The Journal of Social and Behavioral Sciences

OPEN ACCESS | Volume 2 - Issue 1 - 2025

ISSN No: 3065-6990 | Journal DOI: 10.61148/3065-6990/JSBS

Christian Kamtchueng1*, Carl Armand Nchanda2, Mariam Ouliaouli3 and Anaelle Amiot4

1ESSEC Business School Cergy-Pontoise Campus, 95000 Cergy, France. E-mail: christian.kamtchueng@gmail.com

2EDHEC Business School, 16-18 Rue du 4 septembre, 75002, Paris. E-mail: carlarmand.nchanda@edhec.com

3ISTEC School of Management and Marketing, 128 Quai de Jemmapes, 75010, Paris. E-mail: m.ouliaouli@mailistec.fr

4PPA Business School 28-32 Rue de l'Amiral Mouchez, 75014, Paris. E-mail: aamiot4@myges.fr.

*Corresponding author: Christian Kamtchueng, ESSEC Business School Cergy-Pontoise Campus, 95000 Cergy, France. E-mail: christian.kamtchueng@gmail.com.

Received: July 18, 2025 |Accepted: July 25, 2025 |Published: August 04, 2025

Citation: Kamtchueng C, Carl A Nchanda, Ouliaouli M and Amiot A, (2025) “Are the Sustainable Rating Sustainable?” Journal of Social and Behavioral Sciences, 2(2); DOI: 10.61148/3065-6990/JSBS/042.

Copyright: ©2025. Christian Kamtchueng. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Nowadays, the awakening of consciences pushes many people to redefine “profit”: One can benefit economically to shareholders while being harmful to the environment, to the citizens or to the populations living in the locality where a company is established. The purpose of this paper is to give the opportunity to question the pre-established standards of responsible rating because we will show you that it is a major issue. We have established indicators that highlight the different conventional rating procedures to challenge them. First, we want greater transparency in the calculation of these responsible ratings because we do not want to make the same mistakes as in 2008 (“Mortgage crisis”) with hidden ratings. We therefore need transparency, simplification, and objectivity, which will be highlighted in this paper thanks to a rating formula based on a crucial element that is often relegated to the background, yet which sums up the awakening of consciences and may seem antagonistic to liberal capitalism. This awakening of consciousness can be summarized, as we will demonstrate, by the term: << LOCAL >>. We intend to give a definition of this term and to establish a rating associated with this notion of LOCALITY. This paper mitigates the standard idea according to which sustainable rating methods is trustable and promotes Environmental Social-Governance (ESG) politics. In the first part, we will present the problem of responsible rating, then demonstrate the limits of current rating systems, then deduce what we expect from a responsible rating agency followed by concrete cases of this new rating system and finally we will propose a comparative study of rating systems according to our indicators.

Since the COP 21 “Conference of the Parties” agreements in Paris in December 2015, the world’s largest economies have come together to save the planet.1 This international convention was adopted in 1992 to control the increase of greenhouse gasses by humans to avoid dangerous climate disruption. This initiative was born out of the exponential increase in climate changes and has pushed governments to put in place new criteria that will control climate changes. These criteria should make it possible to measure the achievement of the main objective of –2o or even 1.5o in 2050 set at the end of this summit due to the warming of +0.85oC (measured between 1880 and 2012). As a result, the global rating agencies have developed these criteria around three axes: Environmental, Social and Governmental.

The 2021 edition of this world summit was intended to look back on the commitments made before the conference, which are those of limiting greenhouse gas emissions from 2020 onwards, and to set emission reduction targets for the international maritime and air transport sectors and for the refrigerant gas sector, which have a high warming potential, to stop subsidizing fossil fuels and to redirect investments towards greener sectors, to fight deforestation, to transform the agricultural and food model, to reduce waste and wastage, to develop access to renewable energy and to promote energy efficiency and sobriety. Poor countries that are already suffering from climate change will not have to abruptly reduce their emissions but invest in the development of renewable energies and the efficient use of energy.

One of the major preoccupations nowadays, is their rating of companies around the responsible label which concedes in the common ordinary a confidence in its activities. Trust both from its internal environment (employees, partners, shareholders, ...) and external (state, customers, ...) for which companies are fighting. This leads us to wonder about the means of obtaining these ratings when we know that the agencies that deliver them are not independent or non-profit. Studies have been done concerning the evolution and growth of the ESG rating agengies in (Avetisyan and Hockerts, 2017) our work is similar to (Chatterji et al., 2009;

Chatterji et al., 2016; Escrig-Olmedo et al., 2010; and Semenova and Hassel, 2014), in the sense that we want to understand of as much as possible the rating process and framework of each agencies. In addition to the comparison, our purpose is to propose an alternative objective and transparent for all the agents, their clients and the society. It is with the aim of analyzing the vulnerabilities of these agencies and raising collective awareness on a subject that concerns all of humanity that we have decided to write this paper. In other words, we intend to shed light on this issue, the result of which is far too much of a cover for the scientific approach that supports it. To do this, we have established a responsible rating system, which in view of the current systems is empirically superior to the conventional rating system.

The objective of this paper is to have an impact on the scientific and non-scientific community through Raising awareness of the issues of our time and of future generations by showing them how to sustain the environmental heritage; raising awareness of major actors such as governments, global organizations, NGOs and civil society of the inadequacy of the means used so far to reduce uncontrollable climate changes due to the increasingly irreversible damage that is being caused; and providing a new system for measuring environmental impact that sets the scene for a major change in the fight against climate changes. We have therefore drawn up a roadmap for the forthcoming summits and international meetings on the climate.

In the first part of this paper, we will present the problem of responsible rating (1); then demonstrate the limits of current rating systems (2); then deduce what we expect from a responsible rating agency, followed by concrete cases of this new rating system (3); and finally we will propose a comparative study of rating systems according to our indicators (4).

The problem is real at different levels:

Clearly the responsible and sustainable rating has to be responsible.

Tomorrow, we could have a market similar to the carbon one. By extrapolating, we can imagine Big companies buying extra ESG rating from smaller one entities in order to optimize tax deduction. The analogy is more than credible, the question is would we do the same mistake?

Our first point of attraction was the companies publishing different rating from different agencies. Total is a good example, what should the customers or the ESG sensitive institutions relates on those to make a decision?

The discrepancies between rating agencies was our main concern. Could we find arbitrages between agencies? How can a firm as visible as Total, could have a multiple rating? It was not clear on the website at the time of the writing from the figure which rate was the correct one.

We decided to ask Total Energie Group communication team for clarification,

Total Energie Rating

MSCI A

Sustainalytics Medium Risk 29

ISS B-

S&P Global 70

CDP A-

CDP Water A-

The discrepancies is relatively high but goes to Medium to A. This could have an impact on investors decisions. How can we explained it? What differ from one agency to another?

We decide to investigate and objectively to build key performance indicators whose could whish from RSG agencies. Are they aware of their discrepancies?

Sustainability has been defined during the Brundtland Commission in 1987 as “meeting the needs of the present without compromising the ability of future generations to meet their needs”. Sustainability rating is now assessing a company’s economic, environmental, and social value performance compared to peers, and is usually well-known as ESG rating. By taking care of those criteria, companies can identify two main opportunities: Firstly, the opportunity for it and to be aware of growing needs while adapting its innovations and production to those needs, while reducing the impact of legislation that is increasingly focused on sustainability. Secondly, employees see companies which are taking into consideration sustainability as more attractive, which enables them to maintain know-how and increase innovation.

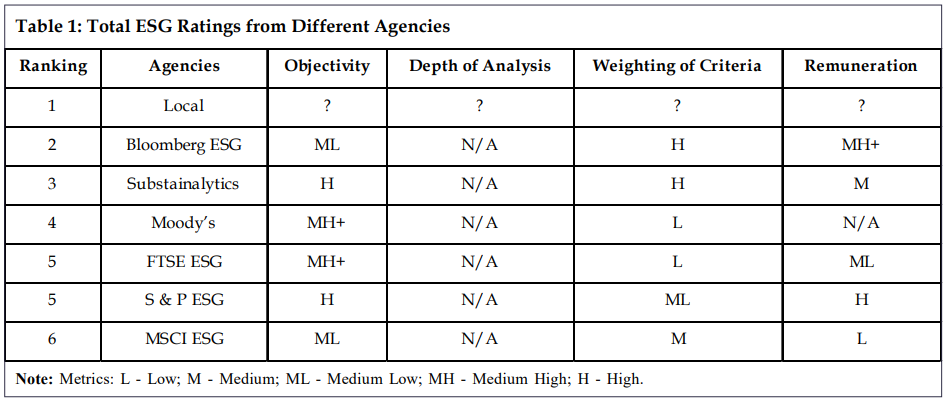

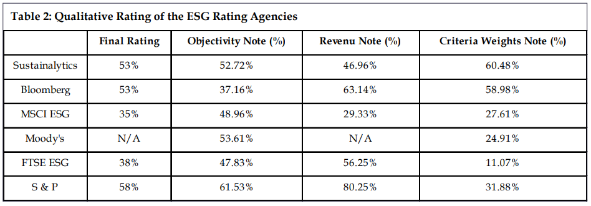

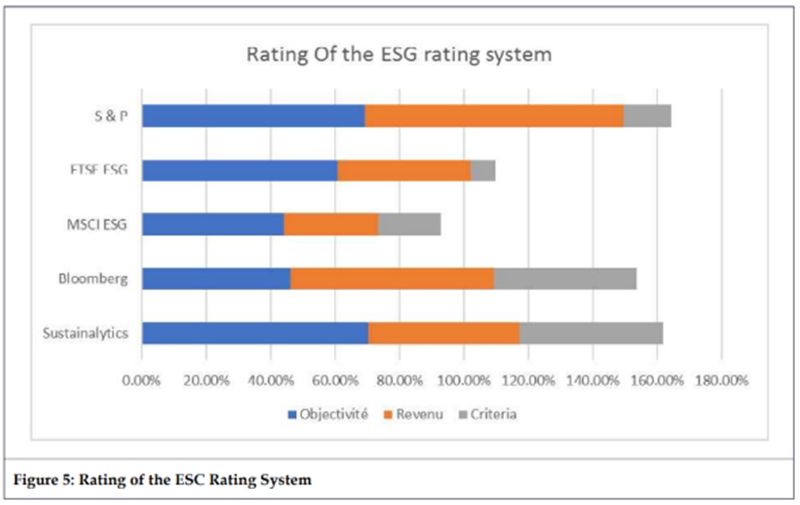

We will focus on four areas of study to assess the relevance of the different rating methods used by these agencies: objectivity, depth of analysis, number and weighting of analysis criteria and remuneration.

In the process of determining this rating, one is interested in the quantification of objectivity in the determination of the rating: more human decision or interpretation or analysis there is regarding the rating, the less objective it will be. The more the rating is determined by numerical KPIs, measurable quantification methods, requiring no human intervention, the more objective the criterion will be. Typically, if the duration of the validation or determination of the rating is stable (does not explode1 with the quantity of documents or company size), once all the documents necessary for the determination of the rating have been provided. The more stable the time is, the more automated the process is and therefore the more it does not require human intervention; less subjectivity is involved. We know that human intervention does not mean necessarily subjectivity but implies potentially operational errors and opinions. The objectivity of these classic rating methods for evaluating the consideration of sustainable development by the company is analized in terms of the number, type and weight of the quantitative metrics used in this analysis. The aim is to identify the presence of patterns in these methods and the synergies between them.

The depth of the analysis carried out for this method of analysis; it is necessary to evaluate the source of the information considered in the calculation of this score. It is about the degree of transparency and subjectivity

in the rating. This is how far the agency goes to determine its rating. One could be interested in all the information that is externally visible in the company’s operations, without however needing internal information. One could also ask for internal information as well as that associated with its partners. Its partners can communicate information on this process. Next, we will look at how the company ensures that responsible criteria are implemented throughout its production, manufacturing and/or distribution process; transitivity, control of the entire production process, distribution and supplier chain (even through there partners selection). This is also a form of governance. How can the company ensure that his ESG criteria are respected by its production and distribution partners. Then, it is a question of verifying the reliability of the information gathered in the framework of this study, for example the reliability of published documents relating to dedicated acronyms such as the report describing the internal policies and procedures in place, their financial cost and expected results.

The number and weighting of the evaluation criteria makes it possible to assess not only different angles of the method but also the most relevant ones. In other words, it is a question of evaluating the real effectiveness of these methods, including through the control of the company’s involvement in the ESG label.

Remuneration is an evaluation criterion that allows the level of value attached to each rating to be judged. In other words, it allows us to know whether the price levels are different for companies of the same size. In absolute terms, it allows us to assess the behavior of rated organizations, which may favor the highest rating at the highest price and vice versa or opt for several ratings from different agencies independently of price. In relative terms, it allows for a comparison of the rating rates of companies according to their size or sector of activity. Thus, it will highlight any subjective bias that may be present within the rating agencies.

Responsible rating is the process of assigning an environmental rating to companies by rating agencies. Socially responsible companies can measure their impact on sustainable development through ESG ratings. This rating aims to evaluate the policies and procedures implemented by companies on issues related to sustainable development for the preservation of the global environment on the one hand and the environmental footprint of the company’s results on the other.

These opportunities and what follows from them are interesting and increasingly considered by long term investors: funds with higher sustainability ratings tend to have higher-quality holdings.

The sustainable rating systems used by companies are those used by rating agencies which define it by three criteria Environmental-Social-Governmental. Among these responsible rating agencies, the most referenced are: Substainalytics, MSCI ESG, Bloomberg ESG, FTSE ESG, S&P ESG, Moody’s. These are the agencies whose rating methods we will analyze in our study. We were also keen to study these points in the main rating agencies, in particular:

We sent an email with an auto evaluation form to those agencies and let them 2 months to respond. The goal is to give them another view on their process and be able to compare them to the market consensus.

Substainalytics ESG is a rating agency which provides ESG data on more than 20,000 companies in 172 countries. Substainalytics is a subsidiary of MorningStar, a large stock data provider. The mission is stated as focusing on helping investors and companies establish a more sustainable global economy especially aims to help investors to identify and understand ESG risks at the security and portfolio level. The rating is given as several globes on a scale from 1 to 5, where 5 involves lower ESG risk. Throughout 138 Sustainalytics defined sub-industry classifications, Sustainalytics will analyze the extent to which a company is exposed to material ESG issues and management, and in other words, the overall unmanaged risks of the company. The score companies obtain is then the sum of unmanaged risk for each of the company’s MEI, and is then put into one of five categories: negligible, low, medium, high, and severe. To do so, numerous rating inputs are taken into consideration. Firstly, the ESG risk ratings measure the degree to which a company’s economic value is at risk driven by ESG factors, in other words, the magnitude of a company’s unmanaged ESG risks. The country risk ratings also entail the risks to a sovereign entity’s socioeconomic well-being with the assessment of the government entity’s current stock of capital with its management of sustainability. The Morningstar Sustainability Rating Calculation Steps determine the sustainability scores for corporate and sovereign products to come to a Sustainability Rating for each type of stocks and finally, the Morningstar Sustainability Rating.

MSCI ESG is also a rating agency which provides ESG Rating. According to MSCI, this rating measures a company’s resilience to long-term industrial material environmental, social and governance risks. It combines the data on macroeconomic risks, regulatory agencies data and product risk data. It then takes the weighted average of individual key issue scores compared to peers. The latter provides a ranking through the identification of industry leaders and laggards depending on their exposure to ESG risks and how those are managed. The two main metrics have been created to assess risk exposure and a risk management score. They respectively measure the company’s exposure to 80 business and geographic material issues, and the ways in which these material issues are managed (150 policy/program metrics, 20 performance metrics, 100+ governance key metrics). It helps to identify through a quantitative model processing industry specific externalized impact.

The ranking provides letters from AAA to CCC. A grade from AAA to AA involves a company leader in its industry. It efficiently manages ESG risks and opportunities relative to peers. Furthermore, an average company has a score between A and BB. It means a mixture of success in managing ESG risks and opportunities. Lastly, a grade from B to CCC entails a laggard company. The latter has a high exposure and failure to the management of ESG risks and opportunities. Because investors are not using ESG rating for the same investment targets, they have created “ESG Transparency tools” dedicated to specific criteria, such as Industry Materiality or Climate. MSCI ESG Ratings are used for several purposes such as quantitative analysis, portfolio construction, benchmarking, disclosure and reporting, and engagement and thought leadership. Therefore, similarly to Morningstar ESG ratings, MSCI ones are used to conduct stock analysis and make investment decisions based not only on the financial performance of a particular security, but also on the ESG risk.

Bloomberg ESG Disclosure Scores provide ESG information regarding climate change, human capital, or shareholders’ rights. Companies are rated based on ESG disclosure and span of key sustainability topics. It includes around 12,000 companies in more than 100 countries. Some topics included in this analysis are air quality, health and safety, diversity, or board independence. This dataset includes derived ratios and country- specific data points to make comparisons between peers of the same industry. One advantage of this dataset is that it includes around 88% of global equity market capitalization, thus, there is a strong coverage enabling accurate comparisons and almost 90% of the equity market capitalization, which enables investors to have a strong scope of comparisons. Moreover, the reporting of these ESG metrics is standardized and comparable with integration of ESG’s grade and news into their investments, but also the grades of other rating agencies as a tool of comparison. Through the publication of ESG Disclosure Scores, Bloomberg is trying to accelerate the implementation of sustainable finance considerations into investment decisions. Consequently, portfolio management is facilitated as investment is integrating ESG data and scores. Lastly, Bloomberg is quite transparent regarding ESG scores as it also displays the ratings of other rating agencies. Hence, an essential tool, such as Bloomberg, delivers its own ESG data while promoting sustainable finance.

FTSE ESG focuses on companies listed in the FTSE Global Equity Index Series and other large stocks to provide an ESG based assessment system of companies’ ESG performance. It includes 7200 securities in 47 Developed and Emerging markets, comprising the constituents of the FTSE All-World Index, FTSE All-Share Index and

Russell 1000 Index. The ratings focus on six ESG categories namely corporate governance, environmental, social policy, labor practices, supply chain policy, country of origin. The overall rating comes from several features that are stated as comprehensive, flexibility and customization, emphasis on materiality, precise rules and focus on data, objective and strong governance, and Sustainable Development Goals aligned. Thus, according to FTSE Russell, these ratings assist in managing exposure to ESG aspects since they enable the integration of ESG data into securities and portfolio analysis. FTSE Russell collects data from publicly disclosed information only and does not investigate on its own through questionnaires. However, after the publication on the web-based research platform, FTSE Russell allows issuers to provide additional information if necessary for a better ESG analysis.

S&P ESG created its ESG scoring systems using a bottom-up approach. The firm intends to provide analysis and reporting on companies around the world. Through this ESG system, scores are assigned at the sector level. They are attributed depending on publicly available information as well as answers to S&P’s ESG questionnaire. The assignment of grades relies on criteria topics for each pillar of the ESG field. Firstly, for instance, for the social pillar, topics might be financial inclusion, human rights, or labor practice indicators. Regarding the environmental dimension, biodiversity, fuel efficiency or recycling strategy are taken into consideration. Lastly, for the governance pillar, brand management, market opportunities and strategy for emerging markets are included. The S&P Global ESG score also provides global and industrial rankings of companies based on the type of assessment which might be survey respondent or public assessment. Therefore, the questionnaire allows this rating agency to be quite precise and accurate when evaluating some factors. A large questionnaire is clearly complementary to the use of public information.

Moody’s ESG Solutions Group was created by Moody’s, one of the largest credit rating agencies in the world. This ESG Group intends to give ESG information on companies to facilitate decision-making for investors when it comes to sustainability. It conducts more than 5,000 ESG assessments of large cap companies and assigns more than 10 million climate risk scores. The first are based on an issuers or transaction’s outright exposure to ESG risks or benefits and ESG-specific mitigants, while ESG credit impact scores explain the impact of ESG considerations on the rating of an issuer or transaction, in the context of the issuer’s other credit drivers that are material to a given rating. According to Moody’s, their mission is to provide clear, traceable, and defensible intelligence that instills confidence throughout their customers’ decision-making process. Moody’s gives an ESG Score Predictor estimated on environmental, social, governance, carbon emissions footprint, transition, and physical risk management scores for a company. This Score Predictor is available for every company type and the methodology is based on a sample of more than 100,000 entities across more than 300 industries in around 70 countries. The main benefit is that it obtains transparent and globally comparable metrics that integrate corporate disclosures, macroeconomic, socioeconomic, climate and spatial data.

The rating agencies are presented according to an approach of objectivity, depth of analysis, number and weighting of analysis criteria and remuneration.

So, we notice that all these rating agencies use their own methodology and criteria to come to a final rating. Even though those criteria might differ from one agency to another, they all have the goal to evaluate ESG risk and opportunities to promote sustainable finance. Even though the amplitude of a rating is different depending on the agency, it is tremendously interesting to conduct comparisons between companies or industries within the same rating system.

The analysis of the rating methods of the main rating agencies, which are: Sustainalytics, MSCI ESG, Bloomberg ESG, FTSE ESG, S&P ESG, Moody’s reveal financial and social conceptual contingencies.

Conceptual contingencies because these rating agencies show a lack of transparency and clarity regarding the scientific approach used in their rating method. This not only prevents them from being genuinely compared with other hypotheses to carry out comparative studies, but also prevents them from making reservations or constructive reflections to advance these methods and thus better solve the problem of climate change. Financial contingencies, as these rating agencies show a lack of traceability and declaration concerning the use of the financial resources allocated to this study. This makes it impossible to assess not only the degree of objectivity of the process leading to the rating of the company and the reliability of each of the links in the company’s entire production chain, but also the depth of the analyses carried out to obtain these ratings, as they do not show a method for collecting and assessing the conformity of the information from the rated company. On the other hand, the lack of transparency on the pricing of the sustainable rating of companies can be seen, firstly, in the distribution of the costs necessary to carry out this rating according to the different stages of evaluation of the company or the rated assets. Secondly, the allocation of financial resources in terms of material and human resources is not clearly described, preventing an uniform audit other than by the organizations mandated to address issues that have a greater impact on society. Hence the social contingencies through two main aspects: The societal impact of these ratings and the apparent stability they bring. The societal impact because rating agencies, often mandated by governments and recognized by the state, have built up a reputation not only for their companies but also for the products/ services they offer. This support from the public authorities has led society to put relatively blind trust in the labels without questioning the production processes of these companies but increasing their consumption. Secondly, when the label is involved, consumers no longer care about the profit or margins of the companies and are ready to pay the price because they either want to show a certain lifestyle or to preserve their physical integrity. For example, the “BIO” label is not necessarily one of the most accessible labels on the market, but it still generates a rise in demand every year. Concerning the apparent stability, it is initially a question of apparent social peace through the increase in prices offered by the labeled products/services, which are only supported by the name of the label it bears or the rating given to it. Although this rating differs by rating agency, it does not prevent these prices from being higher than the average price of the same type of product. In the context of global warming, the labelling of products/services has a marginal influence on the degradation of the environment, as we are still witnessing climate disruption, even though companies’ investments are increasingly being rated and their ecological footprint scrutinized. We have seen that between 1880 and 2012, the average global temperature has risen by 0.85oC. To put this into perspective, when the temperature rises by one degree, grain production decreases by about 5% (according to the IPCC). For these reasons, we have developed a new method for calculating the responsible rating.

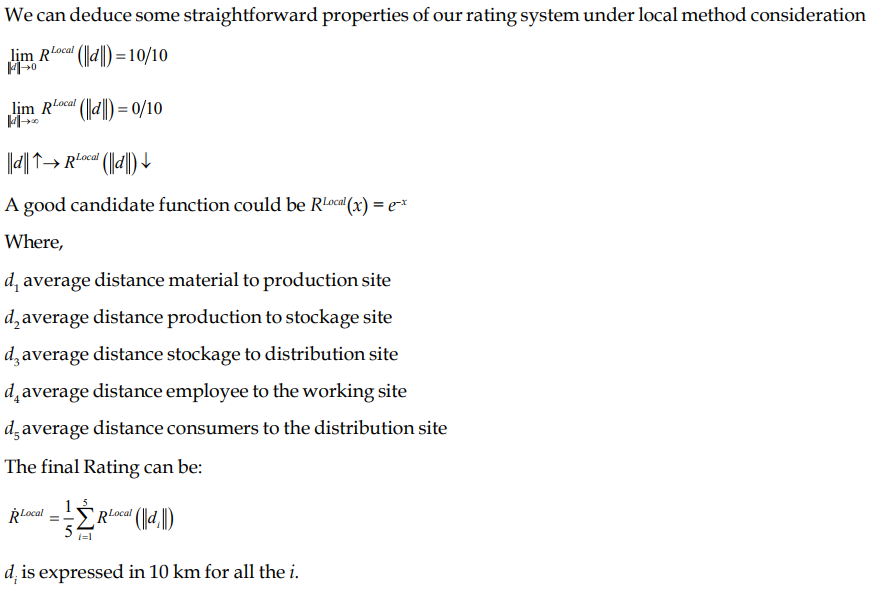

Christian Kamtchueng created a more global method that measures sustainable rating. In view of the conceptual, financial, and social limitations of the current rating agencies’ methods, which are grouped around three criteria: Environmental, Social and Governmental. Therefore, this new method of sustainable rating, which is the LOCAL method, was developed. It is about evaluating the environmental footprint left by all the actors in the production chain: suppliers, manufacturers, and customers. It is an opportunity for us to monitor their ecological footprint on the climate to label the products and services of companies and to rate their investments. This method is based on the footprint left by the average distance travelled by the links in the production chain. It is oriented on six main axes: The first is the average distance travelled by the raw material from its acquisition or extraction to the first processing plant. The second is measured through the average distance traveled by the raw material from the first processing plant to the last processing plant. The third axis measures the average distance traveled by the finished/semi-finished product from the last processing plant to the wholesaler or depot plant. The fourth axis calculates the average distance travelled by the finished/ semi-finished product from the wholesaler or depot to the last link in the distribution chain or retailer. The fifth axis calculates the average distance travelled by the finished/semi-finished product from the last link in the distribution chain or retailer to the final consumer. The last axis is based on the average distance travelled by employees and subcontractors from their home to the production/distribution site or involved in the value chain of the product.

In this way, this method can be used by all rating agencies and can be understood by society. A social awakening based on scientifically credible information can thus be observed.

We will illustrate the LOCAL method using a few examples: Renault Group, Total Energies, Orange farmer and Orange juice producer. To simplify our analysis, we will study the case of a company’s activity on a product/service.

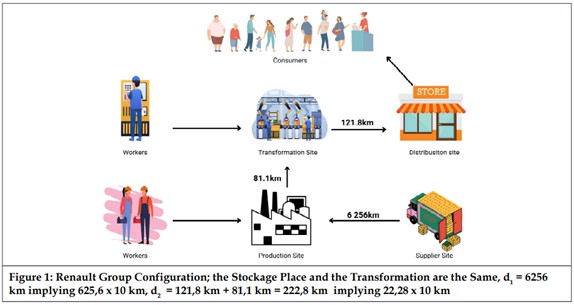

For the Renault Group, an European car manufacturer, we have the following metrics on the value chain: In terms of manufacturing, which is based on the average distance between the place of collection of raw materials (generally DR Congo) and Renault’s supply plant is estimated at 6,256 km. In terms of design, the average distance between the Cleon supply plant and the manufacturing plant is estimated at 81.8 km. In terms of

Distribution via Renault Retail Group, the average distance between the Cleon manufacturing plant and Renault’s main distribution warehouse is estimated at 121.8 km (Figure 1). In terms of Maintenance and Service Contracts, the average distance between the Cleon manufacturing plant and Renault’s main maintenance and service agency is 132 km. For the employee route, the average distance travelled by an employee to his or her place of work will be used, and for the user route, the average distance travelled by a customer to the dealership will be used.

For the Total Energies group, which is a French group whose activities cover the entire oil and gas sector, from exploration to development and production. It is also active in the refining, distribution and transportation of petroleum products and crude oil worldwide. For supply, it is based on the average distance between Total Energies’ main supplier and their refining plant in France is estimated at 204.3 km. In terms of processing, the average distance used between the refining plant in France and their storage warehouse in Dunkirk is 303.8 km. For distribution, the average distance from the Total storage warehouse and the average distance from the nearest to the furthest station depends on the service station or depot supplied. This data was not disclosed neither provided. For the employee route, the average distance travelled by an employee to his or her place of work will be used, and for the user route, the average distance travelled by a customer to a service station will be used.

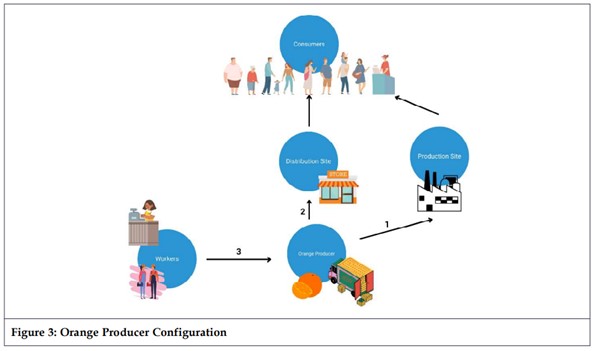

In the first case, the farmer centralizes his production, transformation, and distribution. Thus, the relative distances on which to measure the sustainable rating will be zero. Therefore, it will remain to evaluate the rating on the employee and consumer route. However, this is an extreme case which should reflect the lowest environmental footprint and therefore the highest rating.

The second case is a farmer whose local production will be evaluated on the distance between the raw material and the final processing/production area, i.e., the average calculated is the distance between the place of exploitation of the raw material (orange) and the 1st processing plant (factory). The distribution evaluated by the calculated average is the distance between the storage place and the processing industry. Subsequently, we have the distance of the employees to the production or distribution site observed by the calculated average as the distance between the farmers’ workplace and the last orange distribution agent. Finally, the rating based on the distance between the place of final consumption and the place of distribution seen by the calculated average is the 0 because the oranges are produced but processed in a factory (Figure 4).

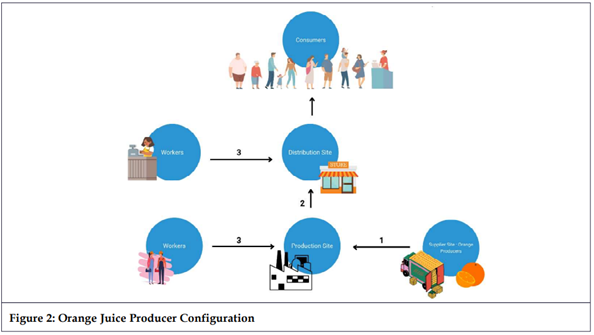

For the production, the calculated average is the distance between the farmer (producer of oranges) precisely the place of storage and the 1st orange juice production factory. For distribution, the calculated average is the distance between the last orange juice production plant and the first distribution agent. The employee and consumer routes will be respectively noted on the calculated average is the distance between the employee’s place of work and the orange juice production/distribution and on the calculated average is the distance between the last distribution agent and the final consumption (Figure 2).

These are practical cases of the use of the LOCAL formula for the calculation of the Sustainable Rating. It shows that this method can be implemented in most sectors of the economy and in investment rating. It is an asset in our fight against uncontrollable climate changes.

6. Comparative Study

This method considers all the contingencies, including the conceptual ones, through the transparency of the approach of this rating method. This will allow us to carry out comparative studies on the subject to advance thinking on climate issues. On the financial level, we propose traceability on the allocation of financial resources. This will make it possible to assess the degree of objectivity of the process leading to the company’s rating as well as the good governance of the entire value chain, which we have called the transitivity rule. It will also be possible to measure the depth of the analyses carried out to obtain these ratings because it is possible to identify the method of collecting and assessing the conformity of the information from the rated company. On the other hand, the pricing of the sustainable rating of companies is more visible firstly on the distribution of the costs necessary to carry out this rating according to the different stages of evaluation of the company or the rated assets. Secondly, the allocation of financial resources in terms of material and human resources are clearly described, favoring a uniform audit other than by the organizations mandated to deal with issues that have a greater impact on society.

In social matters, the two main aspects are: The societal impact of these ratings and the more concrete stability they bring. The societal impact because rating agencies, often mandated by governments and recognized by the state, have built up a reputation not only for their companies but also for the products/ services they offer. This support from the public authorities has led society to place a relatively blind trust in these labels without questioning the production processes of these companies but by increasing their consumption, which is what our rating method will allow. Concerning stability, which will be much better in the first instance by increasing the prices offered by the labelled products/services, which will be supported finally no longer by the name of the label it bears or the rating given to it but by more verifiable and realistic metrics. This rating will be uniform for all rating agencies, which will prevent unfair competition or arbitrage games. In the context of global warming, the labelling of products/services will have a more concrete impact on the fight against climate changes.

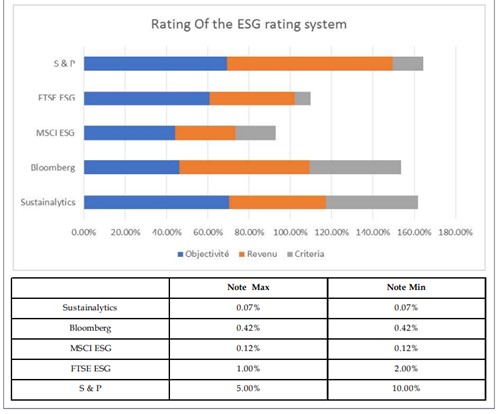

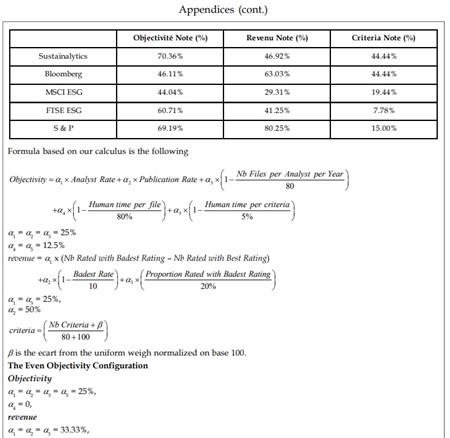

Objectivity: From low to high, it represents the degree of quantitative metrics in the rating calculation. In other words, the less human subjectivity involvement the higher the rating.

Depth of Analysis: From low to high, it represents the level of research needed to obtain the information used in the rating calculation. In other words, the higher the score, the more information is provided and checkable more is the rating. The second aspect is related to the transitivity of the governance concerning the company partners8.

Weighting of Criteria: From low to high, it illustrates the relevance of the criteria taken into account in the rating calculation. That is, the higher the score, the more unilaterally the criteria are distributed in the rating method. More criteria numbers , higher is the rating and more uniform are the weighting higher is the scoring system.

Remuneration: From low to high, it demonstrates the influence of the price signal in the process and the attribution of the rating score.

Thus, the lower the published score, the less impact the price has in the calculation of the rating and the more credible the score awarded.

Our results are based on investigation which has to be open to criticisms. Instead of being focus on story telling about the ESG rating process for each agencies.

We established key metrics with public and accessible information.

The human resources needed to access the rating.

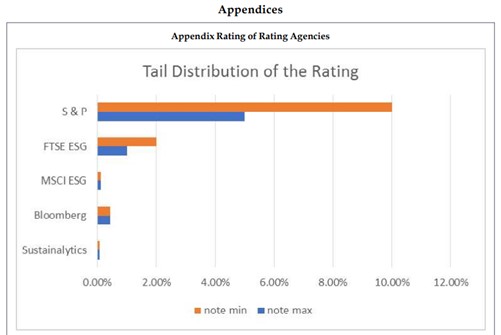

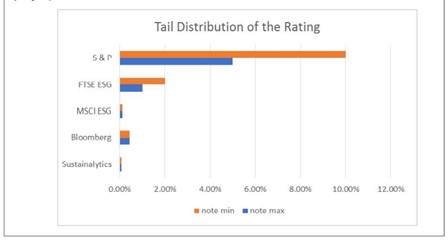

We asked for the business model of each agencies, without specific answers, we decided to find a way to evaluate their remuneration process. The main interrogation is concerning the $ per ESG rate. We decided to extrapolate their revenues through the published rating distribution.

We analyze the number of criteria and sub criteria with the associated data points.

The weight associated to each groups. More uniform are the weighs better is the rating.

3. For Deep Analysis

More information on how the company process information by agencies; How is compiled the information; it is essentially public information? Is there any audit intervention?

We could not rank Moodys due to the lack of basic information concerning the revenue criteria. We asked to each agencies to fill a form but only Moodys replied without any information given.

The local system cannot be considered as an agency. It is a method which have the advantage to be transparent; distant related which can be investigated officially or not officially. This characteristic implies a low revenue income independent of the company size.

9. Conclusion

The sustainable rating is an indispensable metric in the climate challenges of our era. We conclude by noting that all these rating agencies use their own methodology and criteria to arrive at a final rating. Although these criteria may differ from one agency to another, they all aim to assess ESG risks and opportunities to promote sustainable finance. Although the scope of a rating is different from one agency to another, it is extremely interesting to make comparisons between companies or industries within the same rating system. Therefore, each rating agency has its own methods because investors do not use ESG ratings for the same purposes. Their main concerns are ESG issues and returns on investment.

The result is that rating agencies have different approaches, which is not necessarily a problem because investors do not use ESG ratings for the same purposes: some will use them to maximize returns, others to reduce volatility, and still others to achieve an environmental or social objective. So, trying to create a single rating could ultimately be counterproductive for the ESG investment industry. However, it could be useful for credit rating companies to be more transparent to help investors invest in the way that suits them best.

It remains to be mentioned that the administrative and non-productive functions in the sustainable rating calculation will be included in another more global rating to better reflect the ecological impact of organizations. This will result in two rating systems, one including only the productive part (goods/services) and the other the administrative or management part.

At the end of our analysis, we can reaffirm the need to rethink conventional methods and to better grasp sustainable issues that are major challenges for humanity.

Thanks to my colleagues and collaborators particularly my co-writters Carl, Mariam and Anaelle but also my Essec students for their deep analysis of the ESG ratings.