of Kosovo, Pristine, 2005). This is due to the fact that economic growth is closely related to the standard of living of the population of a country. An important indicator of the standard of living would be the output per capita of the population. It is considered an improvement in the standard of living of the population of a country when each individual, over time, has at his disposal more goods and services to consume than before.

Economists and policymakers care not only about the economy’s total output of goods and services but also about the allocation of this output among alternative uses. The national income accounts divide GDP into four broad categories of spending (N. Gregory Mankiw, Macroeconomics, 2010):

Consumption (C)

Investment (I)

Government purchases (G)

Net exports (NX).

Thus, letting Y stand for GDP. Y = C + I + G + NX

GDP is the sum of consumption, investment, government purchases, and net exports. This equation is an identity—an equation that must hold because of the way the variables are defined. Public expenditures represent the expenditure of financial means to meet public needs, which were created by collecting public revenues (Berisha, Agim. Public finances, 2022). Expenditures can be classified in different ways, but the most important is considered according to the economic criteria, as it provides opportunities for an analysis of the budget and the role that macro-fiscal policies have had in the country's economy. In fact, it indicates the purpose of using budget income.

According to the economic classification, expenses are divided into (Sharku. Gentiana, Leka. Brikena Leka, Enklava Bajrami, Finances, Tirana, 2013):

Current expenses and

Capital expenditure.

Public operating expenses are those expenses which are created on the basis of the relevant authorizations from the decision-making bodies, which have the character of exercising governmental and legislative operational activities. Thus, current expenditures include expenditures for goods and services that are necessary to carry out government operations. This category includes: Expenditures for public administration salaries, operating and maintenance expenses (goods and services), subsidies and transfers, interest payments for loans, etc. Public capital expenditures are also called public investments. The very word investment means spending public money on long-term material goods. This can be defined as public property either built or in the process of being built. Capital expenditures include expenditures for infrastructure investments, construction of new public facilities, restructuring of existing ones, investments for long-term projects, etc. Most of the expenses in the state budget are current expenses.

4. The results

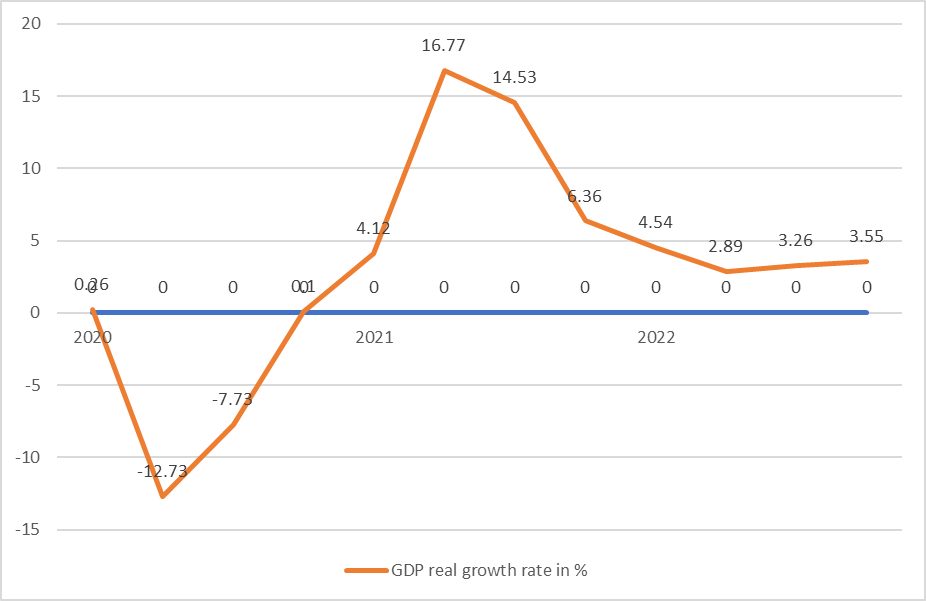

The Gross Domestic Product is taken as the most general macroeconomic indicator through which the dynamics of economic development is expressed. The most important economic indicator in the System of National Accounts is the Gross Domestic Product (GDP), which represents the performance of a country's economy in a given period (Statistics Agency of Kosovo, Series 4, National Accounts Statistics, Gross Domestic Product Q2 2020, Pristine, 2020). According to D. Curtis & I. Irvine, (2021), in an economy with a growing population and labour force, growth in real GDP is necessary to maintain standards of living. The following table reflects the real GDP rate in Kosovo in the period 2020-2022.

Table 1: GDP- Real growth rate in Kosovo in the period 2020-2022

|

Years |

2020 |

2021 |

2022 |

|||||||||

|

I |

II |

III |

IV |

I |

II |

III |

IV |

I |

II |

III |

IV |

|

|

GDP real growth rate in % |

0.26 |

-12.73 |

-7.73 |

0.10 |

4.12 |

16.77 |

14.53 |

6.36 |

4.54 |

2.89 |

3.26 |

3.55 |

Source: Kosovo Statistics Agency, Series 4: National Accounts Statistics, Gross Domestic Product Q4 2021, Pristine, 2022, pg. 3. Kosovo Statistics Agency, National Accounts Statistics Gross Domestic Product Q2 2023, Pristine, 2023, pg. 5. Author calculation.

Figure 1: GDP- Real growth rate in Kosovo in the period 2020-2022

The growth rate of the economy represents the rate at which the real GDP grows (Dornbusch, Rudiger, Fischer Stanley, Macroeconomics, Translated by: Marta Muco, Sulo Haderi, Tirana, 2000). Economic growth is never achieved at a constant growth rate. The table and graph reflect the trend of the real GDP growth rate in Kosovo during the period 2020-2021 and 2022. The real GDP growth in 2020 in Q4 was 0.10%, this is as a result of measures and restrictions in the economy with the beginning of the Covid19 pandemic, while at the end of 2020 and in 2021 with the removal of measures and restrictions in the economy (opening of the economy) it is also reflected in economic growth trends with an increase in 2021 in Q4 to 6.36%. In 2022, the GDP growth rate in the fourth quarter was 3.55%.

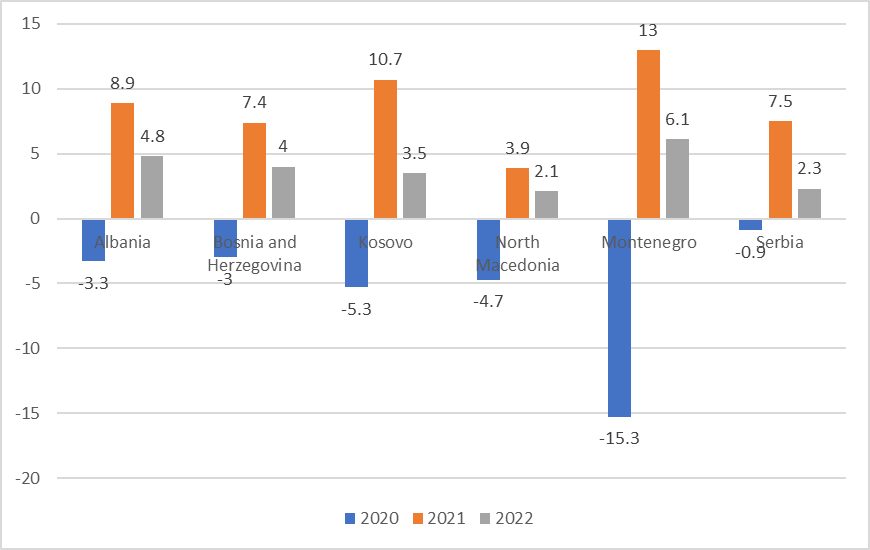

The following table shows Real GDP Growth (percent) in the countries of the Western Balkans.

Table -2: Real GDP Growth (percent) in the countries of the Western Balkans in the period 2020-2022

|

2020 |

2021 |

2022 |

|

|

Albania |

-3.3 |

8.9 |

4.8 |

|

Bosnia and Herzegovina |

-3.0 |

7.4 |

4.0 |

|

Kosovo |

-5.3 |

10.7 |

3.5 |

|

North Macedonia |

-4.7 |

3.9 |

2.1 |

|

Montenegro |

-15.3 |

13.0 |

6.1 |

|

Serbia |

-0.9 |

7.5 |

2.3 |

Source: World Bank Group, Western Balkans Regular Economic Report, No.23|Spring 2023, pg,6.

Figure 2: Real GDP Growth (percent) in the countries of the Western Balkans.

Based on the data in table no. 2 and figure no. 2, in 2021 compared to the previous period, a higher trend of GDP growth is observed in all the countries of the region. The countries of the Western Balkans and Kosovo during 2020 as a result of the Covid19 Pandemic had an economic growth trend, while during 2021 after the removal of restrictive measures and the opening of the economy, they had an economic growth trend, having a slower growth trend during the year 2022.

The low trend of economic growth in Kosovo, taking into account the unemployment rate and the high trade deficit, in such an economic situation in the country, the decision-makers should orient the fiscal policy as an instrument of the implemented economic policy for the economic development of the country.

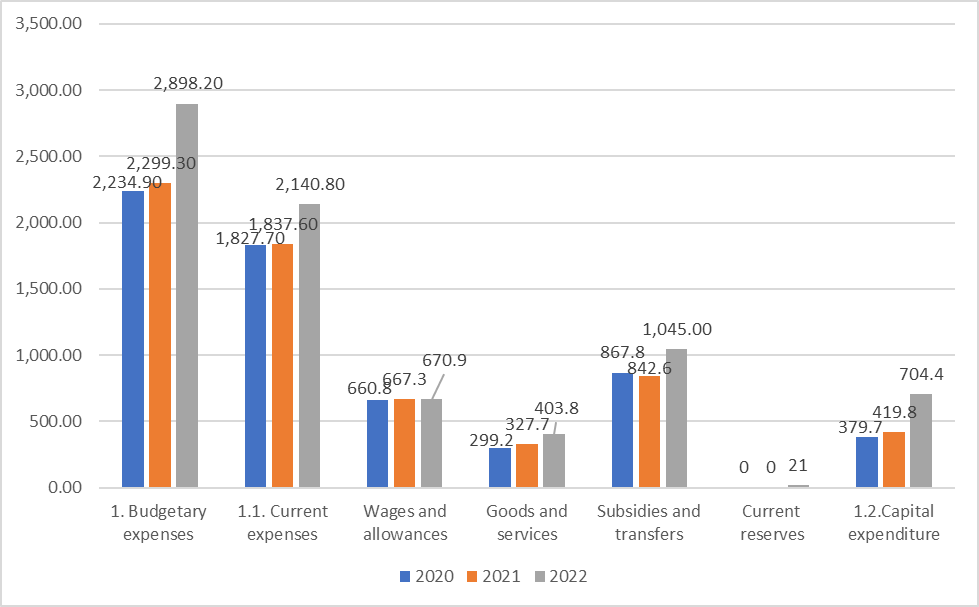

In the framework of government policies, the issue of government spending is considered quite important. In order to maintain fiscal sustainability, attention should be paid to how much spending burdens the budget and where their spending is directed. Based on the Law on the Management of Public Finances and Accountants (2008) it is important to state that "Public money will be used only for approved public purposes". In this aspect, the method of spending budget funds and the orientation of government expenditures for productive purposes remains important.

Table 3: The structure of public expenditures in the Republic of Kosovo-in million euros

|

Description |

2020 |

2021 |

2022 |

|

1. Budgetary expenses |

2,234.9 |

2,299.3 |

2,898.2 |

|

1.1. Current expenses |

1,827.7 |

1,837.6 |

2,140.8 |

|

Wages and allowances |

660.8 |

667.3 |

670.9 |

|

Goods and services |

299.2 |

327.7 |

403.8 |

|

Subsidies and transfers |

867.8 |

842.6 |

1,045.0 |

|

Current reserves |

0.0 |

0.0 |

21.0 |

|

1.2.Capital expenditure |

379.7 |

419.8 |

704.4 |

Source: Law No. 08/L-193, On budget allocations for the Budget of the Republic of Kosovo for the year 2023, pg, 20.

Figure 3: Structure of public expenditures in the Republic of Kosovo

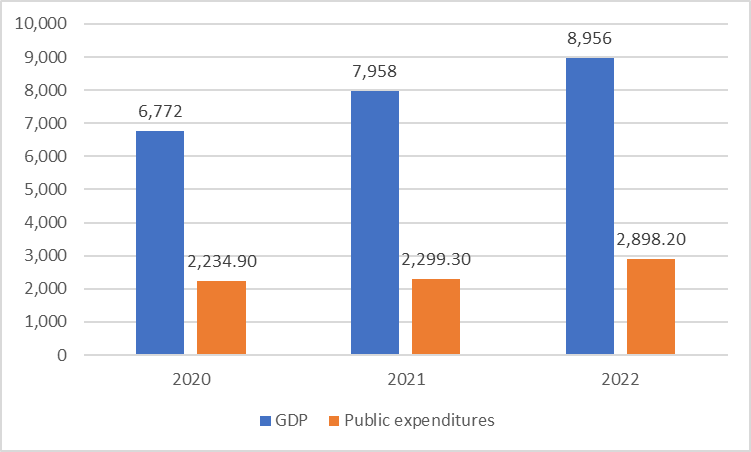

The following table shows the participation of public expenditures in Gross Domestic Product-GDP in Kosovo.

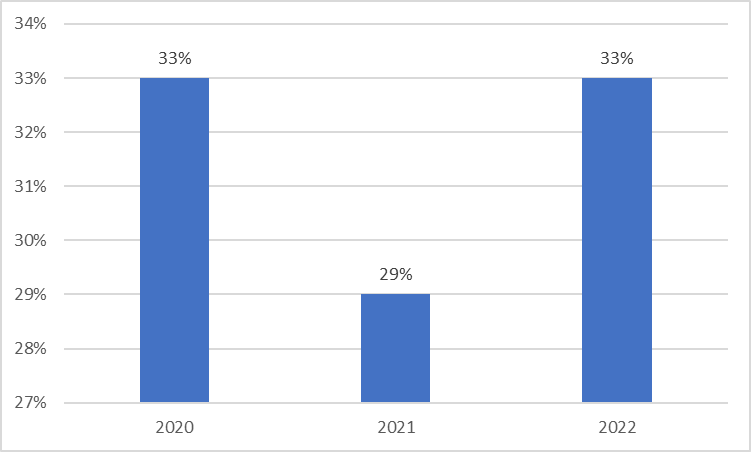

Table-4: Participation of public expenditures in BPV- in million euros

|

Years |

GDP |

Public expenditures |

Public Expenditure Report/GDP (%) |

|

2020 |

6,772 |

2,234.9 |

33% |

|

2021 |

7,958 |

2,299.3 |

29% |

|

2022 |

8,956 |

2,898.2 |

33% |

Source: Law No. 08/L-193, On budget allocations for the Budget of the Republic of Kosovo for the year 2023, pg, 23.

Figure 4: Participation of public expenditures in GDP

Figure 5: Public expenditure ratio in BPV

The financing of the public sector and the provision of public services is conditioned by the level of development of the economic sector of the respective country, which depends on the level of provision of financial means for financing public needs.

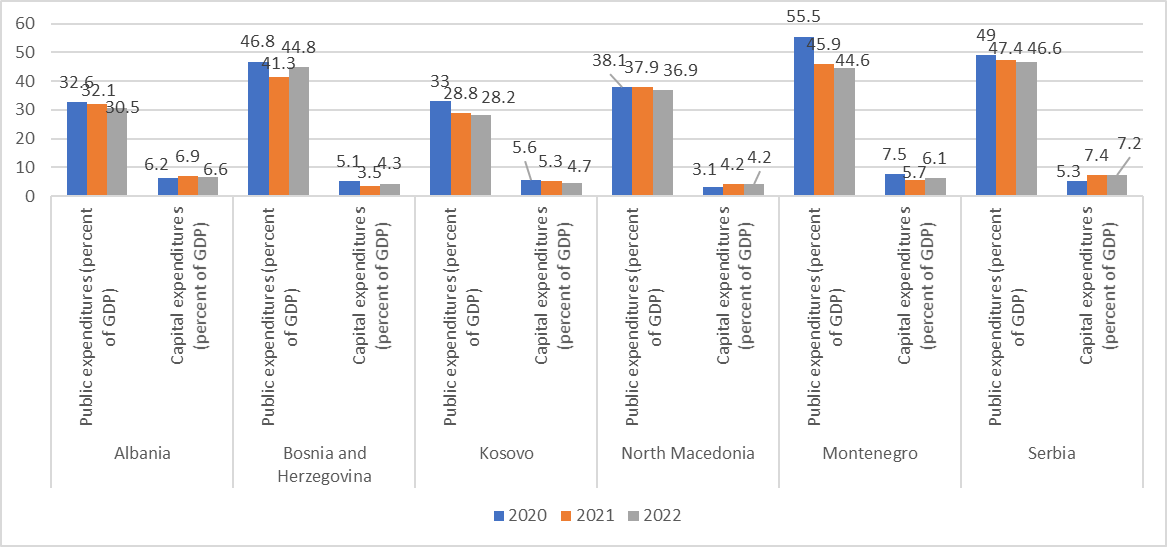

So, the financing of the public sector also depends on the economic sector or economic indicators (Kadriu. Sabri, Public Finances. 2012). From this we can say that the level of financing of the public sector is determined by the level of development of the economic sector. In the countries of the region, the participation of capital expenditures in general expenditures and in GDP remains at a low level. The table reflects public expenditures and public investments and participation in GDP in the countries of the region.

Table 5: Public expenditures and public investments in relation to GDP in the countries of the Western Balkans

|

2020 |

2021 |

2022 |

||

|

Albania |

Public expenditures (percent of GDP) |

32.6 |

32.1 |

30.5 |

|

Capital expenditures (percent of GDP) |

6.2 |

6.9 |

6.6 |

|

|

Bosnia and Herzegovina |

Public expenditures (percent of GDP) |

46.8 |

41.3 |

44.8 |

|

Capital expenditures (percent of GDP) |

5.1 |

3.5 |

4.3 |

|

|

Kosovo |

Public expenditures (percent of GDP) |

33.0 |

28.8 |

28.2 |

|

Capital expenditures (percent of GDP) |

5.6 |

5.3 |

4.7 |

|

|

North Macedonia |

Public expenditures (percent of GDP) |

38.1 |

37.9 |

36.9 |

|

Capital expenditures (percent of GDP) |

3.1 |

4.2 |

4.2 |

|

|

Montenegro |

Public expenditures (percent of GDP) |

55.5 |

45.9 |

44.6 |

|

Capital expenditures (percent of GDP) |

7.5 |

5.7 |

6.1 |

|

|

Serbia |

Public expenditures (percent of GDP) |

49.0 |

47.4 |

46.6 |

|

Capital expenditures (percent of GDP) |

5.3 |

7.4 |

7.2 |

|

Source: World Bank Group, Western Balkans Regular Economic Report, No.23|Spring 2023, pg,71-106.

Figure 6: Public expenditures and public investments in relation to GDP in the countries of the Western Balkans

The table and graph reflect public expenditures and public investments in the countries of the Western Balkans and the participation in GDP during the years 2020-2022. In the countries of the Western Balkans, the participation of public investments continues to be at a low level.

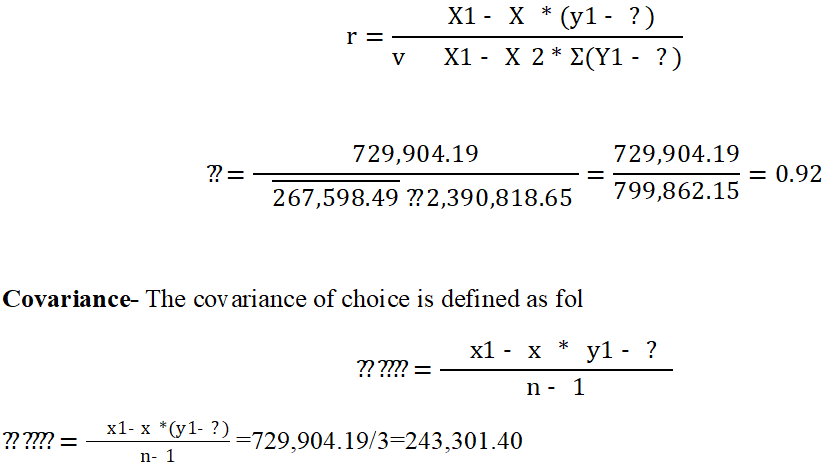

Results- Korrelation between Gross Domestic Product and Public expenditures

Public expenditures are a key issue in economic discussions and at the same time an extremely intensive area of research. Correlational analyzes were used in this article to measure the strength of the relationship between the independent variable Public expenditures (X) and the GDP dependent variable (Y). The result of the correlational study is obtained by the correlation coefficient. The correlation coefficient values are between - 1 and + 1. Its + 1 value indicates that both variables are in complete linear relation and in the same direction which means that all points lie in a straight line with coefficient positive angle. Whereas the value - 1 of the correlation coefficient indicates that the variables are in complete linear relation and in the opposite direction. For correlation analyzes, it has been argued that the correlation coefficient is a summary measure describing the degree of the statistical relationship between two variables; the dependent variables and the independent variables (Leroux, 2009). Indicators of the Correlation Analysis of Public expenditures and GDP are presented by the Correlation Coefficient (r), the Determination Coefficient (????????) and Alliance/the Contingency Coefficient (ka). On the basis of correlational analyzes we analyze the impact of Public expenditures on GDP. For Public expenditures and GDP, the correlation analysis covers the period from 2020 to 2022.

Table 6: Data are expressed in EUR millions over the period 2020– 2022

|

Years |

Public expenditures X1 |

GDP Y1 |

X1-X |

(X1-X)2 |

Y1-Ӯ |

(Y-Ӯ)2 |

(X1-X)*(Y1-Ӯ) |

|

2020 |

2,234.9 |

6,772 |

-242.57 |

58,840.21 |

-1,123.34 |

1,261,892.75 |

272,488.58 |

|

2021 |

2,299.3 |

7,958 |

-178.17 |

31,744.55 |

62.66 |

3,926.27 |

11,164.13 |

|

2022 |

2,898.2 |

8,956 |

420.73 |

177,013.73 |

1,060.66 |

1,124,999.63 |

446,251.48 |

|

Total |

2,477.47 |

7,895.34 |

0.01 |

267,598.49 |

-0.02 |

2,390,818.65 |

729,904.19 |

Correlation coefficient

The correlation coefficient is r = 0.92 From this we see that we have a positive average correlation, and that there is a positive average correlation between Public expenditures and GDP.

Determination coefficient:

???????? = (0.92)2 = 0.84 From here it results that 84.00% of the Public expenditures variation is explained by the variation of GDP.

Alliance coefficient:

Ka=1-???????? = 1 - 0.84 = 0.16 It results that 16.00% are other unexplained factors affecting Public expenditures.

Conclusions and recommendations

General government expenditures as a category represent public expenditures for the provision of goods and services to citizens. The level of public expenditures is closely related to public revenues. This means that the state accepts public money for collective purposes and for meeting public needs.

For the period 2020-2022, a positive dependence between GDP and public expenditure is evident. The results of the analysis show that public spending remains one of the important factors for the economy as a whole.

In the framework of the work related to public expenditures in the Republic of Kosovo, we present some of the conclusions and recommendations as follows:

Conclusions:

General public expenditures in Kosovo continue to grow, where in the structure of public expenditures, current expenditures have the largest increase.

Recommendations:

To improve the structure of public expenditures by reducing current expenditures and increasing the category of capital expenditures.

Public expenditures should be mainly oriented towards the financing of public investments and development projects.